Student Loans in California Worth the Burden and Make Economic Sense

The latest study from the Public Policy Institute of California (PPIC) provides a cost-benefit analysis and discussion of student loans in California. Student debt is currently a hot discussion on the national level, but the Golden State seems to have relatively better situations for college students.

Hans Johnson, co-director of PPIC, spoke on a panel discussion hosted by the organization on June 4. When asked if student loans make economic sense, he answered with a "resounding yes." Johnson does not speak for the PPIC, but refers to the data provided by its study.

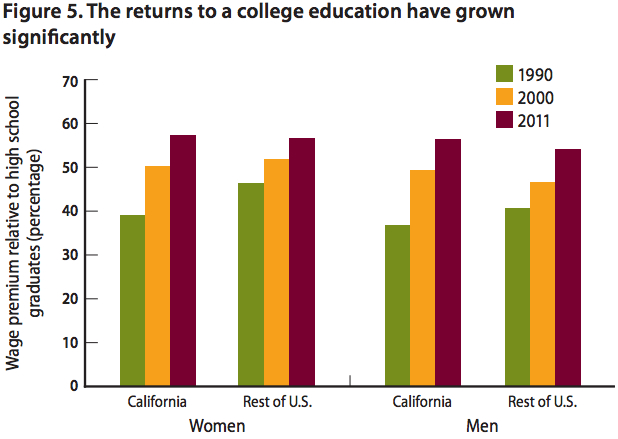

On average, college graduates are shown to earn much more than high school graduates, and the gap has grown over time. From 1990 to 2011, the percentage of wage earning increases have gone up almost 20 percent. This holds true in both California and the United States for both men and women.

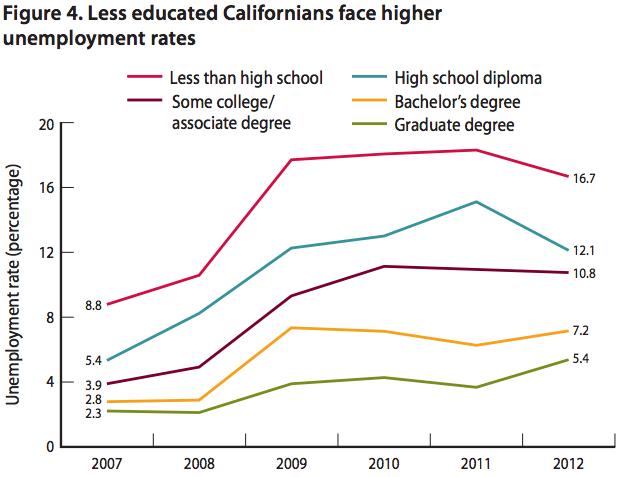

Although unemployment remains high in the state, college graduates have a much lower unemployment rate. Of course, the point of a degree is to secure better employment. But, through the recession, Bachelor's degree holders experienced unemployment rates 5 percent lower than those with high school diplomas.

The figure may not answer the concern of underemployment, but the study does. It states that 11.8 percent of degree holders are underemployed, while high school graduates are at 23 percent.

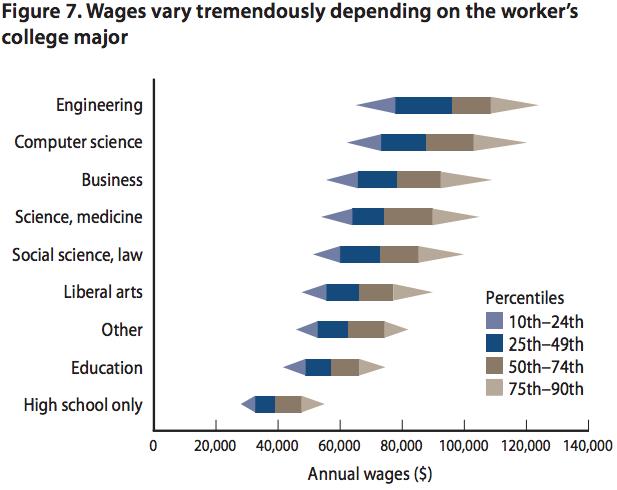

Degree majors are still a significant factor in wage earnings. This is one of the most important data set to look at when determining the worthiness of an education and if student loans are a smart option. However, the median annual income for all degrees are higher than that of a high school graduate.

It is still possible for the highest income percentile of high school graduates to earn more than the bottom percentile with the least lucrative degrees. In fact, 15.6 percent of high school graduates earn more than those who graduated with a four-year degree in education. However, the income gap will grow over time.

Tuition has spiked in recent years, and trends in student loan debt are reminiscent of the 2008 housing bubble. Still, the data supports the notion of incurring reasonable amounts of debt to earn a degree.

Debbie Cochrane of the Institute for College Access and Success participated in the PPIC panel discussion. She explained that a very loose rule of thumb is a student should not take on loan debt higher than expected first-year income.

Smart borrowing is paramount and taking out large loans to earn a degree that does not net enough earnings to pay back is dangerous, and it still happens. However, student loans remain a viable tool for degree attainment, leading to generally better economic situations.

The PPIC provides a wealth of information on the student loan debt dilemma. The entire PPIC study can be downloaded here.