Cost of Tuition Increasing As More Students Take On Loans

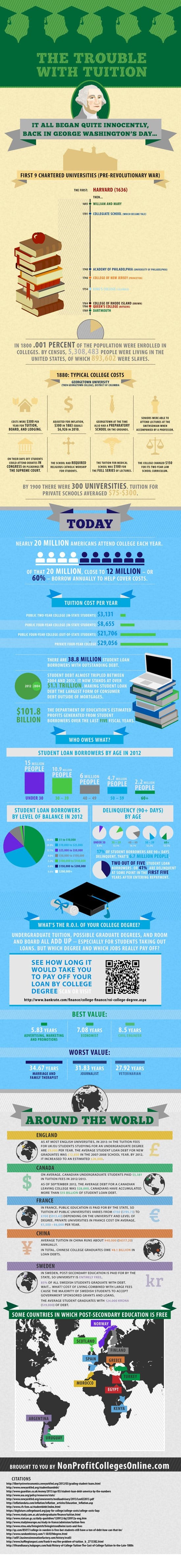

The cost of education has undergone dramatic changes over the last century. Institutions like Harvard, Yale, and others were initially attended by 0.001 percent of the population. By 1900, the average tuition for private schools was anywhere from $75 to $300 per student.

Those figures have dramatically increased since. Today, the average cost of tuition for a private, 4-year, university sits at about $30,000 per year. Two-year community colleges run about $3,000 a year per student.

More than half of the nation's 20 million students borrow annually to help pay for higher education. The average student needs to borrow $26,600 in order to complete their education.

Meanwhile, these loans can take half a lifetime to repay. Family therapists, journalists, and veterinarians take about 30 years to pay back their college degrees. Whereas marketing, economics, and engineering graduates are likely to be debt free in under 10 years.

What is really telling about the United State's educational system is how the country stacks up abroad. Canada is the closest, the average Canadian student graduates $28,000 in debt.

The average student loan debt load in the United Kingdom in 2012 was about £26,000. China's harder to gauge, but the country's graduates owe ¥8.1 billion in loan debts as of 2012.

In Sweden and France, post-secondary education is paid for by the state, rendering up-front costs for a college degree essentially 0.

International models may be more difficult to replicate in the United States due to cultural and legal differences. Yet the consensus remains that only highly educated and innovative citizens will keep an economy competitive in today's globalized world. Whether or not the students of tomorrow will be able to shoulder the growing debt load looms overhead like a final examination that one hasn't studied for.

Source: NonProfitCollegesOnline.com