Trump's Tax Plan: Will it Actually Affect The Working Class?

President Trump recently urged support for tax reform as a benefit to the middle class at the Andeaver oil refinery in Bismarck, ND.

However, he didn't reveal specific details of the plan, instead, reiterating his prior ideas.

https://www.youtube.com/watch?v=IxkdB80TivA

President Trump has promised a tax plan that would provide relief to middle-class Americans so that they could achieve the American dream, let people keep more money in their pockets, and increase after-tax wages.

Quotes from Trump's talk include:

We've moved at a record pace...to eliminate the barriers that have been holding back our economy.Our country and our economy cannot take off like they should unless we reform America's outdated complex, and extremely burdensome, our taxcode. Our painful tax system has become a massive barrier to America's economic comeback.If we want to renew our prosperity, restore opportunity, and reestablish our economic dominance...then we need tax reform that is pro-growth, pro-jobs, pro-worker, pro-family, and yes, pro-American.

Trump urged the audience to vote out representatives who would not vote for tax reform.

Specifically, on his tax plan, Trump said "my administration is working with Congress to develop a plan," including a simple, easy-to-understand tax code, a single-page tax form, tax cuts for middle-class families and businesses, and ending the "death tax" or inheritance tax.

Trump promised, "We're going to get into great detail in the next two weeks, but we're working on it with Congress now, and coming up with very exacting numbers."

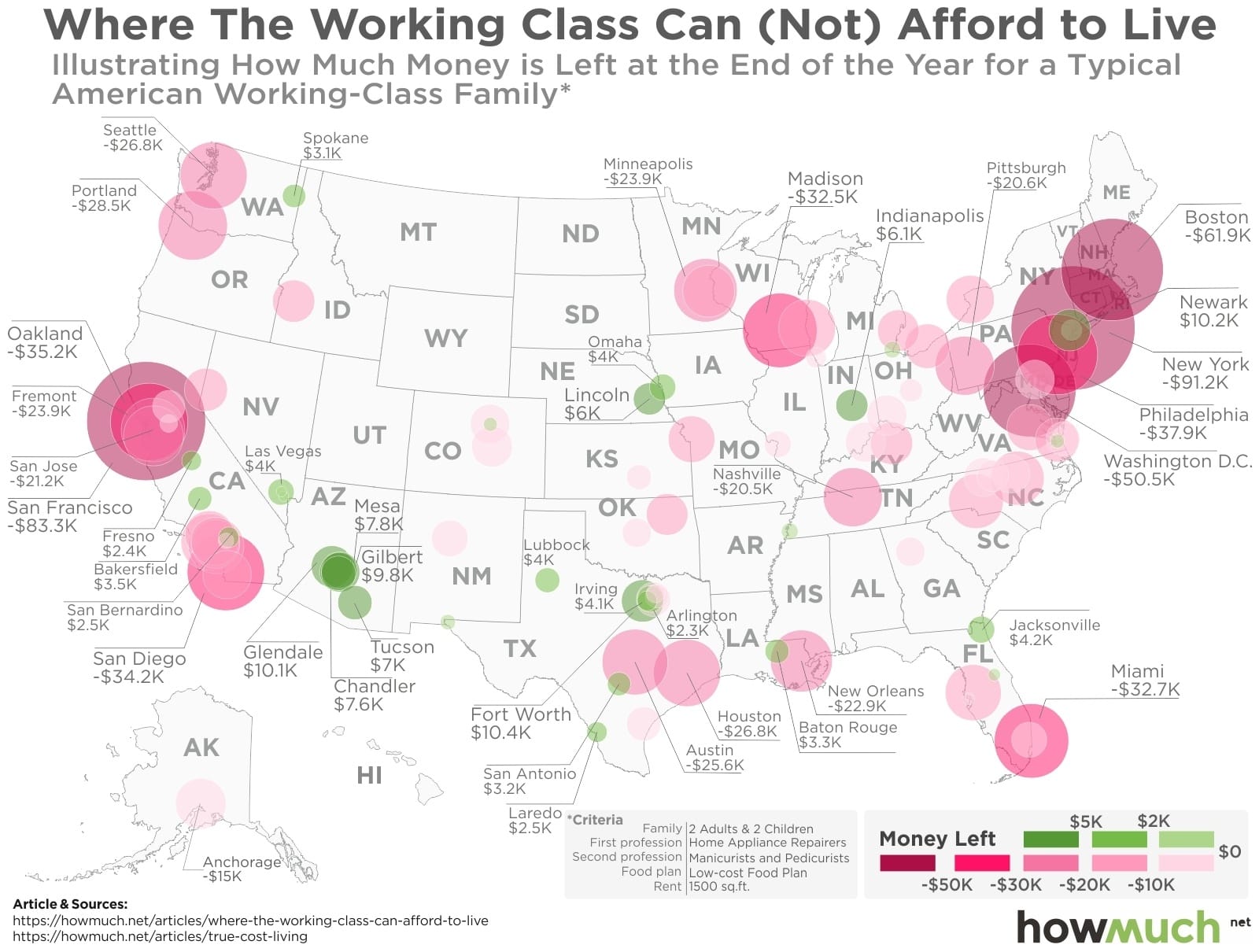

Recently, HowMuch.net put together a map (below) delineating the least and most affordable cities for the working class people in the U.S. This map can provide insight into where working class people need the most relief.

Unsurprisingly, most major cities appear to be more expensive.

HowMuch.net created the map from their new True Cost of Living tool, which grabs data from places like the Bureau of Labor Statistics, National Bureau of Economic Research, and the U.S. Department of Agriculture in order to determine income levels, tax data and the cost of food. The True Cost of Living tool allows you to view cities estimated costs, and provides remaining funds after taxes, rent, food costs, childcare, healthcare, and transportation.

Of the top 50 largest cities, only 12 are considered affordable, where you can enjoy a decent standard of living without taking on debt. Smaller cities offer better living and less debt. The further inland, especially coming from the west coast where there are exactly no affordable cities, the more affordable the cities become.

HowMuch.net breaks down the top five and worst five cities for net surplus remaining after living expenses:

Top 5:

- Fort Worth, TX ($10,447)

- Newark, NJ (($10,154)

- Glendale, AZ ($10,120)

- Gilbert, AZ ($9,760)

- Mesa, AZ ($7,780)

Worst 5:

- New York, NY (-$91,184)

- San Francisco, CA (-$83,272)

- Boston, MA (-$61,900)

- Washington, DC (-$50,535)

- Philadelphia, PA (-$37,850)

The question remains: What will Trump’s tax plan be able to offer working class people in the U.S.?