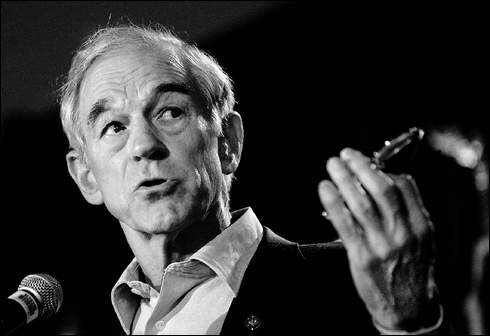

House to Vote on Ron Paul-Sponsored Fed Audit Bill

The Federal Reserve Audit bill, sponsored by Ron Paul, is expected to appear before the House floor for a vote today. If passed, the legislation will require the Government Accountability Office (GAO) “to conduct a full audit of the Federal Reserve, including its monetary policy deliberations.”

Today bipartisan agreement over any legislation seems nearly impossible in the House. However, the bill has acquired bipartisan support with 270 co-sponsors from both parties.

Wary of the 2010 outcome of the Paul’s sponsored bill, “ spokeswoman for Paul said that she was confident the votes would be there, but that approval was still uncertain.” Because the bill is carried through the suspension calendar, it needs two-thirds of the House vote to pass.

In 2010 Ron Paul sponsored an Audit the Fed bill, and it passed in both the House Committee of Financial Services and the House itself. However, the Senate rejected Paul’s language calling for an independent audit. Instead the Senate wrote its own financial reform bill, the Dodd-Frank financial reform law. The bill did not include an audit, and actually functioned to expand the Fed’s power in regard to “banks, lending, and money,” which eventually passed in the house and senate.

Ron Paul hopes for a different outcome this time around to ensure the legislation requires the Federal Reserve to be transparent and accountable via an independent audit.

"The audit mandated in the Dodd-Frank Act focused solely on emergency credit programs, and only on procedural issues (such as the effectiveness of collateral policies, whether credit programs favored specific participants, or the use of third-party contractors) rather than focusing on the substantive details of the lending transactions. H.R. 459 does not limit the focus of the audit," Paul said in a Q&A on his congressional site.

Federal Reserve Chairman Ben Bernanke has consistently opposed congressional legislation attempts requiring independent audits. Bernanke believes that an audit of the “Fed's monetary policy deliberations would expose the politically independent institution to lawmaker pressure.”

Recently Bernanke made a statement to the Financial Services Committee defending his opposition to Paul’s bill:

I agree absolutely with Dr. Paul that the Federal Reserve needs to be transparent and it needs to be accountable.I would argue that at this point, we are quite transparent and accountable on monetary policy. Besides our statement, besides our testimonies, we issue minutes after three weeks. We have quarterly projections, I give a press conference four times a year, there's quite a bit of information provided to help Congress evaluate monetary policy as well as the public.Also very importantly, the Federal Reserve's balance sheet, its finances, its operations are thoroughly vetted. We produce an annual financial statement, which is audited by an independent external accounting firm. We provide quarterly updates and a weekly balance sheet. We have an independent I.G. We have additional scrutiny imposed by the Dodd-Frank Act.And very importantly, and this is, I think, the crux of the matter, the general -- the Government Accountability Office, the GAO -- has extensive authority, broad authority to audit essentially all aspects of the Federal Reserve, and the Federal Reserve accepts that and is cooperative with the GAO's efforts.There is, however, one important exception to what the GAO is allowed to audit under current law and that specifically is monetary policy deliberations and decisions. So what the Audit the Fed bill would do would be to eliminate the exemption for monetary policy deliberations and decisions from the GAO audit. So, in effect, what it would do is allow Congress, for example, to ask the GAO to audit a decision taken by the Fed about interest rates, for example.Now that is very concerning because there's a lot of evidence that an independent central bank that makes decisions based strictly on economic considerations and not based on political pressure will deliver lower inflation and better economic results in the longer term.So, again, I want to agree with the -- the basic premise that the Federal Reserve should be thoroughly transparent, thoroughly accountable. I will work with everyone here to make sure that that's the case. But I do feel it's a mistake to eliminate the exemption from monetary policy and deliberations, which would effectively, at least to some extent, create a political influence or a political dampening effect on the Federal Reserve's policy decisions.

Despite Bernanke’s rationalization and justification of the Federal Reserve’s activity, there is no denying the skepticism and uncertainty of some of the Fed’s special interests revealed in select transactions.

For example, amidst the financial crisis, James M. Wells the Chairman and CEO of SunTrust Banks received major loans amounting to $7.5 billion total from the Federal Reserve Bank of Atlanta. The transaction transpired at the same time Wells was a member of the Board of Directors of the Atlanta Fed. “SunTrust also received $4.85 billion in bailout funds from TARP, a separate program run by the Treasury in 2008.”

Jamie Dimon, JPMorgan Chase’s executive, also sits on the Board of Directors of the New York Federal Reserve. “Senate candidate Elizabeth Warren has called on him to give up in the interest of good governance.”

In 2009 Ron Paul authored End the Fed. In his book he challenges the purpose and validity of the Federal Reserve and suggests it is not an indispensable institution, but rather dispensable.

Today, the House will decide whether to come together regardless of party affiliation, to decide if this Federal Reserve audit is necessary or not.