Bitcoin Faces Uncertain Future Even after Favorable Court Ruling

A U.S. judge ruled that Bitcoin (BTC) can now be recognized as an official currency, same as the dollar, gold, or silver. The ruling has been used in order to pursue the prosecution of a BTC investor operating a ponzi-like scheme. Previous coverage discussed its growing popularity, but the ruling could create another boom in value.Unlike the dollar, and it is anonymous. Bitcoin value is solely determined by the community that uses it, and by the fact that they are scarce in nature.

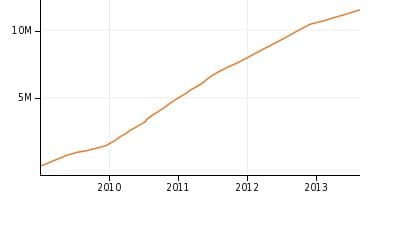

Bitcoins are created through a process called "mining;" a computer processor is prompted to solve a complicated mathematical problem, the difficulty of which is gauged by the amount of Bitcoins in circulation. The more Bitcoins there are, the harder the math becomes. A chart depicting the total amount of Bitcoins in the global market as of 2013.

As of today, there are 11,548,300 Bitcoins ($1,178,000,000) in circulation. (For the most current exchange rate, visit http://preev.com) This staggering amount has led to a sharp increase in mining difficulty, creating problems that could potentially take decades to solve.

Scarcity plus the belief of value equals actual value. Subsequently, the few investors with a majority of the shares in Bitcoin shape its value. This explains the volatile nature of the currency; its value is spiking and falling frequently.

Investors can constantly buy large amounts of Bitcoins and sell them later at a higher price. The process is known as a "pump and dump." It happens often and quickly.

With the announcement of its legal legitimacy, the Bitcoin market is beginning to gain traction in economic discourse, but its future is uncertain. Outlined are two scenarios that could happen in wake of its legitimacy:

The idea that Bitcoin is in direct "competition" with the U.S. dollar is a new one, as national banks have begun official investigations into the crypto-market.

With so many large investors buying into Bitcoin and raising its value, along with the growing number of international companies beginning to accept Bitcoin, some argue the faith in the U.S dollar's value could soon deplete in relation to a globally-recognized payment system.

CoinDesk published an article explaining the different effects resulting from Bitcoin's value reaching $500 USD. Among them:

- Incentive to "mine" would increase, as well as the difficulty level of mining. There are already numerous companies designed with the main purpose of mining in mind.

- Transactions in Bitcoins would increase. One particular company, Foodler, has seen a monthly rise of thirty percent in BTC payments.

- Increased "hype." BTC is a hot, new trend with much appeal to younger generations and offers a viable alternative to current fiat currency.

The infamous Silk Road website utilizes Bitcoin as a payment method for drugs and drug paraphernalia. While this website incurs many BTC transactions, it is but one illicit operation in a sea of anonymous services.

With the current investigations being made, along with the increased word-of-mouth of Bitcoin, many illicit investors could be spooked into dumping their shares back into the market, sharply reducing the value of Bitcoin. The NSA's recent breakthrough into encrypted sites -- like Silk Road -- may lead to an increased caution of BTC distribution and scare off potential investors, thus significantly devaluing Bitcoin.

One thing is for certain: Bitcoin is a budding topic and has become a viable alternative to other forms of payment. However, its future is tied to legislation and government intervention.