Home Price Recovery Linked to Taxpayer Burden

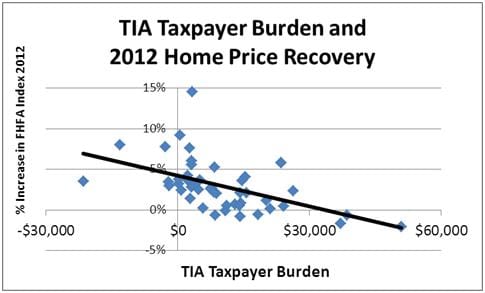

In 2012, states with higher taxpayer burdens had a lower recovery in home prices.

The American dream is to own a home, and it’s every American’s dream that the price of his/her home rises continually. Of course, there are many reasons for a change in the price of any single house—the local housing market, a neighborhood renovation, the construction of a nuclear power plant—but there are also broad statewide trends, which leads to an important question:

Can political decisions influence the price of the single largest asset for many Americans?

Home prices have endured a roller coaster ride in the past decade, tumbling throughout the nation during the recent Great Recession, but last year the 50 state average for the Federal Housing Finance Agency (FHFA) house price index posted its first increase in the past five years.

There was a great deal of variation across the fifty states, however, in the amount of recovery enjoyed. One factor at work appears to be state government financial conditions. Consistent with evidence of higher outmigration in fiscally challenged states, the FHFA home price index posted significantly lower changes, or even declines in 2012, in states with higher Truth in Accounting (TIA) estimates for state taxpayer burdens.

According to this survey, home prices continued to decline in seven states in 2012– Connecticut, Delaware, Illinois, Maine, New Hampshire, New Jersey, and Rhode Island. The average TIA Taxpayer Burden estimate for these seven states comes to roughly $25,000, nearly four times as high as the average of about $7,200 for the other 41 of the 48 continental United States.

Of course, all voters are not homeowners, and the promotion of home ownership though public policy can lead to distorted market prices, which played a major part in recent economic troubles. It is important to monitor states' financial positions because policies leading to weak fiscal health have had broader economic consequences that all voters care about, not just homeowners.

For all Americans who own homes or dream about that perfect brick townhouse or a peaceful country cabin, perhaps it’s time to examine your state’s finances—because they might have a big effect on your personal finances