As Markets Slide, Polling Shows Independent Voters Are Growing Wary of Economic Direction

The Nasdaq Composite has officially entered bear market territory—defined by a drop of 20% or more from its recent high—while the S&P 500 is nearing the same threshold today. Last week U.S. stock markets shed $6.6 trillion in value over a two-day span, triggered by President Trump’s larger-than-expected tariff announcement and China’s vow to match the tariffs on all American-made goods.

While financial analysts monitor the implications for the broader economy, independent voters across the country are also paying close attention. For many, market volatility and rising prices are reigniting concerns about the direction of economic policy and political leadership.

Economic Expectations vs. Current Sentiment

Independent voters played a pivotal role in the 2024 election, with former President Donald Trump significantly narrowing the gap among this key demographic compared to previous cycles. In some cases, independents split almost evenly between Trump and Kamala Harris, reflecting a clear shift from 2020. Many of these voters were drawn by promises to lower costs and restore economic stability.

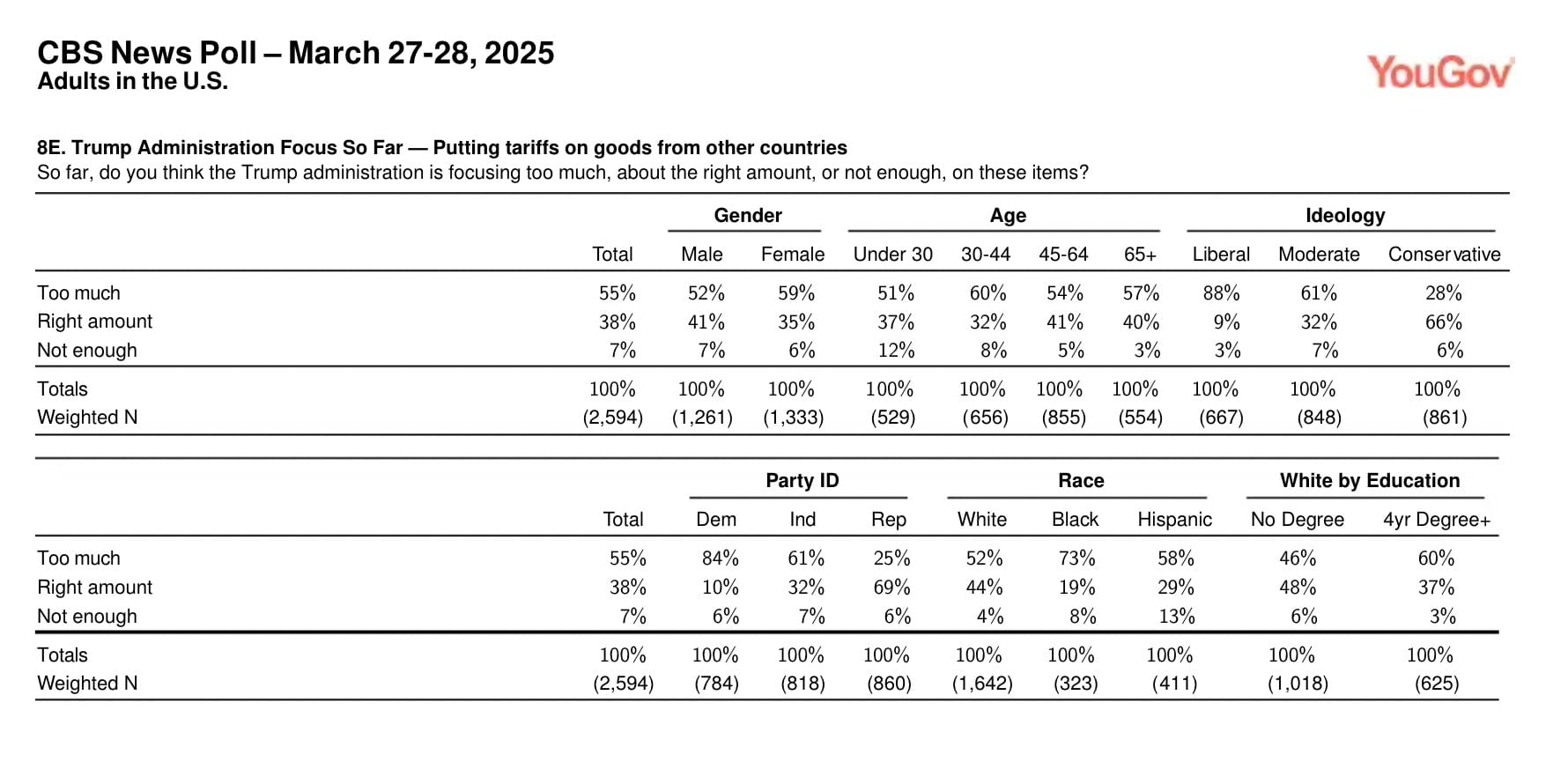

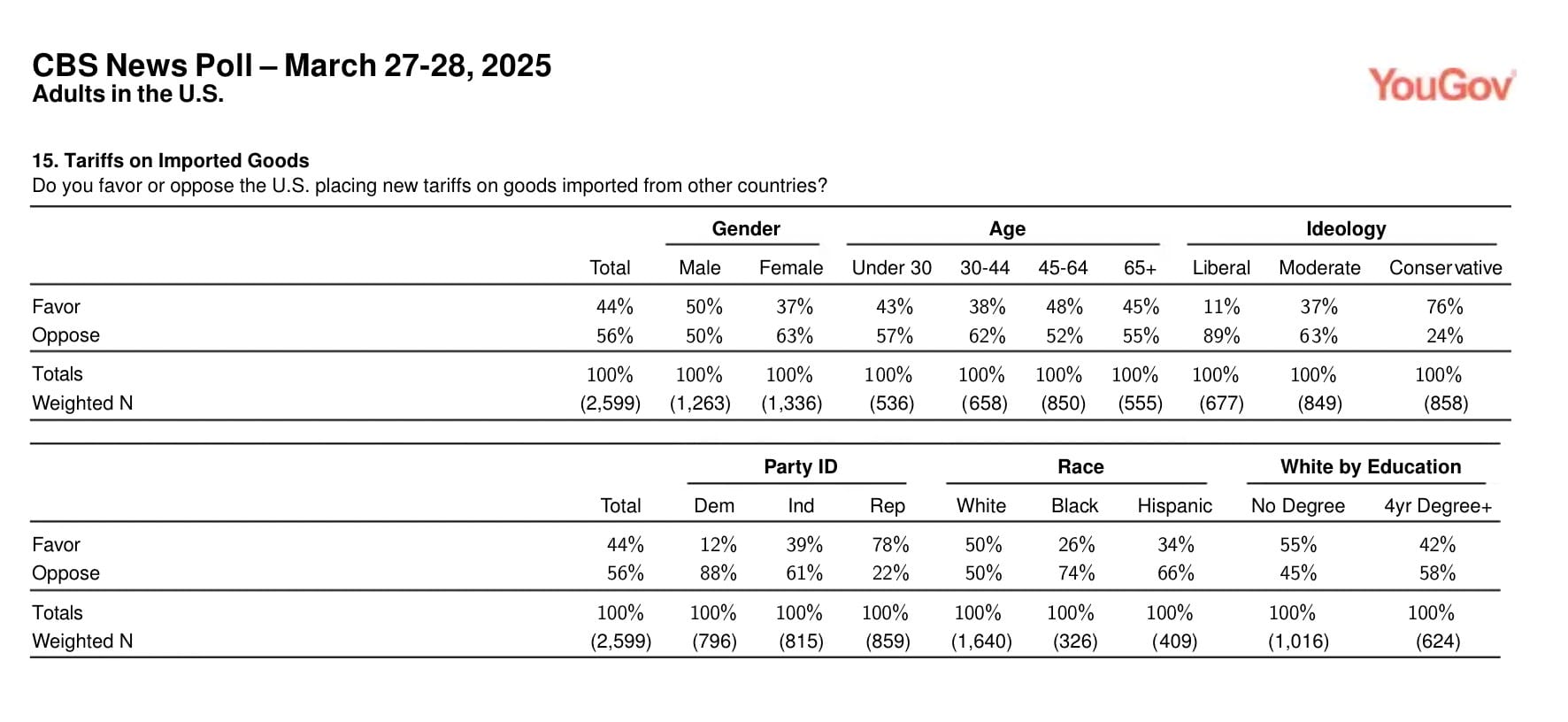

However, recent polling and sentiment data suggest a growing disconnect. A CBS News/YouGov poll conducted March 27-28, 2025, shows that most independents do not support the current administration’s focus on tariffs.

Tariffs as a Political Swing Issue

Sixty-one percent oppose the recently proposed tariffs and think the president is focusing too much on them. Seventy-seven percent of independents say the tariffs will increase prices in the short term. These views suggest tariffs may function as a political swing issue, particularly for independent voters. Many of these voters say they are seeing the opposite of what they anticipated: more economic uncertainty, not less.

While President Trump is currently more popular overall than he was at this point in his first term, his ratings on economic stewardship among independents are slipping. Financial Times data journalist John Burn-Murdoch recently noted after looking at the YouGov polling that “the larger group of other voters who backed Trump last November is rapidly souring on his economic policies and overall record.”

That shift may not reflect a wholesale rejection of the administration, but rather a recalibration of expectations. Independent voters—who tend to prioritize outcomes over ideology—are reevaluating whether current policies align with their concerns about cost of living, wages, and financial security.

Markets and Momentum

The Nasdaq’s entry into bear market territory adds another layer of uncertainty. While bear markets don’t always lead to recessions, they often influence voter sentiment and contribute to a climate of economic caution. Market trends, combined with the rising cost of essentials like housing and groceries, reinforce a sense of unease for many voters who already feel financially stretched.

Looking Ahead

As the 2026 midterms approach, the evolving views of independent voters could prove decisive. They remain a highly engaged and influential bloc, particularly in competitive districts. If economic conditions continue to overshadow other political priorities, their shifting sentiment may reshape both parties’ strategies moving forward.

Cara Brown McCormick

Cara Brown McCormick