Why Liberals should support the tax cut compromise

An acquaintance, undeniably well-off, complained to me recently that a tax increase on those making more than $250,000 was unfair to small businessmen like her husband (a physician). I experienced a rush of liberal orthodoxy and immediately asked if she didn’t think there was a problem with the concentration of so much wealth at the upper end of our society. She agreed. And she complained about how much bank executives made. But, she argued that $250,000 was too low to be considered anything other than middle income in this day and age, and that it was especially egregious for small business owners such as her husband.

So I asked whether anyone at any income level should be denied continuation of the Bush tax cuts, and she said yes. She just couldn’t identify the exact level, except to note that it was more than $250,000. We had reached a point of genuine agreement, the kind of agreement that has recently brought about the political compromise being debated in Washington. Clearly, the issue for us was resolved, but the devil remained in the details.

That’s when I realized how valuable the offered compromise of a two year extension of the full Bush tax cuts could be for progressives such as myself. The imposition of an across-the-board maximum on which tax reductions would apply is simply not in keeping with the reality of our nation. It is possible for $250,000 per year to provide great wealth in Lima, Ohio while falling clearly in the middle-income category in San Francisco, CA. It is also possible that some $250,000 per year earners will make hiring decisions based on a narrow margin of increased or reduced income. There is no absolute guarantee that all earners in one monetary category will behave in precisely the same way.

In general terms, there is no question that people in lower income categories spend more money on necessities and have less disposable income than those with higher incomes. But income is relative to costs, and costs vary widely from region to region in the U.S. There is also a tremendous difference in the amount of income that is truly “disposable” when someone is trying to run a business with his or her own money versus someone taking a salary from a large corporation. Hence, the small business argument can be a sound one and should certainly be considered when evaluating the impact of tax reductions (or increases) on individual incomes.

Under the compromise of a two-year extension of all tax cuts, liberals and conservatives have a real opportunity to review the ramifications of tax policies on the nation’s recovery and make rational adjustments to the approach. For example, there could easily be a regional formula figured into the cut-off for tax cuts. Higher incomes might be set for high-cost states like California than for lower cost states such as Ohio and Alabama. Also, income levels that are strictly salary based could be separated from income that is earned through entrepreneurial efforts such as private business development.

These are somewhat muddy waters that could and would be manipulated by those whose self-interest is at stake. But a spirit of compromise could result in a resolution not only of this issue, but of the ridiculous stand-offs that have become unwelcomed symbols of modern politics.

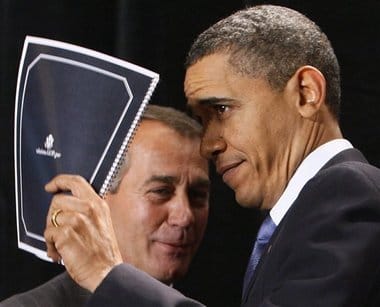

So, I’m asking my fellow progressives to support the Obama compromise, then to fully participate in a rational discourse on how best to energize the economy without taking a sledge-hammer approach to taxation that may well punish some who are truly searching for ways to succeed.