Timeliness of State Financial Reporting "Improves"

More states file “on time” -- on their own standard, anyway

Truthful accounting includes timely accounting. Our governments have made some progress on this score, but we believe there is still a lot of room for improvement.

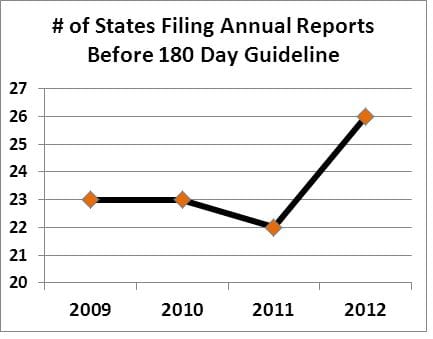

We track the timeliness of state government financial reporting, as part of our annual review of the states’ “Comprehensive Annual Financial Reports” (CAFRs). From 2009 to 2011, less than half of the states met the timeliness standard set by the Government Finance Officers Association (GFOA), which currently is 180 days, or six months, after the end of the government’s fiscal year.

In 2012, we saw some improvement. The number of states meeting the 180 day standard rose to 26, a bare majority. But the average number of days to file across the 50 states remained unchanged, at 199 days, in part because some late filers (like New Mexico, at 426 days) kept the average high.

The 2012 timeliness results are a step in the right direction, but more needs to be done. For some perspective, note that publicly-traded firms in the private sector are required to file equally-complex annual reports with the SEC within 90 days of the end of their fiscal year.

One area could use some urgent attention is derivatives reporting. Large risks can blossom into massive losses in derivatives markets, and rapidly. With fiscal challenges looming for many state (and local) governments, there may be an incentive to take greater risks in derivatives and other investments, in order to get out from behind the eight ball. For this and related reasons, we believe state and local governments should consider improving the timeliness of reporting their derivatives activity, independent of any initiatives from government accounting standard setters. Quarterly or even monthly reporting could be the norm.