US Partisanship Is Putting the World Economy at Risk -- Here's How

With the United States officially entering into the second month of the longest government shutdown in history, much has been made about partisanship in American politics. While partisanship has long existed in our political system, it has never impacted the United States’ ability to act as a world leader during times of crisis.

In this day and age, it may be easy to forget that the United States exists alongside other countries; some big, some small, some friendly, and some not. While every country on earth is unique, one increasingly common characteristic they share is the fact that their economies are slowing down, quickly.

Since October, the world’s largest economies have been publishing economic data that seems to indicate the world is about to enter into another global recession, so if there were ever a time for the United States to provide strong leadership, now would certainly be it.

However, as evidenced by the record breaking government shutdown, The United States is hardly in a position to alleviate these issues. Jumping around the world, here are some of the concerns that stand out most:

Germany

- German industrial production declined by nearly 2% in November

- Annual economic production declined by 4.6%, the worst decline since the aforementioned 2008 crisis

- Germany’s projected Q4 GDP growth is now at 0% and their economy, quite literally, could not possibly be closer to a recession. In fact, some economist are making the argument that Germany has been in a recession for the past 6 months, citing different data points to support their argument.

Italy

- The Italian economy has unexpectedly shrunk this quarter and is seemingly teetering on the edge of another recession.

- Italy’s newly elected populist government has found itself in a bitter dispute with the European Union after proposing a 2019 budget that significantly increases the country’s budget deficit.

- Last October, Moody’s downgraded a wide array of Italian mortgage and consumer debt bonds, which has already made it more expensive for Italy to finance their debt, further increasing their risk of another recession.

The United Kingdom

- Set to leave the European Union in roughly two months, UK manufacturers have watched as their customers from other EU countries have stopped buying from them to avoid the complications of trading with a country outside of the EU.

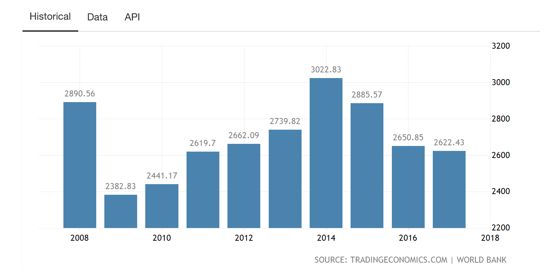

Even beyond the troubles posed to the UK by Brexit, the British economy remains in a steady decline, having contracted every year since 2014 (shown below).

China

- For the past 15 years or so, China’s economic growth has been driven by their rapidly growing population, and an unprecedented amount of government stimulus to promote Chinese industries.

- Recently, the Chinese economy has begun to show signs that it is coming under pressure as a result of their government’s proclivity for issuing debt in order to spur growth.

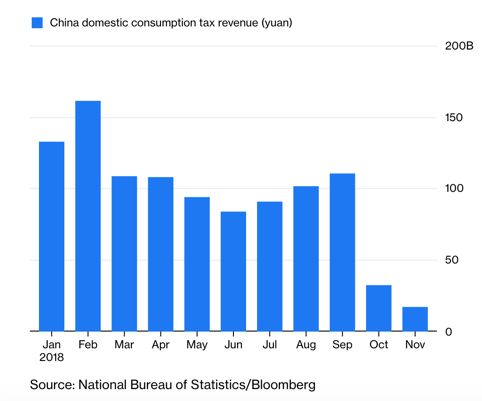

- As shown in the graph below, the amount of consumption tax revenue collected by the Chinese government slowed significantly in October, signaling that China’s aggregate demand is declining- often seen as a precursor to economic contraction.

- Additionally, China’s population growth has been slowing for a number of years now, further hindering their ability to create economic growth through an expanding workforce.

- Finally, with the world growing more and more suspicious of China’s true ambitions, their ability to export high value products such as phones, tablets, 5G network technology and more will also be more difficult, raising questions related to the long-term feasibility of their state-lead economic model.

- The Chinese economy is growing at a slower rate than it did during the 2008 recession.

What about US?

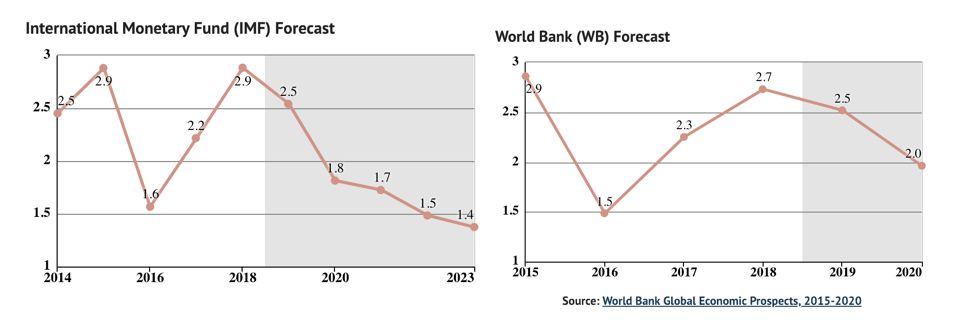

Despite economic trouble brewing all over the world, the United States has produced strong economic numbers. However, independent projections from the World Bank and the International Monetary Fund show that US economic growth is expected to slow significantly over the next few years. It should be noted that if the global economies, especially those of the Eurozone and Asia continue on their current trajectory, a global recession that infects the US will be almost inevitable.

Despite all the rancor in the United States over trade deficits, the United States still exports 2.3 trillion dollars worth of goods and services every year. Those in the United States complaining about trade deficits would do well to understand that as global economies continue to slow, the United States’ ability to export will decline as well, further deepening the trade deficit and hurting the economy.

Additionally, it is also important for these individuals to understand that a significant reason for the United States’ trade deficits is because US consumer demand for goods exceeds The US’ ability to produce them domestically. This is actually a sign of a healthy economy.

Unfortunately, the United States may soon find out the hard way that the best way to decrease trade deficits is to go into recession, where consumers make and spend less money, thus leading to less trade.

As the world economy continues to slow, it is only a matter of time before it impacts the economy of the United States. It is in moments like this where strong, competent, and bipartisan American leadership is needed to help coordinate a global response. In fact, the United States’ ability to help coordinate such a response during the 2008 recession is what allowed the world to avoid a second Great Depression.

Being at the forefront of world affairs is a burden, to be sure, but it is also the price a country pays for being the leader of the free world. However, given the fact that the United States cannot even coordinate a plan to open its own government, does anybody really believe it could once again coordinate a plan to respond to a global recession?

I’ll let you answer that yourself.