The US is Pulling Away from Europe on the Road to Abundance

Editor's Note: This piece originally published on The Independent Center's website and has been republished on IVN with permission from the publisher.

Europe and the United States are often viewed together as the shining examples of Western liberal democracies. In many ways, Europe and the US are nearly identical: from universal suffrage to freedom of the press, liberalism is alive and well.

However, Europe significantly lags behind the American economy in terms of innovation, growth, and overall abundance. This is largely due to a burdensome regulatory environment combined with a precarious energy policy.

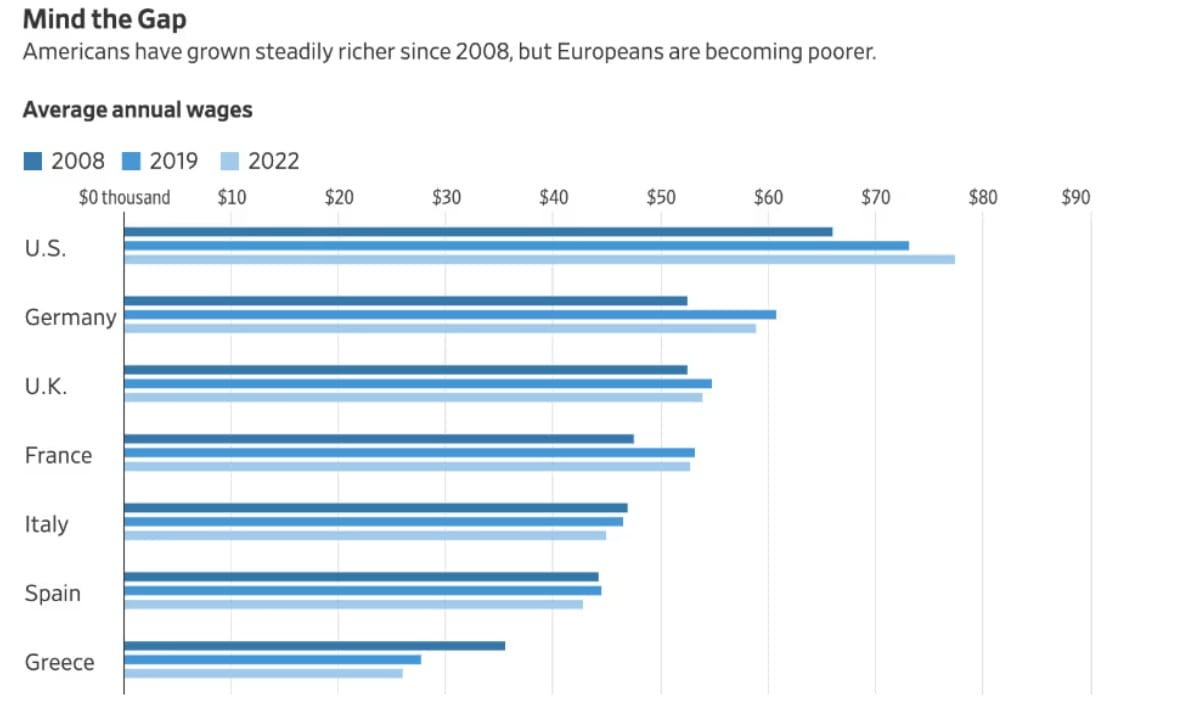

What we’re witnessing now is a European economy that is being surpassed by the United States at an alarming rate.

Key Facts

The mood in Europe and in the United States and Europe are at opposite ends of the spectrum. One European insurer commented on this contrast to the Wall Street Journal recently, “It’s almost like they’re on drugs. Everybody’s talking about growth, growth, growth. And then you come to Europe, and everybody’s depressed.”

Note: Adjusted for inflation and purchasing power

Source: Organization for Economic Co-operation and Development

- If the current trend continues, by 2035 the gap between economic output per capita in the U.S. and EU will be as large as that between Japan and Ecuador today.

- The United States leads the world in venture capital investments, boasting a $152.4 billion edge over China, which ranks second.

What’s wrong with Europe

European capitals are struggling to rein in massive deficits paired with dwindling tax revenue, largely due to an aging population. But Europe has also become what Politico has called an “innovation desert.”

- Former Italian Prime Minister and central banker Mario Draghi noted in a recent report that only four of the world’s top 50 tech companies are European.

- Europe today doesn’t have a single entry among the 15 best selling electric vehicles.

- US tech companies spend more than twice what European tech firms do on research and development, resulting in a 40% jump in productivity for US corporations since 2005

- US stock market valuations have tripled since 2005 while Europe’s have risen by only about 60%.

- “We are living through a period of rapid technological change, driven in particular by advances in digital innovation and unlike in the past, Europe is no longer at the forefront of progress,” according to European Central Bank (ECB) President Christine Lagarde.

Why the United States performs so much better

In simple terms, the United States has a climate that fosters innovation, entrepreneurship, growth, and abundance. This is not only due to the sheer size of its economy but also because of a pro-business regulatory environment that encourages choice and competition within the private sector. When wealth is generated organically from private entities, the overall economy grows, and the country’s citizens benefit.

- The United States is currently the global leader in technology, driven by advancements in artificial intelligence and quantum computing. This contributes $2 trillion to the US economy.

- According to a report by the World Economic Forum, “The world's top 100 companies account for $31.7 trillion in market capital. 65% of the total market value are US companies, equal to $20.55 trillion. China accounted for 13% or $4.19 trillion, Europe accounts for just $3.46 trillion or 11% of the total market cap value of the list.”

- TMF Group’s Global Business Complexity Index 2024 indicates that the US remains one of the simplest jurisdictions for doing business due to an active focus on creating a business-friendly environment that entices foreign direct investment (FDI).

- Structurally, the United States has a well-developed legal system that protects businesses and their investments, advanced infrastructure, and access to one of the world’s most lucrative consumer markets.

- The country also has a low tax environment and a tax system that provides a variety of lucrative incentives for businesses to invest in research and development, helping to maintain a competitive advantage over other enterprises.

How this impacts independents

Our polling and research clearly show that independent voters care about their personal finances and economic well-being above all other issues.

One of the primary themes that respondents in our polling expressed a desire for from the new administration is a focus on growth and abundance to enhance their quality of life and improve their overall standard of living.

Growth and abundance are vital for improving quality of life and raising everyone's standard of living. By promoting innovation and expanding opportunities, Americans are empowered to pursue their dreams and reach their goals. To remain competitive, we must embrace modernization, encourage competition, and support individual ambition. A thriving economy—driven by productivity, job creation, and entrepreneurship—supplies the resources necessary for a prosperous and self-sustaining nation.

If the American economy is heavily regulated and interfered with by the government, it risks stagnating like that of Europe.

Our neighbors across the pond should serve as a cautionary tale of what occurs when innovation, productivity, and prosperity are not prioritized by government officials.