Correlation Between Taxes on Wealthy and Economic Growth Questionable

To qualify as one of the top 1% of income earners in the United States, one must earn around $350,000 and above, annually. For the purposes of this article, ‘rich’ will refer to this top 1% of income earners.

The prevailing arguments surrounding tax policy reform this election fall into two primary camps. One argues that the wealthiest Americans are already paying their fair share in taxes and any increase would stifle already weak economic growth and lead to higher unemployment. The other camp argues that wealthy Americans have perverted the tax system to benefit themselves and this has resulted in weak economic growth.

Driving this debate is the mounting US deficit. In order to address America’s overwhelming debt, tax policy must change in one form or another in order to slow and eventually reverse the growing disparity between revenue and borrowing. There is consensus on one facet of this debate: the only way to address the mounting debt is to either increase revenues (by raising taxes or closing loopholes and exemptions) or cut spending (government services like Medicare and Social Security), or a combination of both.

A Congressional Research Service report released in September sought to answer a key question: Will raising taxes on the wealthy create economic growth?

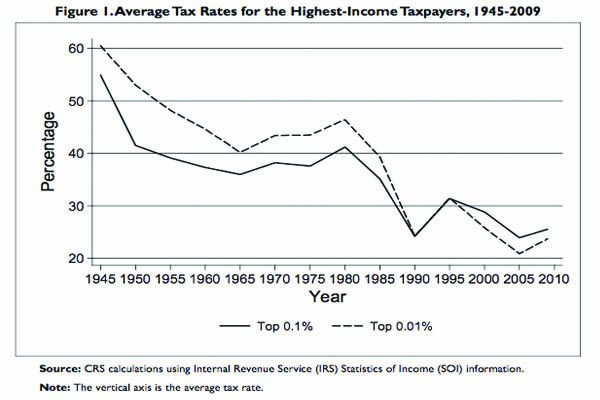

Historical anecdotes are used by all camps to justifier higher or lower taxes on the rich. Opponents of raising taxes on the wealthy reference the past periods of economic prosperity like the 1920s and the Reagan era. During the Reagan era, real median household income rose by $4,000, as tax rates were lowered. Similarly, during the roaring 20s marginal tax rates on high-income earners were lowered from 73 percent to 25 percent.

“If you look at the whole period from 1978 all the way to 2007 we cut the highest tax rate on earned income from 50 percent to 35 percent, we cut the capital gains tax rate, we cut all of these tax rates across the board…We had huge growth during that period. If you look at what happened to the tax revenues from the top income earners.” -Arthur Laffer debating on Intelligence Squared

Those in favor of raising taxes on high-income earners point to post-war growth from 1945-1981.

“They will say that higher taxes have a negative impact on economic growth. Well guess what? In the three decades before 1981, when taxes were higher on the rich, the economy on average, per year, grew faster than it has grown since 1981. There was no negative impact on growth.” – Robert Reich debating on Intelligence SquaredThese results suggest that as the top tax rates are reduced, the share of income accruing to the top of the income distribution increases - that is, income disparities increase.

The Congressional Research Service’s report made several conclusions regarding economic growth and its relationship to tax rates on the wealthy.

“The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

Whether or not lowering or raising tax rates on the wealthiest Americans leads to more or less economic growth remains murky. Yet, there is one Congressional Research Center finding that is absolutely clear: the correlation between tax cuts on the wealthy and income inequality is a positive one. As tax cuts for the wealthy increase, so does income inequality.