The Debt Crisis: The ONLY Issue That Matters in 2018

Note: the author is an independent candidate for Ohio’s 12th Congressional District.

Whatever my stance is on any other issue won't matter if we don't take care of this one: the national debt. I have a plan to avoid the coming crisis; however, we need to act now to implement it, as our window of opportunity is rapidly closing.

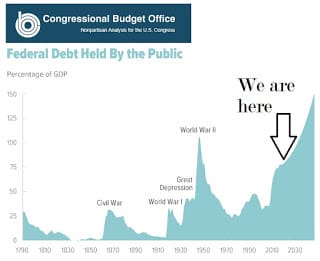

This chart, from the Congressional Budget Office, illustrates exactly where we are at this point in our nation's history (I added the "we are here" with an arrow):

Since 2001, the last time we had a budget surplus in this country, our debt as a percentage of our GDP (gross domestic product) has skyrocketed to levels we haven't seen since World War II, and the projections according to the Congressional Budget Office are for things to get worse on their current course.

Much worse.

We've all heard the doomsday predictions concerning what will happen if the United States government defaults on its obligations. We've also heard from many sources, both within and outside the government, that our spending is "unsustainable."

What neither party is telling us is that a default is mathematically inevitable within the next ten years -- less if the rest of the world loses confidence in the American dollar before then.

What's causing this?

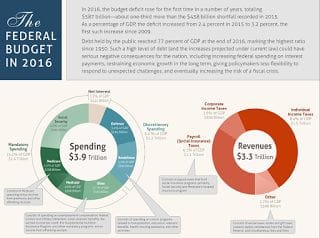

Lets start with the CBO's 2016 "Infographic," an annual cartoon that the office has been publishing for the last few years:

That doesn't look so bad, does it? The spending doughnut is only a little bigger than the revenues doughnut, right? So what's the big deal?

First, the difference between the two, according to this chart, is $600 billion - more than half a trillion. That figure represents our deficit for 2016, which is added to the $20 trillion in debt.

It's as if the government is trying to make it look like an anvil falling on our heads isn't so bad by putting Wile E. Coyote underneath it.

But there's a lot this happy little drawing isn't telling you. That spending doughnut is going to be almost twice as big in ten years if we do not act NOW. There are three things that will cause this:

1. Interest on the debt.

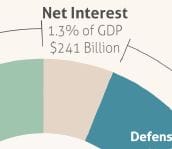

Did you notice that brownish grey section on the spending doughnut?

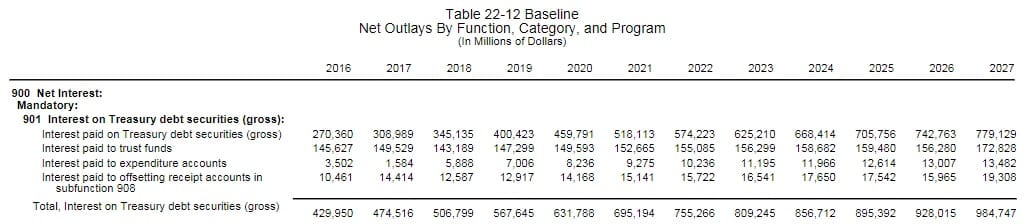

It may look small, but there's two problems with that: first, it's a big fat lie. Second, it will be nearly four times bigger than what you see here in ten years. Here's the real numbers, according to the White House and the Congressional Budget Office:

That number is actually $429 billion for 2016, when you include interest being taken from trust funds such as social security and a few other line items. In 2027, that figure will be $984 billion.

We will be paying out almost a third of all our revenue in 2016, just to make our interest payments on the federal debt. Note that almost all of this increase is due to interest paid on Treasury debt securities - T-Bills.

I don't think this chart reflects another critical variable that makes matters even worse: interest is a function of risk. Historically, interest rates on Treasury Bills have been very low, since Treasury Bills historically have been such a sound investment.

As it becomes increasingly unlikely that our federal government will be able to meet its financial obligations, one of two things will happen:

(a) People will quit buying T-bills (and if you think that isn't already starting to happen, look at what Bitcoin futures did in 2017), which means we won't have that revenue stream to fund our deficit, forcing a shutdown and default, or

(b) The Federal Reserve will be forced to dramatically increase interest rates in order to attract investors to an increasingly risky investment, triggering a large increase in the amount of federal interest, as well as inflation and an economic slowdown.

The United States is entering a financial death spiral over the issue of federal interest.

We must do whatever we have to do to stop and reverse increases in the amount of interest on the national debt. In order to do that, we must end the deficit now, and we must maintain enough of a surplus to begin paying down that debt.

2. Social Security must be made self-sustaining. Now.

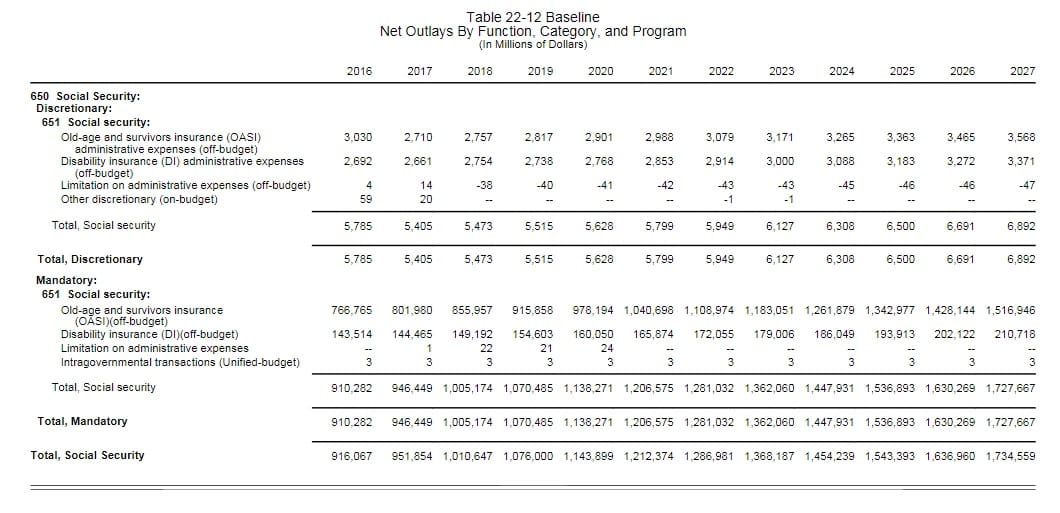

It is no secret that Social Security is running out of money, and all sources indicate the trust fund will be completely depleted by 2033. Here are the official projections for social security over the next ten years, from the same chart in which I found the projections regarding Federal interest:

In this case, the 2016 "Infographic" above was dead on as far as mandatory spending. According to this chart, Social Security spending will increase from $916 Billion in 2016 to $1.7 Trillion by 2027.

That increase is bigger than the increase we can expect in Federal interest.

Protecting benefits for those who have paid into the system should be our first priority.

Social Security was originally designed as a pension substitute, funded entirely by payroll taxes, which would guarantee some income in retirement to those who have paid into it. However, there is another portion - the unfunded entitlement portion - which writes checks to people who have not paid into the system (or in the case of those who have qualified for disability after working for a few years, have paid only a tiny portion of what they are taking from it).

If we have to choose between giving Social Security to those who have paid into it and those who have not - and I believe we are at the point where we do have to make that choice - I choose to give Social Security to those who have paid into it.

Notice that the bulk of the added cost of Social Security, though, is going to come from old age and survivor benefits, not from disability insurance.

We as a nation need to face a simple mathematical reality: if we are to continue paying benefits at current levels, we need to make adjustments. I see two ways that we could accomplish this, and I think we need to do both:

1. Increase the age at which people become eligible. The closer I get to the age of 62, the more I realize that this age is far too young to assume a person will no longer be able to work and will be dependent on the federal government to get by.

2. Increase or eliminate the ceiling for deducting employment taxes. Currently, Social Security is not withheld once an employee reaches $107,000 or so. Imagine all the people who make more than $107,000, and what 15 percent of that amount could do to put Social Security back on track!

These two variables can be altered in a number of ways - the higher the age of eligibility for benefits, maybe the lower the ceiling needs to be for withholding Social Security taxes; and vice versa.

I would favor maintaining eligibility as close to the current age as possible, and grandfathering in anyone who has already qualified.

3. We must freeze the amount we pay for Medicare and Medicaid at 2000 levels. Now.

Before you get out your pitchforks, ask yourself one question: who will actually be hurt if we reduced and capped our spending on these programs?

Will it be the old, infirm, and those needing care? Or will it be those who have been selling them services and products at artificially high prices because our government has been paying them?

I believe no one will quit providing health services if our government pays less for them. I believe health care providers and pharmaceutical companies will be (and should be) forced to charge more reasonable prices if they want to remain in business at all.

AND THEY DO.

Our largest industries in this country, by far, are the health care and pharmaceutical industries. For decades we have wrung our hands and tried to figure out how to pay the skyrocketing costs these two industries continue to charge.

What we should be doing is asking why these costs are skyrocketing. It's time for a correction.

Why are nursing home bills going through the roof when they still pay their help barely more than minimum wage? Why are pharmaceutical companies charging more for products sold in the U.S. as opposed to the products they export?

Why is nobody looking at this? The answer is simple: look who contributes to the campaign funds of your local representatives and senators.

The answer is not demand - it's supply.

Our federal government is paying too much for these services, and these two industries know they can't charge different prices for private pay than they do for taxpayer pay.

What will a nursing home that has profited so handsomely on Medicaid charge if Medicaid will only pay half as much? Will they convert to private pay? In all likelihood, no, because if they could get private individuals to pay those rates, they already would have done so.

Will a pharmaceutical company stop creating and selling lifesaving drugs if the federal government pays less for them? Absolutely not - they will either reduce their prices or they will sell fewer drugs.

We are all in this together. The federal government has done more than its fair share to take care of an aging population.

It's time for those who have benefited most from this arrangement to start acting charitable - or, should they choose to continue their aggressive business practices, they should be subjected to the same consequences for price-fixing and profiteering as any other for-profit industry.

CONCLUSION

In future articles, I will be detailing plans to overhaul other areas of our federal budget. There is much we can and should do with our national defense and in other areas which we can and should do to further stabilize our financial future . . . and guarantee the survival of the great experiment that is America.

Editor's Note: This column originally published on the author's campaign website, and has been republished by request and with permission from the author.

Photo Credit: zimmytws / shutterstock.com