How It Really Works: The Unfair Fight Between Legal Cannabis and Unregulated 'Gas‑Station' Hemp

Introduction — From Nixon’s Crackdown to the Hemp Loophole

When President Richard Nixon told the nation on June 17, 1971, that drug abuse was “public enemy number one,” he formally launched the War on Drugs and cemented cannabis in Schedule I of the Controlled Substances Act.

Ronald Reagan’s White House doubled down a decade later: “We’ve taken down the surrender flag and run up the battle flag,” the president declared in 1982, as federal cannabis seizures jumped 50% that year. First Lady Nancy Reagan toured the country with her “Just Say No” crusade, warning that an entire generation was at stake.

Arrests soared; California alone jumped from 7,560 possession arrests in 1964 to more than 50,000 by 1968.

Voters eventually rebelled. Beginning with California’s medical cannabis law in 1996, 24 states now operate licensed adult-use markets, generating billions in tax revenue.

But Congress carved out a surprise detour in 2018: the Farm Bill legalized “hemp,” defined only by a Delta-9‑THC ceiling of 0.3%. Chemists soon learned to convert hemp CBD into potent isomers like Delta 8, Delta 10, HHC, and THCP, while others grew “THCA hemp” that passes legal testing, but yields extremely high‑THC after it is heated, transforming it into a psychoactive drug.

While some in the hemp industry argue that THCA doesn’t count toward THC content, USDA regulations say it is. Yet, the “loophole” continues to be exploited.

Today, a consumer can buy a lab‑tested, child‑proofed 10 mg edible from a licensed dispensary … or a 500 mg “hemp” gummy from a gas station that has never seen a regulator.

The following 5 sections unpack how this two‑track system emerged, why it threatens public health and state budgets, and what Congress and the Trump administration may do next.

Want to Learn More? Check out our full coverage

1. Same Plant, Different Products: Cannabis vs. “Gas‑Station” Hemp

At the genetic level, both marijuana flowers and hemp prerolls come from Cannabis sativa. They are just different varieties of the same plant. Legally, though, “hemp” is anything that measures 0.3% Delta 9‑THC or less before it leaves the farm. That single metric opens three giant loopholes that have allowed for the proliferation of intoxicating hemp across the nation:

- THCA "loophole" — THCA is the biosynthetic precursor to THC that’s converted when heated. According to some THCA retailers, a hemp flower can pass pre-harvest testing at 0.3% even though it can have levels as high as 20% when converted into edibles, smoked, or vaped.

- Isomer loophole — A California investigation dubbed “The Great Hemp Hoax” tested 104 hemp products: 95% contained synthetic cannabinoids, and nearly half carried THCP. This synthetic can be up to 33 times more potent than natural THC. THCP is considered the most potent cannabinoid found in cannabis.

- Weight loophole — Massachusetts inspectors recently found “hemp” gummies with toxic levels of THC - 500 mg THC per piece, 100 times the state cannabis limit.

Hemp-derived products with psychoactive effects are unregulated due to these loopholes.

Intoxicating hemp is also able to skirt strict advertising and marketing laws designed to protect consumers and children. To the casual shopper, though, a neon‑wrapped “Stoner Patch” bear looks tastier than a plain blister pack from a licensed dispensary.

A Boston legislative hearing noted that intoxicating‑hemp products pay “no additional tax, no recall process, no FDA testing, no age limits.”

The confusion is profitable: synthetic “hemp” brands can sell stronger highs with no testing requirements, no packaging laws, no dispensary overhead, and no excise tax, siphoning customers from the regulated market.

2. Two Rulebooks, One Cash Register: Compliance Costs Only Cannabis

What a legal cannabis dispensary must do:

- Fingerprint background checks and local zoning approval

- 24‑hour video surveillance and restricted‑access vaults

- Seed‑to‑sale inventory tracking

- Batch testing for potency, pesticides, heavy metals, solvents, and microbes

- Child‑resistant, plain packaging with universal THC symbols

- State and local excise taxes plus ordinary sales tax

- No federal business deductions because of Internal Revenue Code §280E

- Follow all other state rules regarding waste disposal, environmental protection, and vehicle registration

What a “hemp” vendor usually does:

- Unlock the display case.

Labor advocates warn hemp loopholes cost union jobs: Many synthetic‑hemp producers operate out‑of‑state or overseas, dodging labor standards while undercutting licensed shops.

Others argue that there really isn’t a hemp loophole at all: Intoxicating hemp, they argue, is simply a designer drug masquerading as hemp. In other words, the 2018 Farm Bill is just an excuse for synthetic drug dealers to claim legitimacy.

The debate could eventually end in court. But, regardless of the legal resolutions, Congress and several states are scrambling to catch up with the onslaught of unregulated, intoxicating hemp.

- Tennessee House Bill 1376 (May 2025) bans THCA and synthetics, restricts sales to licensed retailers 21 years of age or older, and assigns oversight to the Alcoholic Beverage Commission.

- Texas Senate Bill 3 (May 2025) was vetoed by the Governor after the legislature voted to ban any hemp product that “causes intoxication,” curbing a $5.5 billion industry.

- California emergency rules (Sept. 2024) ban detectable THC in hemp foods, set a 21‑plus age floor, and limit packages to five servings—but investigators still buy untested items online without age checks.

- Alabama House Bill 445 (May 2025) provided a state regulatory framework for hemp-derived consumable products. Still, just-introduced Senate Bill 1 (June 2025) proposes a far more restrictive approach, banning the sale of Delta-8, Delta-10, and similar psychoactive THC products outside of pharmacies, and classifying those compounds as controlled substances.

- Maine LD 1942 (May 2025) introduces a new 20% excise tax on hemp and hemp products containing THC.

- Rhode Island House Bill 6270 (June 2025) bans the sale of hemp beverages or beverage powders containing Delta 9 unless sold under the state’s existing cannabis framework. It requires hemp beverages to be sold in dispensaries.

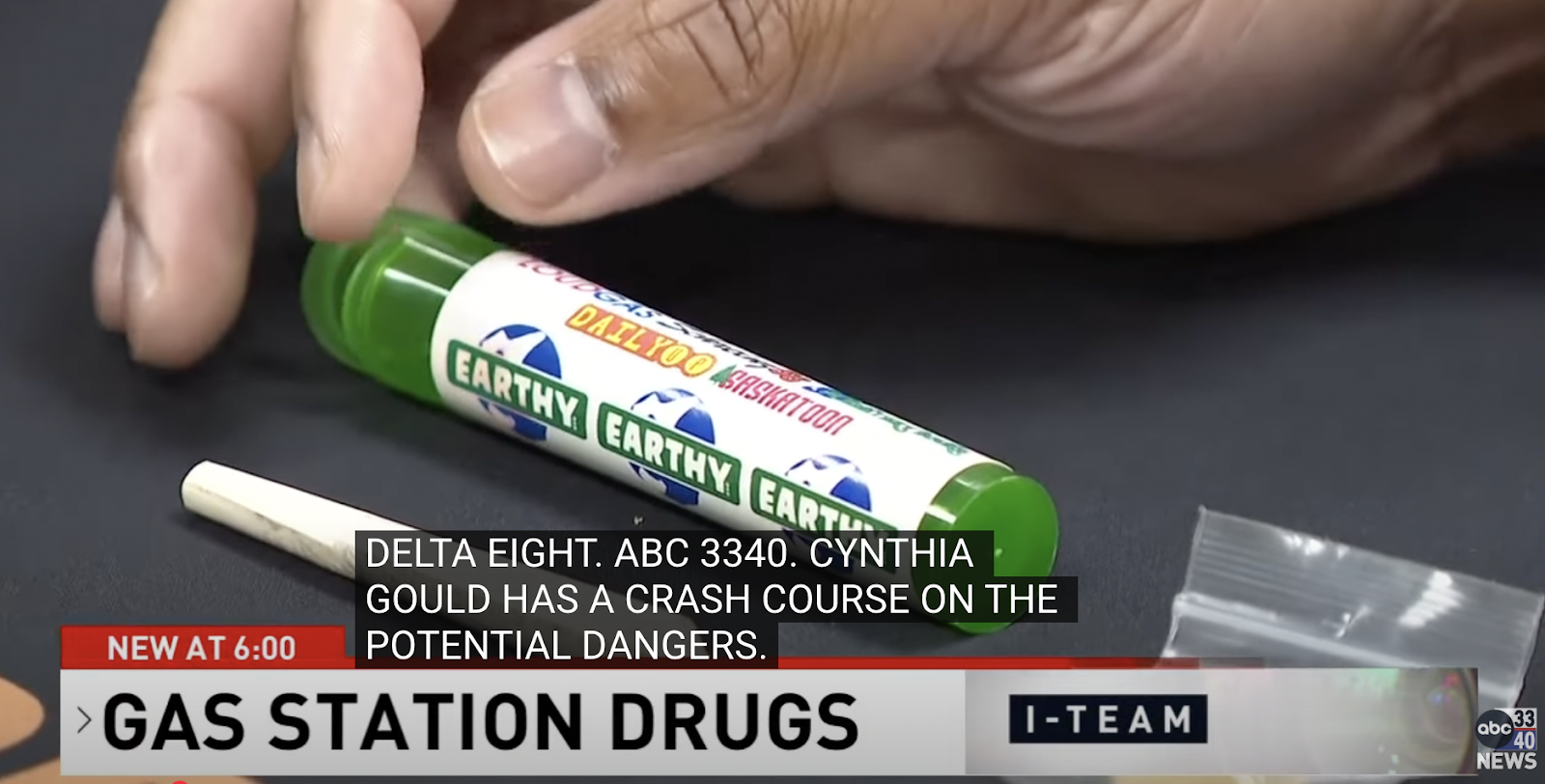

3. Threat to Public Health: Lab‑Tested Flower vs. Synthetic Mystery

School nurses in Springfield, Massachusetts, have called ambulances for students “so blasted” on hemp snacks they couldn’t speak. The same California study that revealed toxic levels of THCP in gummies also found products laced with kratom and hallucinogenic mushrooms; chemists convert CBD into THC isomers using corrosive solvents and heavy metals.

No federal agency demands pre‑market safety data or age verification.

Licensed cannabis, for all its flaws, offers seed-to-sale traceability: when a contaminant is detected, regulators can pinpoint the farm, batch, and lab results within hours. With “gas‑station weed,” the supply chain often ends at a P.O. Box. As one investigator put it, “We’re seeing a resurgence of designer drugs like Spice and K2, disguised as legal hemp.”

“My concern is that we have no idea what these products are,” says Christopher Hudalla, president and chief scientific officer of ProVerde Laboratories, an analytical testing firm with facilities in Massachusetts and Maine. “Consumers are being used as guinea pigs. To me, that’s horrific,” he says. “Like making methamphetamine from cold medicine, just because the starting materials are legal does not make the resulting product legal (or safe).”

California’s crackdown on illicit cultivation underscores the stakes. In May 2025 a multi‑agency task force seized $123.5 million in illegal cannabis, much of it grown with banned pesticides that threaten consumers and watersheds. Regulators fear the same toxins lurk unseen in untested hemp vapes and gummies.

As reported by Boston Globe journalist Diti Kohli, a recent white paper from cannabis company INSA revealed that many of these unregulated products are mislabeled, illegally potent, and shaped to resemble popular candies, in direct violation of standards applied to state-regulated cannabis.

In one case, a package of hemp gummies tested at 500 milligrams of THC per serving, roughly 100 times the legal limit in the state-regulated market.

Kohli told NEPM’s Carrie Healy that because these products are sold without age verification or potency restrictions, they’ve become easily accessible to minors. Chris Madsen, dean of students at Springfield High School, reported at least 10 hospitalizations this school year from students consuming these hemp products, often without understanding their strength.

4. Show Me the Money: Tax Giants vs. Tax Ghosts

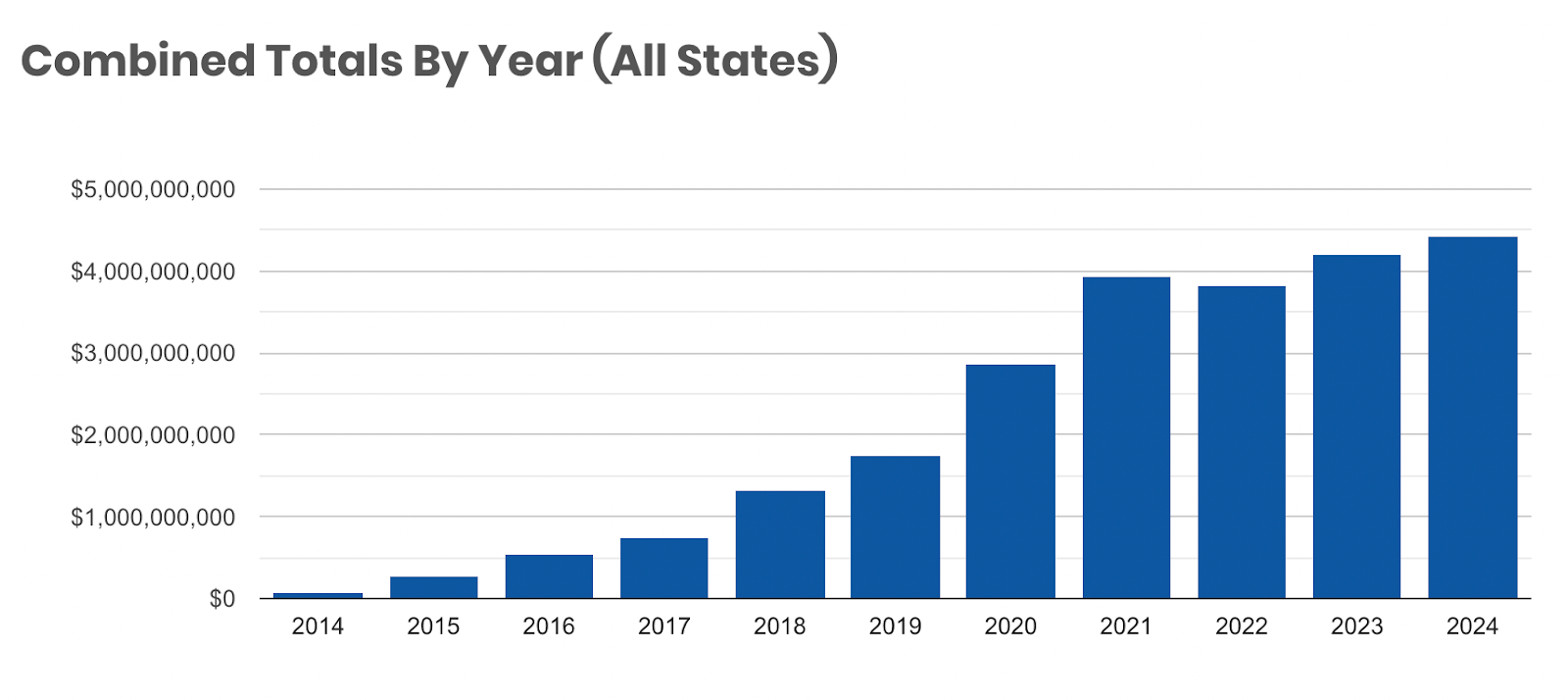

Since 2014, adult‑use states have collected more than $24 billion in cannabis excise taxes, including a record $4.4 billion in 2024. Those tax dollars build schools, fund opioid treatment, and pay for veteran services.

Intoxicating‑hemp sellers, by contrast, contribute almost nothing. A 2024 survey of 50 online hemp retailers found widespread non-compliance with tax laws: 91% did not charge state sales tax, and none remitted cannabis excise tax. The double hit: legal retailers lose market share while legislatures lose the budget lines that justified legalization in the first place.

California operators already wrestle with high taxes, new federal tariffs on vape hardware, and a proposed statewide ban on disposable vapes—costs that widen the price gap with untaxed street‑corner hemp.

In addition to state excise levies, legal cannabis also bears an invisible federal surcharge known as Section 280E of the Internal Revenue Code. Because cannabis is still a Schedule I substance, companies are barred from deducting ordinary business expenses and must calculate income tax on gross, not net, profit. Whitney Economics estimates that this penalty cost state-licensed operators more than $1.8 billion in excess federal taxes during 2022 alone, a burden hemp sellers avoid entirely.

If intoxicating hemp products were taxed like regulated cannabis, governments would capture a sizable new revenue stream. Market researchers peg annual sales of hemp-derived THC is around $19.6 billion (Viridian Capital) per year. Applying the average effective cannabis excise rate of roughly 12-15%, the hemp industry avoids $2.5 billion in excise taxes alone, a massive competitive advantage against the regulated cannabis industry.

5. Policy Crossroads: Will Washington Pick a Lane in 2025?

Two federal threads could soon collide:

- Closing the loophole. A House FY 2026 agriculture funding bill would redefine hemp to exclude any cannabinoid product for human or animal use, explicitly to “close the hemp loophole.”

- Rescheduling cannabis. A DEA rulemaking to move cannabis to Schedule III remains active but has been paused by an administrative‑law judge. Rescheduling would lift the 280E tax burden that cost cannabis firms an extra $1.8 billion in 2022. Yet Senate conservatives have introduced a bill to preserve 280E even if rescheduling occurs.

Congress could harmonize the definitions and let states regulate potency and taxation coherently, or leave consumers with a marketplace where the riskiest products face the fewest rules.

Conclusion: Why the Outcome Matters

Every day the perceived loophole stays open, teenagers ingest untested megadoses, state treasuries forfeit millions, and compliant growers question why they left the black market. As one California regulator warned, today’s unregulated synthetics are “simply another incarnation of the illicit market. It needs to be stopped in its tracks before more people get hurt.”

Meanwhile, in California, federal and state agents have raided three major cannabis operations over the past week, targeting two sites run by Glass House Brands and one connected to Stiiizy, two of the state’s most prominent cannabis companies. The coordinated actions mark some of the most significant enforcement operations since President Donald Trump took office in January 2025.

Importantly, all of the recent enforcement activity appears to be targeting operators accused of criminal activity beyond participation in California’s legal cannabis industry alone. Unlike what recent coverage from CalMatters to the AP have suggested, federal authorities may not be targeting otherwise legal cannabis operators. Every raid, to date, has involved operators accused of underlying criminal allegations, including child-labor violations, gray and black interstate commerce activity, and political corruption.

California’s legal cannabis market has struggled under high taxes, strict regulations, and competition from a sprawling illicit sector. Glass House and Stiiizy are among the few companies that have expanded their operations in the state even as others shutter.

The raids have opened a broader debate about the conditions under which cannabis companies achieve success. With federal investigations into potential labor violations at Glass House and diversion allegations at Stiiizy, the coming months could reshape the public image of two of California’s biggest cannabis brands, and the industry as a whole.

The ICE raid that swept through two Glass House Farms greenhouses in Ventura County on July 15, 2025, made national headlines. News outlets focused on the dramatic visuals of agents arresting hundreds and hundreds of undocumented workers, and on a pending child labor investigation reported by the Los Angeles Times. But beneath the immigration narrative, a more complex story is unfolding, one that may expose whether publicly traded cannabis companies are part of a national gray market for unregulated high-THC hemp products.

Half a century after Nixon’s televised vow to stamp out drugs, Congress, individual states, and the DEA hold the pen on the next chapter. They can align hemp and cannabis under one safety regime and restore fair competition, or keep the two‑track system that pits lab‑tested flowers against cheap mystery molecules in the gas station checkout line. These decisions will shape the future of American cannabis, public health, and state finances for decades to come.

Cara Brown McCormick

Cara Brown McCormick