Rising Cost of Tuition Feeds the Student Debt Crisis

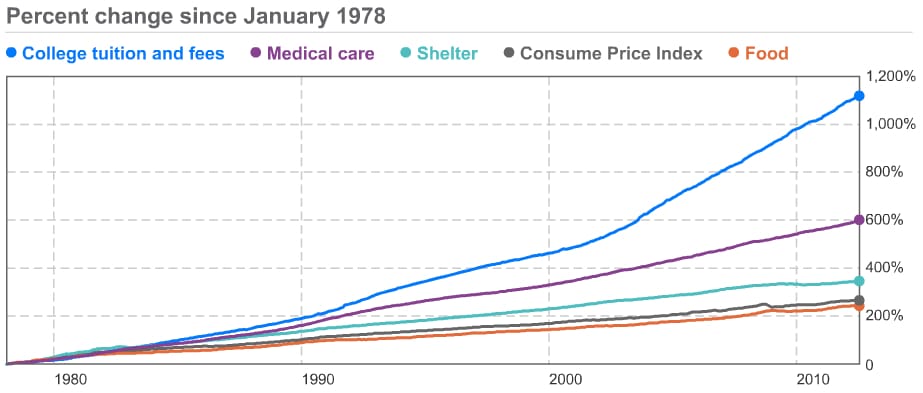

Credit: Bloomberg / Labor Department

The Department of Labor shows that college tuition experienced the most significant cost increase for the past 30+ years, more so than medical care and the consumer price index. So, what happens if tuition just keeps increasing and colleges don't have to worry about losing students because guaranteed student loans are available, but results in graduates leaving school with significant debt?

You get an ever-growing $1.1 trillion student debt crisis composed of 38 million borrowers. And it's exponential. The more unaffordable tuition becomes, the more borrowing takes place.

The notion of college tuition reaching a breaking point is not unfounded. Students are still enrolling in colleges and higher education is increasingly important for economic success.

At what point will an entity, whether it be government or the academics, step in and realize that there are too many post-grads who in terrible situations of debt?

President Barack Obama is on a college tour discussing his latest plan to hold colleges accountable. He'll have the administration tie financial aid to a sort of college ranking system. One of the variables in ranking will be tuition rates. The idea is to incentivize colleges to bring down costs by limiting the loans student can use to attend that college.

This may help slow the growth of debt, but it's doubtful colleges will bring down prices to a point where excessive borrowing is no longer a problem.

The administration may have been short on solutions for the student debt and student loan crisis. Notable actions are the pay-as-you-earn student loan repayment plan, which provides a reasonable structure for debtors. There is also the recent bipartisan compromise on government-backed student loan interest rates and tying them to the 10-year treasury note, instead of leaving it a fairly high 6.8 percent.

But neither of those solutions get to the root of the problem, either.

The S&P stated:

"If students can attend a state university with similar or better-quality education than private university choices for a much lower cost, many families are encouraging this option."

The issue still arises at the public university level, albeit not as drastic as private universities. As previously reported, student debt at private colleges far exceeds public universities. But that doesn't mean there still isn't a student debt problem at the more cost-effective schools. The top 10 percent of student debtors have an average debt of $39,000 at public universities around the US. That same percentile of debtors owe $45,000 to $49,000 at private colleges.

It seems lawmakers are short on solutions, but it's an incredibly large crisis to avert. What solutions would you propose to solve the problem of student debt and college tuition?