Declining Deficits Show False Relief from National Debt

Even though the improving economy has its benefits, such as a declining national deficit and increasing tax revenue, the problem is far from over. With the near-term outlook appearing less turbulent, the focus on the deficit may be waning. As a matter of little debate, if nothing is done to correct the longer-term fiscal outlook, the worst is yet to come.

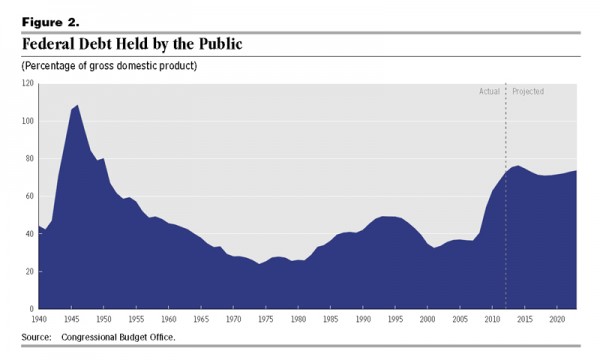

The national debt has often been observed as a percentage of GDP. Currently, it sits at 76.3% of GDP, but by 2018, as GDP grows and deficits fall, it will only make up 73.1%. That is positive news, but not the whole picture. Greg Valliere, chief political strategist at Potomac Research, points to what the scenario would look like beyond 2018 and the causes.

"It would be naïve to think we're out of the woods. At the end of the decade we're back in the soup on entitlements. And debt servicing costs start to become a problem as well."

Republicans could stop blaming Obama with causing trillion dollar deficits year after year. The newly revised deficit for FY 2013 is $642 billion, $200 billion below earlier estimates due to increased revenue and sequestration. However, taken through the context of long term forecasts, this good news is only temporary.

The budget and ensuing national debt that grows from the annual deficit has become a highly saturated media topic. Along with the slowly improving economy, some Republicans may not view the national debt as much of a talking point against the president. In light of newer “scandals,” the GOP has enough to criticize Obama.

Former director of the Congressional Budget Office under Bush, Douglas Holtz-Eakin emphasized this point.

"What's more politically potent? Another round of complaining on the budget and the economy or the IRS, AP and Benghazi? I think it's the latter…both sides were tired of the budget battle."

There is a distinction between the budget and other issues in Washington. The fiscal nature of the government can be quantified and is more than a simple contemporary issue.

The sequester is partially to thank, or blame, for the decreasing deficit, but for all the billions that it is taking out of the federal budget, for the most part it left mandatory spending untouched. Mandatory spending is the main component of the growing federal liabilities.

According to the CBO, net outlays for entitlements will reach $3.617 trillion by 2023. To put that in perspective, total federal spending in 2012, including mandatory, discretionary, and interest, was $3.537 trillion. Even taking into account federal spending as a percent of an expanding GDP, mandatory spending will continue to outpace all other categories. The longer the United States goes without a solution, the larger the problem becomes for future generations.

The other side of the declining deficit came from increased tax revenue, or more specifically the American Taxpayer Relief Act of 2012. The Bush tax cuts were rolled back and the Clinton-era 39.6% top tax rate was imposed on incomes over $400,000. The entire tax code should be reformed as part of the solution to the national debt. Unfortunately, tax increases by itself is not tax reform and there is little relief when taking sequestration into account.

In recent weeks, some light has been drawn back on the budget debate, particularly on the in-fighting within the Republican Party to move forward with reconciling both chambers’ budget proposals.

When the House and Senate pass conflicting bills of the same nature, whether its healthcare or budgets, a conference consisting of representatives from both chambers works to reconcile the differences. Conservative Tea Party Republicans have claimed that any step towards a conference should not include a debt ceiling increase, reminiscent of what happened in 2010.

Three years ago the United States credit rating was downgraded as a result of the gridlock. The debt ceiling has been a formality in Congress for many years; it rose during both Democratic and Republican presidents and previously divided Congresses. Any such deal would still require passage from both the Republican-led House and Democratic-controlled Senate.

Ultimately, Congress should not take their focus off the longer-term implications behind the growing national debt, even in the case of declining deficits in the short-term. A grand bargain must be reached, including a debt ceiling increase and a solution to the arbitrary sequesters cuts. It will be easier on the economy if such a deal can be reached while the recovery is still going strong. Recent first quarter GDP growth was revised downward from 2.5% to 2.4% as a result of sequestration. Entitlement and tax reform, both individual and corporate, could be included in a solution to generate more efficient deficit reduction as opposed to simple across-the-board spending cuts and tax increases.

A version of this story is from The Can Kicks Back blog