Most Americans Have Less Than $1K, But Wait... It Gets Worse

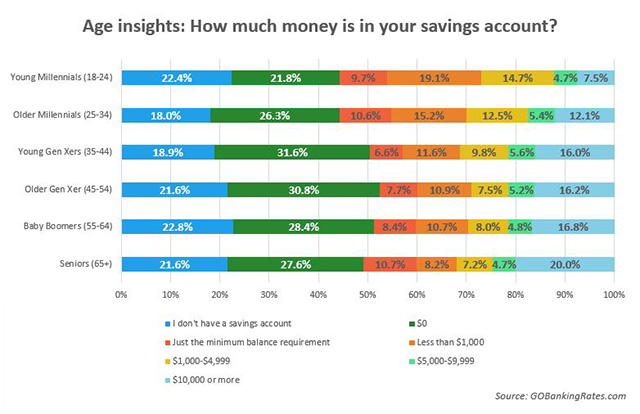

Market Watch reported on a new study that most Americans have less than $1,000 in a savings account--with almost 20 percent having none.

And while this figure seems staggering, the problem is actually much worse.

Retirement accounts are booming, hitting record highs this year. But what happens in a prolonged bear market?

When the heirs to the Walmart fortune can lose $11 billion in a single market day, ordinary investors are eventually left out in the cold when the market free-falls.

Homeowners have faced similar evaporations to wealth all over the nation in collapsing home values, once seen as a safe haven for wealth preservation.

Why are Americans content to have almost no real money, while seeing their other assets evaporate on a regular cycle as markets go from boom to bust?

Therein lies the worst reality. The average American has little to no "real" money or assets and don't have a clue as to how to fix the problem.

Our politicians give us a steady stream of 'answers,' from privatizing Social Security to eliminating the Federal Reserve, because the 'real answer' is too hard for most Americans to accomplish in our society of consumerism.

We encourage consumption and over-extension of credit, all while never emphasizing the value of creating a savings cushion of hard currency to weather bad times.

But it's much easier to buy into any number of quick fix plans from our politicians.

And so for the next four years, America will be run by whoever can present the best "chicken in every pot" solution to our modern problems.

But if we pick wrong--we'd better be prepared to have our goose cooked.

Photo Credit: TunedIn by Westend61 / shutterstock.com