To Fix The Economy, We Need to Treat the Disease -- Not The Symptoms

If the American people ever allow private banks to control the issue of currency, first by inflation , then by deflation , the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.” - Thomas Jefferson

Picture yourself in this situation:

You are experiencing severe abdominal pains so you visit with your doctor. Your doctor does a perfunctory examination and announces that he will write you a prescription for a pain killer.

Of course, you quickly recognize that the doctor is treating the symptom of your problem, but not the problem itself. So you visit a specialist who happened to fall asleep during the abdominal portion of his medical preparation. His uninformed diagnosis of your problem is acid indigestion and you are prescribed antacids.

Unfortunately, his misdiagnosis causes your pains to continue. With the underlying disease untreated, you ultimately end up in a hospital where you are diagnosed with abdominal cancer.

In the above scenario, the following things have happened:

- The first doctor treated the SYMPTOMS of your problem which did not nothing to treat the DISEASE that was causing the symptoms, and over time would only make the SYMPTOMS become worse.

- The second specialist doctor misdiagnosed the DISEASE, so his treatment would also not address the problem and over time would cause the SYMPTOMS to worsen.

- The hospital finally correctly diagnosed the DISEASE and therefore the prescribed treatments now have a chance at addressing the problem where the first 2 treatments would have failed.

We have a very similar situation existing in the economy right now.

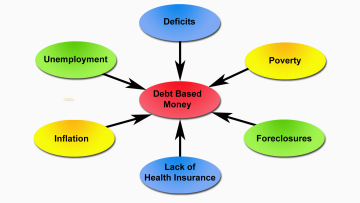

In place of the first doctor, we have our economically illiterate politicians who are looking at the SYMPTOMS of our problems such as unemployment, budget deficits, foreclosures, bank fraud, poverty, inflation, erosion of the middle class, to name just a few. They are trying to treat these SYMPTOMS, however this does nothing to treat the DISEASE that is causing these SYMPTOMS.

The financial class is also the largest donator to political campaigns. So the politicians find themselves in the position where it is to their advantage to intentionally remain ignorant of the DISEASE so they can maintain their power and positions of influence.

Then we have the specialist economists “advising” our economically illiterate politicians on what to do, but they are also lacking what they need to correctly diagnose the DISEASE.

The central banks have sponsored academic research at the major schools. However this sponsorship directly and indirectlyinfluences the research, which ends up tending to support the existing money system. Those who develop conclusions that are not in the interests of the central bankers soon find themselves without jobs or further funding for their research.

This leaves the Economics students who are our future economic specialists with a view of banking that favors the entrenched banking interests. With their lack of education on alternative monetary systems, it is not surprising that they misdiagnose the DISEASE due to their bias towards our current “debt-based” money system.

The end result is that both the economists and the politicians are nothing more than the hired servants of the financial class. It is in their individual interest to perpetuate the illusion that our current monetary system is the only “free and efficient” way to bring money into circulation. Listen closely to these economists during their interviews and notice how all of their “solutions” center around the SYMPTOMS while never mentioning “debt-based” DISEASE itself.

Add to this mix a general public that is chained to this debt slavery, working more and more hours and finding it increasingly harder to maintain their families. After exhaustive toiling, they seek relief and diversion in the form of mind numbing gladiator football games, celebrity worship, reality TV, or other minutia, rather than taking the time to educate themselves on complex issues.

This disinterest or lack of understanding creates an environment where it becomes easy for the financiers to continue a system that benefits them personally at the expense of everyone else. No one is watching the store and the till is open.

I recently attended the Public Banking Conference in Philadelphia where a 12-year-old girl blew the crowd away with her understanding of our corrupt money system. If a 12-year-old can “get it,” then it is time for our leaders and the general public to “get it” as well.

During this conference, the following question was asked by another speaker, “How can a nation and its people become trillions in debt when most of what they have done over the last 250 years is produce wealth through their labor?”

This profound question inspired me to do some serious thinking about where this debt actually originates.

Consider these questions: If you owned a printing press in your basement and could LEGALLY print your own money…

- Would you choose to pay your bills by printing the money you needed?

- Would you choose to pay your bills by going to the bankers for a loan?

Of course you would print your own money. Our government is in exactly this same position. It can legally print its own money as stipulated by the Constitution, and yet we have the spectacle of our the government going to private bankers to borrow money to pay its bills, rather printing its own debt-free money.

Most people are not aware of this fact, and that is by design.

Can you imagine yourself printing your money, then selling these same bills for the cost of printing to a private bank? Can you imagine yourself then going back to the bank and borrowing that same money at face value plus interest?

That is the unbelievable and absurd situation we currently have.

The Treasury Department prints our paper dollars at a cost of approximately 4 cents per bill. The cost of printing each bill remains the same regardless of whether the denomination is $1, $10, or $100. These newly printed bills are then sold to the Federal Reserve for the cost of the printing. The government (taxpayers) then borrows this money back at face value plus interest.

The name “Federal Reserve” was deliberate in its attempt to deceive the people. It is a cartel of PRIVATE bankers, it has no reserves, and it is no more federal than Federal Express. In fact, the federal income tax was started in order to pay the interest on our “debt-based” money supply.

Now there are 3 ways that money can be placed into circulation: it can be GIFTED, it can be SPENT, or it can be BORROWED.

If the government were to simply give people printed money, it would be GIFTED into circulation. Since this “free money” provides no incentive to produce anything, there is no increase in production. The money supply increases, but not the number of produced goods or services, which ultimately results in inflation.

If the money is SPENT into circulation, it is used to pay for a goods or service that have been produced. The creation of these goods or services represents the creation of wealth.

Therefore this created money is a payment for wealth that has been produced. This also increases the money supply, but since a matching amount goods or services were also created, this does not result in inflation. This money is then “wealth-based,” making it is a representation of wealth that has been created and therefore has no debt or interest burden associated with it.

If the money is BORROWED into existence as it is done in our current “debt-based” monetary system, the money is created out of thin air by the banks using thefractional reserve lending system. This money is then a representation of debt and has a debt and interest burden associated with it.

The way money is brought into circulation is at the very heart of our problems. It turns out that in our “debt-based” monetary system, our entire money supply (except for coins) is created when a loan is taken out. Once the loan is repaid, the money is removed from circulation. This system unfortunately has a fatal flaw that guarantees its ultimate collapse.

Let’s assume that we are on an island with a totally closed monetary system and you were to borrow $100 at 10% interest. You can pay back the $100 principle because $100 was put into circulation as a result of your loan. However, where will the $10 in interest payments come from if there is no other money in circulation? The fact of the matter is that the loan must default because there is not enough money in circulation to pay principal and interest.

Since the $100 in circulation is the result of the loan being taken out, this $100 is placed as a liability on the bank’s books. Once you have paid off the loan, this liability is removed from the bank’s ledger.

That is how the money is extinguished once you have repaid the principal on the loan. The only way to pay back the interest on the loan is to borrow more money into circulation. Only the principle is extinguished, the interest is not extinguished because the interest was not a liability on the bank’s ledger. The interest amount ends up in the pockets of the bankers.

If someone takes out additional loans to cover the interest charges, it will only delay the day of reckoning. Ultimately you will have an even higher interest burden that can never be repaid. Doesn’t this sound familiar to the economic situation we currently find ourselves in?

Of course, our monetary system has millions of people taking out loans, making payments, and doing other transactions all of the time. However, the fact remains that you can only repay a loan with interest if you or someone else takes out a loan to place additional money into circulation.

The problem is that now someone else will have a loan to repay and will also need additional money in circulation to pay for their interest charges. So the debt burden for the money to pay the interest payment on your loan has been shifted to someone else, and over time the interest burden continues to grow.

It becomes quickly obvious that as a nation we must constantly be in debt in order to service the interest charges on our money supply. As time passes, this debt overhang, with its associated compounding interest charges, becomes a larger and larger burden on the society, eventually reaching a level that is no longer sustainable as it is becoming today.

The other fatal flaw in this system is that in order for the money supply to keep up with the growth in the economy, we must also continue to grow the debt in order to grow the money supply.Some of those clueless politicians represented by the first doctor we visited at the beginning of this article think we should pay off the debt. What they do not realize is that if the debt was ever totally paid down, there would be no money in circulation. Our current “debt-based” monetary system is the DISEASE.

Until we change our monetary system from “debt-based” to “wealth-based,” we can never pay off the debt, because if we did, there would be no money in circulation. The patient would die!

Think about this example of the insanity of the current system.

If a government wants to build a bridge, instead of printing and then SPENDING the money into the economy with no interest bearing debt associated with it, the government instead goes to the bankers and BORROWS the money into existence. By BORROWING the money into existence, the government incurs interest charges which means that over the term of loan the government will pay more money for this bridge in finance charges than it pays for the materials and for the labor for the project. This financing cost of “debt-based” money is then passed onto everyone.

In a “wealth-based” system, the government would SPEND the money into existence, rather than BORROW it into existence. The costs of all infrastructure projects could be cut by more than half.

This fact should resonate to those of you with a home mortgage, once your mortgage is paid off, the interest charges have easily exceeded the original cost of your home. The same thing is happening to all of our infrastructure projects. The financial class is profiting immensely from our current “debt-based” system.

So, is a “wealth-based” monetary system some utopian vision of what has never been and can never be? The answer is no.

In our colonial past, we had colonial script where the government SPENT the money into existence. Our colonies were prospering at that time.

David Hayes writes about Benjamin Franklin during a visit to England:

The English officials asked how it was the Colonies managed to collect enough taxes to build poor houses, and how they were able to handle the great burden of caring for the poor. Franklin’s reply was most revealing: “We have no poor houses in the Colonies, and if we had, we would have no one to put in them, as in the Colonies there is not a single unemployed man, no poor and no vagabonds.” Think long and hard about this. In the American colonies before the American Revolution, there was “not a single unemployed man, no poor and no vagabonds”. — no one on Welfare, no one on Social Security, no homeless, no income tax, no alphabet agencies, No IRS, BATF, FBI, DEA, CIA, HEW, OSHA, SBA, and on and on and on to provide for the “general welfare” of our villages, towns, cities and states. How did Benjamin Franklin explain this to the British officials of his day? How would he explain it to today’s lawyers, judges, politicians and other government officials? “It is because, in the Colonies, we issue our own paper money. We call it Colonial Script, and we issue only enough to move all goods freely from the producers to the Consumers; and as we create our money, we control the purchasing power of money, and have no interest to pay.”

There was a reason the term Commonwealth was applied to Massachusetts, Pennsylvania, Virginia and Kentucky. The term was also used interchangeably with the term “state” by Vermont and Delaware in its 1776 constitution.

When Benjamin Franklin was in England, he observed hunger, tramps, beggars, and poverty in the richest nation of its time. He asked how England with all its wealth had such grinding levels of poverty. The reply was that they had too many workers and that the rich were already overburdened with taxes. (Sound familiar?)

However, they also had misdiagnosed their problem. It was not that they had too many workers, it was that they had too little money in circulation and it all carried the endless burden of unrepayable debt and interest.

The colonies did not have this problem because they used “wealth-based” money that had need SPENT into circulation. This caught the attention of the English bankers. They had laws passed that prohibited the colonies from using their “wealth-based” currency and mandated that “debt-based” currency should be used.

Within a year after passage of these laws, the colonies found themselves with mass unemployment and beggars as Franklin had found in England. This suffering brought on by a “debt-based” currency was the trigger for the Revolutionary War. Unfortunately, even after the Revolutionary War, the monetary system remained “debt-based” and -- except for brief periods of time -- we never returned to a ‘wealth-based” currency.

Later in our history, Abraham Lincoln was faced with the financing costs of the civil war. He went to the bankers and found to his dismay that they were going to charge him 24% to 36% interest which would have left the country hopelessly indebted to the bankers.

Instead, he issued Treasury Notes that came to be known as Greenbacks because of their green colored ink on the back. This money was independent and debt free and was spend into circulation with no debt or interest burden. Lincoln understood the power of the bankers which led him to write:

“The money powers prey upon the nation in times of peace and conspire against it in times of adversity. It is more despotic than a monarch, more insolent than autocracy, and more selfish than a bureaucracy. It denounces, as public enemies, all who question its methods or throw light upon its crimes. I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at the rear is my greatest foe.” - Abraham Lincoln

In fact, Lincoln did exactly what the Founding Fathers had envisioned for the Republic when they specified that “only Congress shall have the right to coin money.” We all know what happened to Lincoln after the war.

John Kennedy also understood the damage that the current “debt-based” money system was having on the nation and he signed Executive Order 11110 which allowed the Treasury to issue “United States Notes” without having to go through the Federal Reserve system.

Some of you may remember these “United States Notes” as they had the red seal on them, not the usual green seal of the Federal Reserve Notes. This money was also spent into the economy and was free of any debt and interest burdens.

We all know what happened to Kennedy a few months after signing that executive order.

The amounts of money that benefit the financial class by maintaining our current “debt-based” money system is staggering. According to the U.S. Treasury, the amount of interest we have paid on the “Debt Outstanding” since 1988 is more than $8.2 trillion. To better understand the scope of that figure, that would be $8,200 billion!

Our interest payments on the debt are projected to continue to grow if nothing is changed.

Can you imagine what could be done for our nation with all that money? Education, health care, infrastructure, space exploration, alternative energy sources, research and development, lower tax rates, to name just a few.

Add to that the fact that with huge debt overhang, we would not be at the mercy of the global bankers in this time of economic crisis. In fact, if we eliminated fractional reserve lending, and had a “wealth-based” money supply, there would be no crisis.

I see so many good people working so hard to address unemployment, lack of health insurance, budget deficits, foreclosures, endless wars, bank fraud, poverty, inflation, erosion of the middle class, and other SYMPTOMS of our current “debt-based” money system that afflict our society and place huge burdens on the people. Yet, until we eliminate the DISEASE, we will never be successful in eliminating the SYMPTOMS.

This corrupt “debt-based” system is at the very core of most of our social and economic problems. However, there are alternatives to our current system and many people and organizations are working towards changing our money system.

The very powerful forces who wish to keep our current “debt-based” system in place for their own self-serving, individual benefit have the advantage of inertia, the support of the media controlled by them, and a general lack of knowledge about the subject.

Most people are not even aware of the DISEASE, its nature, and that alternatives do exist.

We need to start laying down the foundations of a movement BEFORE the inevitable next economic crisis hits us. People need to become aware that in the past we had a better system. This can be accomplished through education, independent media, and word of mouth. It is time to end the illusion that our current “debt-based” system works for the benefit of everyone.

I would encourage people to take a break from mass entertainment and to become more familiar with the concept of a “wealth-based” money system. These are some good places to start:

The free YouTube video: “Secret of OZ”, by Bill Stillhttp://www.youtube.com/watch?v=swkq2E8mswI

Review: Having private banks create money is the root economic cause of world poverty, ignorance, hunger, and much preventable disease. We can fix this. We can fix it in a matter of months — a year at most – if we have the will. We can make our government the most financially sound in the world — nearly overnight. All we have to do is to take back the power to create and control the quantity of money from private banks (including the privately-owned Federal Reserve banks) and put that power back into the hands of the Congress of the United States where it was under Presidents Jefferson, Jackson and Lincoln.

The book: “The Web of Debt” by Ellen Brownhttp://www.webofdebt.com/

Review: Ellen Hodgson Brown may have done the impossible. She wrote a book about the most stupefying subject in the world – money, where it comes from and how it is manipulated – and made it readable, compelling, even suspenseful. Web of Debt is a page-turner that explains the origin of the Federal Reserve, the functioning of our money supply, currency speculation, capital flows, and the rest. As you read, interest grows like a Wall Street bonus package.

The book: “Modern Money Secrets” by Byron Dalehttp://www.wealthmoney.org/modern-money-secrets/

Review: For the first time ever, I see a potential solution to our debt black hole. Most financial “experts” don’t get it. The Ivy League ones get lost in flawed neoclassical economics so they can’t see the obvious, and the ones wearing suits on TV are just propagandists. Byron makes it real clear: no money gets into circulation without going into debt to a bank. There is no other source. The United States issues no sovereign money! Therefore Americans are not free people. It is time for us to admit the truth and either do something about it, or stop blowing up stuff on the 4th of July believing a myth.

The organization: The Public Banking Institutehttp://publicbankinginstitute.org/

Since its founding little more than a year ago, the Public Banking Institute has become a significant force that is helping to turn banking and finance away from fraud and predation back toward their intended objectives of promoting general prosperity and the common good. According to the PBI website, PBI’s vision is to establish a distributed network of state and local publicly-owned banks that create affordable credit, while providing a sustainable alternative to the current high-risk centralized private banking system. (beyondmoney.net)

The organization: American Monetary Institutehttp://www.monetary.org/the-need-for-monetary-reform/2009/09

The power to create money is an awesome power – at times stronger than the Executive, Legislative and Judicial powers combined. It’s like having a “magic check book,” where checks can’t bounce. When controlled privately it can be used to gain riches, but much more importantly it determines the direction of our society by deciding where the money goes – what gets funded and what does not. Will it be used to build and repair vital infrastructure such as the New Orleans levees and Minneapolis bridges to protect major cities? Or will it go into warfare and real estate loans creating the real estate bubble – leading to a crash and depression.

Editor's note: this article originally published on EndTheIllusion.org and was edited for publication on IVN.