Parcel Taxes Made Easier to Raise Local School Revenue by Amendment

Credit: tlegend / Shutterstock.com

Credit: tlegend / Shutterstock.com

California school and community college boards can increase local revenues for their schools through a parcel tax. These are voter-approved tax increases on property.

Parcel taxes require a 2/3 vote in a local election to be approved. However, Senate Constitutional Amendment 3 in California hopes to bring the requirement down to 55 percent.

SCA 3 is authored by Senators Mark Leno, Jerry Hill, and Fran Pavley. According to the authors, the amendment is intended to give local communities more flexibility for raising educational revenues. They further argue:

"The current 2/3rds vote requirement for passage of a local parcel tax allows a relatively small minority of voters to block a local education funding proposal that may have the support of more than a majority of voters."

Parcel taxes are applied to property at a flat-rate across the encompassing school district. Only property owners pay the annual increase, which can range anywhere from $50 to over $200 a year. These increases can last as short as four years or can be permanent.

Issues of inequity arise because the tax is not based on the value of a piece of property. High value property would be subject to the same flat rate as lower value property, which is a regressive form of taxation. Proposition 13 (1978) limits the extent to which property can be taxed on assessed value.

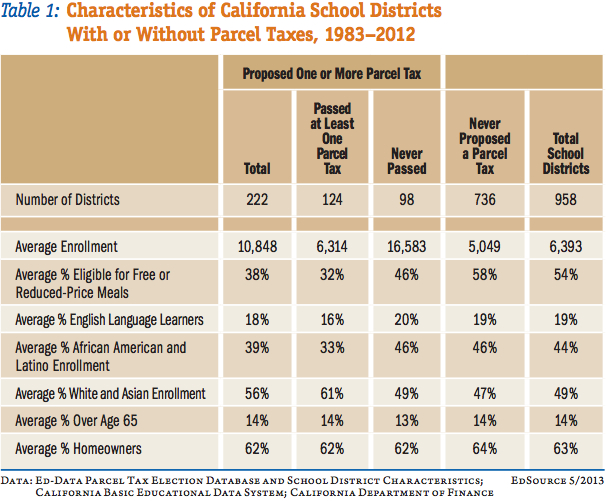

EdSource conducted a study analyzing the history and usage of parcel taxes in the past 20 years. There are 958 K-12 and community college districts in California; 222 held an election for a parcel tax, 124 passed the measure, and 108 currently have the tax in place. The study mentions what effect a 55 percent voter approval threshold would've had on failed measures:

"If a 55% voting threshold had been in place, a significantly larger number of parcel tax measures—192 out of the 271 measures that failed to get a two thirds vote—would have been approved.""Of all 608 parcel tax elections held in California since 1983, 87% would have been passed with the lower voting threshold, compared to the just over half approved by a vote of two-thirds or more."

Data shows that parcel taxes have been mainly passed in more affluent school districts. In the 124 districts that a tax passed, 32 percent of those students qualified for free or reduced lunch. The 736 districts that never proposed a parcel tax have 58 percent of their students on free or reduced lunch.

Credit: EdSourceSome have argued parcel taxes present another type of inequity. Affluent districts are more willing to increase their funding locally, while lower-income districts have not attempted, or do not have the means, to seek this type of funding. The gap of access to resources may be widened, but this tax is the prerogative of a district and its voters.

School districts also have the ability to put bond measures on the ballot. Bond measures require voter approval -- at a 55 percent requirement -- but bonds are subject to interest rates. High-interest, capital appreciation bonds have brewed controversy and the California Legislature is set to curb districts' ability to seek these bonds.

This isn't the Legislature's first attempt at lowering the approval requirement for parcel taxes. Former Senator Joe Simitian proposed a similar amendment in 2011, but it died in committee. California is also the only state in the U.S. with parcel taxes.

SCA 3 was introduced back in December of last year, but is up for a hearing in the Governance and Finance Committee this Wednesday. Conventional wisdom would say the amendment will pass through the Senate and Assembly with Democratic majorities. However, party affiliation is becoming less indicative of legislative action.

(Read EdSource's entire study on California parcel taxes here.)

(Read Senate Constitutional Amendment 3 here.)