History of Taxes in the US and the Fiscal Cliff

Published: 08 Nov, 2012

1 min read

Now that President Obama has been elected and the campaigning has ended, the President will have to find solution regarding the upcoming fiscal cliff.

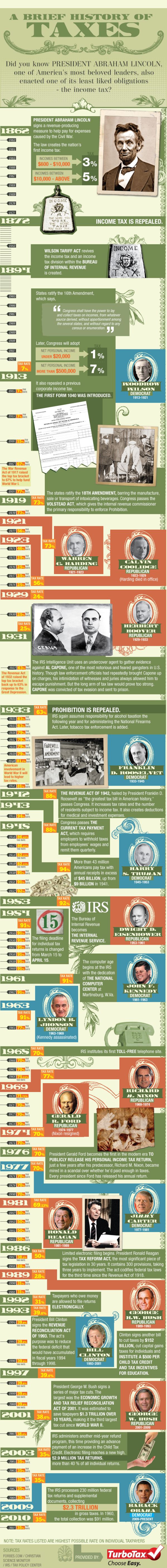

The President will have to chose between different measures to reduce the budget and the deficit. One of them will be to change the taxes on incomes, capital gains, dividends, or corporations. Raising income taxes is always unpopular and the debates in the Congress will be heated. The following infographic, created by Turbo Tax, gives us an overview of how incomes taxes evolved over the years and that our ancestors were in a much worse situation.

Credit: http://turbotax.intuit.com/You Might Also Like

NEW POLL: California Governor’s Race Sees “None of the Above” Beat the Entire Democratic Field

A new statewide poll conducted by the Independent Voter Project finds California’s independent voters overwhelmingly support the state’s nonpartisan primary system and express broad dissatisfaction with the direction of state politics....

12 Jan, 2026

-

4 min read

This California Disposable Vape Ban Could Devastate The Legal Cannabis Industry Even Further

Good intentions often make for compelling policy. But in practice, consequences rarely fall in line as neatly as the ideas that inspired them....

12 Jan, 2026

-

6 min read

Missouri Republicans Admit They Skewed Ballot Language to Protect a Rigged Map

Missouri state officials have pulled out all the stops to prevent a veto referendum from getting on the ballot that would overturn a mid-cycle gerrymander. This includes writing a ballot summary that makes it sound like the veto referendum is trying to protect gerrymandering in the state....

13 Jan, 2026

-

4 min read