The Pharmaceutical Industrial Complex: Where do Drug Sale Profits Really Go?

Most of America hates Big Pharma. You can quantify it. But many of the sins committed by the Pharmaceutical Industrial Complex fall outside the reach of brand name pharmaceutical companies that tend to take the most heat.

Gallup regularly polls the attitudes of Americans toward various industries and institutions. In the most recent survey, just 33% of those asked had a positive opinion of the pharmaceutical industry. Only the federal government has fewer fans, at 28%.

While bad actors like Turing Pharmaceuticals and Valeant Pharmaceuticals International that raise prices extravagantly on life saving drugs get the headlines and stoke the outrage, the cash flows in the Pharmaceutical Industrial Complex is a bit more, well… complex.

The Pharmaceutical Industrial Complex includes brand manufacturers like Pfizer that you may have heard of, but also lesser-known generic manufacturers like Aspen. It includes wholesalers and distributors like AmerisourceBergen and pharmacy benefit managers (PBMs) like Express Scripts. Insurers, of course, get their cut. The final link is retail pharmacists like Point Loma Cabrillo Drug or the Rite-Aid on the corner.

President Trump, who has had problems with approval ratings himself, is taking them on. It's a tough neighborhood.

Who is the Pharmaceutical Industrial Complex?

Eight of the Fortune 20 companies are members of the Pharmaceutical Industrial Complex, and oddly, none of them are drug manufacturers. Two branches of the Pharmaceutical Industrial Complex, arguably three, are oligarchies. Oligarchies, for those who remember Econ 101 from their freshman year in college, tend not to promote fair business practices or create efficient economies. They tend to increase prices.

Let's start with the retail pharmacies and work backwards. Five pharmacies - CVS, Walgreens, Walmart, Rite Aid and Kroger - combine for eighty percent of the market share when measured by pharmacists employed.

Retailers rely on distributors to deliver the prescription medicine to their pharmacy. Just three Fortune 20 companies - McKesson, AmerisourceBergen and Cardinal Health - control ninety percent of the revenues in drug distribution.

For perspective on the power these distributors wield, let's look to Amazon. Amazon has disrupted industries ranging from bricks-and-mortar retail to food delivery to cloud computing to streaming entertainment. Jeff Bezos is the richest man in the world for a reason.

Yet Bezos could not break into prescription drug distribution and retail sales.

The process is so complicated that the insurance industry can't understand it. They hire PBMs to represent them to both drug manufacturers and pharmacies.

Three pharmacy benefits managers in the top 22 of Fortune’s 500 - United Health Care’s subsidiary OptumRx, CVS Caremark and Express Scripts - control the retail price of as much as 80% of America’s prescriptions.

Drug manufacturers break down into generic manufacturers and brand manufacturers. While much can be said of manufacturers, the industry is not an oligarchy. The top three generic manufacturers combine for about 35% of the market. The top three brand manufacturers account for about 34% of the revenue of the top 15 companies.

Pharmaceutical Industrial Complex Shell Game

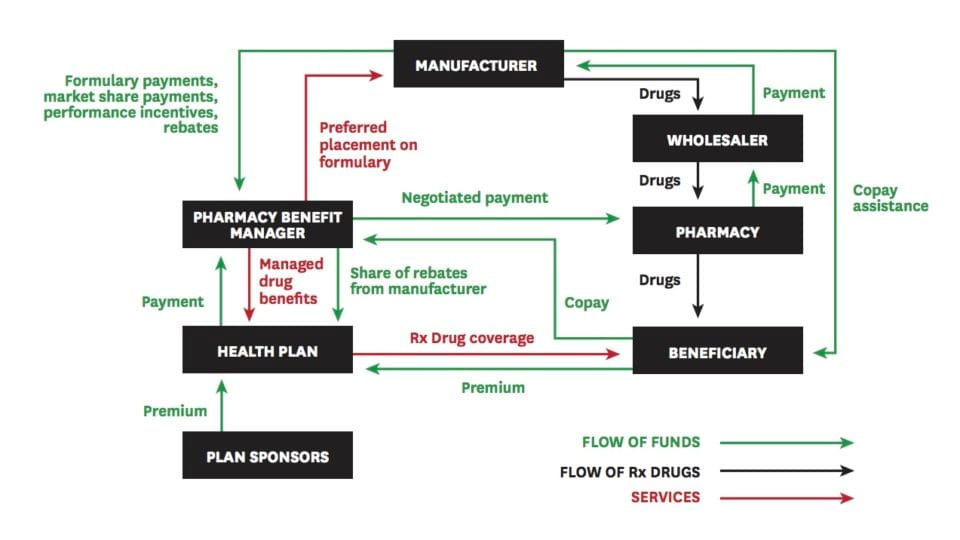

Graphic credit: USC Schaeffer Center for Health Policy and Economics

The green lines are the flow of funds. The black lines are the flow of manufacturer products. The red line indicates an exchange of services. Keep your eye on which cup has the marble under it.

Like many other industries, the manufacturer uses a wholesaler to get the product (drugs) to market (the pharmacy).

As if health plans weren’t difficult enough to understand, the Pharmaceutical Industrial Complex introduces another twist - the relationship between the PBM and the insurance carrier.

The health plan provides the majority of the payment for the product, rather than the beneficiary. The beneficiary pays a relatively small co-pay to the PBM, and may not even be aware of the price of the drug. In very few transactions in life do people not know the price of their product nor pay for the product directly.

Note that the black line never comes near the PBM box in the above graphic. PBMs don’t make the product, they don’t transport the product, nor do they sell the product. They simply set prices.

Yet if you follow the green lines, PBMs get paid three ways - from the health plans, from the manufacturer and the beneficiary.

One of the ways that PBMs get paid is from manufacturers rebates, which drug manufacturers use to get better placement on formularies. Not the best drug for the patient, not the least expensive drug but the drug that means the most profit for PBMs.

Manufacturers set what is called the "list price," then PBMs negotiate down from that using rebates and discounts.

What transactions take place within the Pharmaceutical Industrial Complex are not known, but estimates for the percentage of the drug price that goes to PBMs range from 20% to 50%.

Knowing this, pharmaceutical manufacturers have an incentive to set their prices as high as possible to be in a good negotiating position with the PBMs. This feeds the spiral of increasing drug prices.

What Happens Next

Health and Human Services Secretary Alex Azar is the former president of Eli Lilley. Whether manufacturers will take a big hit is in doubt.

Azar testified before a Senate subcommittee on Tuesday, saying "The key is can we detach the incentives of everybody in the system from these artificial list prices." Azar went on to say "Rebates are a cut, a percent, of that artificial list price and they basically foment this game we have of list price goes up, rebate goes up, where everybody's winning except the patient, who ends up paying out of pocket."

Industry experts say that the demise of the current system of negotiation using rebates and discounts will collapse revenues at PBMs, wholesalers and pharmacies. The Pharmaceutical Care Management Association, the PBM's representation in DC, argues that by taking out rebates and discounts, it leaves patients at the mercy of the pharmaceutical manufacturers.

Azar has suggested that pharmaceutical ads should include price information.

Trump is playing his usual role of "bull in the pharmacy." The Pharmaceutical Industrial Complex is headed for a shakeup. And as usual, much is left to play out.