Plenty of other tax options exist to close California's gaping budget gap

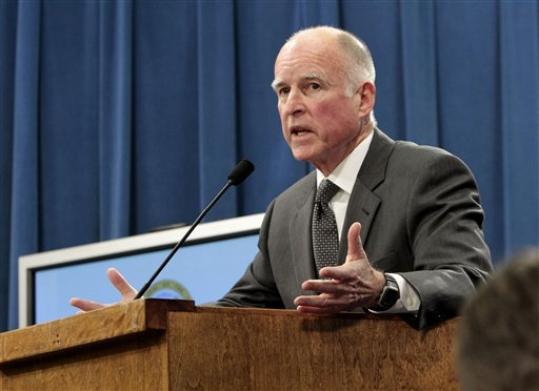

The lynchpin of Gov. Jerry Brown's proposed budget is persuading voters this June to keep paying $9.2 billion of "temporary" taxes for five more years. If they agree to do so, more than one-third of the $26 billion budget gap will be filled. If voters don't approve the tax extensions in June, the cuts to replace the lost revenue will be "extremely difficult", Brown warned when unveiling his spending plan January 10.

Brown might even have trouble placing the tax proposal on the ballot. It requires a two-thirds vote which means at least two Republicans in the Senate and the Assembly must vote for it. All but one Republican legislator -- Sen. Sam Blakeslee of San Luis Obispo -- has signed a "no tax" pledge circulated by Americans for Tax Reform. The head of the group, Grover Norquist, interprets that pledge to prohibit a vote in favor of placing the tax proposal on the ballot for voters to decide.

"Voting to send tax increases to the ballot would violate the Taxpayer Protection Pledge, a written commitment that you made to your constituents to 'oppose any and all efforts to raise taxes.' "

What Brown proposes is maintaining a .25 percent surcharge on the state income tax that will raise $2.1 billion in the fiscal year beginning July 1, 2011. He also would keep the credit taxpayers get for dependents at $99, to save $1.2 billion. A 1 percent boost in sales tax rate would also stay for five years, generating $4.5 billion annually. So would a boost in the vehicle license fee from .65 to 1.15 percent, worth $1.4 billion.

Some of the revenue would be sent to mainly counties to pay for new responsibilities Brown would transfer to them under his proposal. Brown said he chose this tax strategy in part "because these tax rates are already in place, they are less likely to unduly interfere with the economic recovery."

In his budget plan, Brown said:

"It's uncertain how other tax changes of similar magnitude would affect the economy. The prudent approach is to continue on the current path as opposed to adopting a different set of tax policies that could work their way through the economy in different -- and potentially more disruptive -- ways."

Politically, maintaining the status quo is also thought to be an easier sell with voters.

A Public Policy Institute of California poll released January 26 shows mixed results. While 54 percent of likely voters favor the general plan Brown has proposed of keeping taxes in place and diverting some of the revenue to local government, just 27 percent favor raising the state income tax. 34 percent favor raising the sales tax and 36 percent support higher vehicle license fees.

Instead, 55 percent of likely voters prefer increasing business taxes. 62 percent of likely voters would support higher taxes to avoid cuts in public schools whose funding level will fall by at least $2.3 billion if the tax extensions aren't approved.

Although Brown has chosen to keep the current "temporary" taxes in place, he and policymakers have -- literally -- at least 80 different deductions, exemptions and credits in the state income and corporate tax codes they could use to help fill the budget hole. The variety of tax breaks is dizzying. Besides better known ones like the state "Renters Credit," there is also a "clergy housing exclusion," a "reforestation expenditure amortization," and a "transportation of donated agricultural products credit." Of the 80, 14 cost the state $1 billion or more each year and, combined, represent $27.7 billion in lost revenue, more than enough to close the budget gap.

The complete list -- and an analysis of each -- can be found in the Franchise Tax Board's 99-page California Income Expenditures Compendium of Individual Provisions. Although updated in December 2010, the most recent complete tax year used in the report is 2007.

Politically, it's extremely unlikely voters would embrace eliminating the mortgage interest deduction on their homes which, at $5.1 billion, is the largest of what the state calls "tax expenditure programs." Nor would businesses want the contributions they make to their employee pensions taxable, worth $3.6 billion to the state, or Social Security recipients to pay taxes on their monthly check.

What the tax board's report does is help spotlight who the beneficiaries of these various write-offs are. For example, nearly 5 million Californians took the mortgage interest deduction in 2007. Far fewer filed personal income or corporate returns using the state credit for research and development expenses. While the board says the credit might be helpful in drawing companies to California which in turn leads to an increase in other industries supporting that company -- like Silicon Valley -- it says the creation of those interlinked economies are complicated and the role the R&D tax credit played is "not known."

What the board does know is that in 2007, 8 percent of the 3,771 income tax and 2,184 corporate tax returns claiming the credit were companies with gross receipts greater than $1 billion. Those companies received 84 percent of the credits.

The state is not required by the federal government to use what's called the "water's edge election" to calculate California taxes owed by multinational corporations. Doing so will cost the state $800 million in the fiscal year beginning ing July 1, the board estimates. In 2007, the board reports that corporations with gross receipts of more than $1 billion represented 6 percent of those using the water's edge methodology. Those corporations received 76 percent of the benefit.

There are also changes Brown and lawmakers can make to the sales tax although the Democratic majority in the Legislature views the tax as "regressive" since a family of four earning $39,000 each year pays the same rate as a billionaire. Income and corporate taxes are "progressive" because the less earned, the less taxes paid.

Several groups, over several years, have advocated imposing the sales tax not just on goods but services, which represent a growing percentage of consumer spending. Among the suggestions are accounting, legal help, veterinary services and dry cleaning.

Gov. Arnold Schwarzenegger in his budget for the fiscal year beginning July 1, 2009, proposed making tickets to amusement parks and sporting events subject to the sales tax, as well as golf, veterinary services and appliance, furniture and auto repair. The Republican governor predicted it would raise $1.2 billion. The affected parties easily killed the measure in the Legislature.

California loses $1.8 billion annually by not taxing prescription drugs, a number that will increase as more Baby Boomers turn 65. But, both seniors and the pharmaceutical industry would mount strong opposition.

Possibly more politically palatable would be including sales tax on energy bills -- electricity, water and gas -- because that is less regressive. A household that is more energy efficient, would be pay less.

No legislative effort to push these ideas has been made, just as no effort has been made to date to move Brown's proposal forward.