Cannabis Cash: City of San Diego Grabs Over $6 Million in First Year

San Diego, Calif.- The City of San Diego is cashing in with its first year of taxing and collecting fees for cannabis.

Businesses are taxed at a rate of 5 percent of monthly gross receipts, which will increase to 8 percent on July 1, 2019. The rate is not to exceed 15 percent of gross receipts.

According to a city spokesman, tax receipts for the 2018 calendar year total $4,745,332.81. The spokesman noted, "The tax revenue goes directly into the General fund to be used for Mayoral and City Council priority services such as public safety, neighborhoods services and street and road repairs."

In addition to tax receipts, permit fees for the city totaled $1.7 million. "Permit fees received by Development Services of $1.7 million are solely revenues of the Development Services Enterprise Fund and not the General Fund. These fees are collected to recover costs incurred by Development Services to process permit applications for marijuana outlets and production facilities in accordance with San Diego Municipal Code Chapter 4, Article 2, Division 15," said a city spokesman.

The first year total is $6,445,332.81.

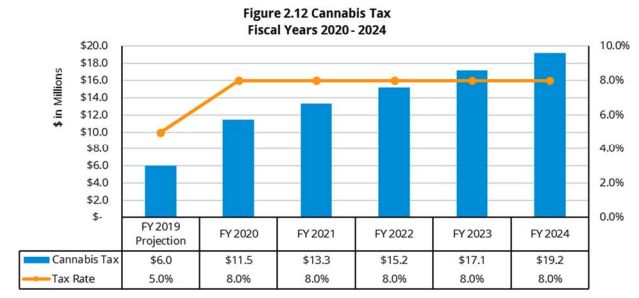

The chart below outlines the increased tax revenue expected over the next 6 years.

City of San Diego Fiscal Outlook 2020-2024

City of San Diego Answers Questions

1. How is the Cannabis tax and permit money being used?

Cannabis Business Taxes collected are enacted solely to raise revenue for general government purposes and are deposited in the City’s General Fund to be used for Mayoral and City Council priority services such as public safety, neighborhoods services and street and road repair.

The Permit fees received by Development Services of $1.7 million are solely revenues of the Development Services Enterprise Fund and not the General Fund.

2. How does the tax rate change going forward and do you anticipate revenues climbing?

Section 34.0112 (c) of the San Diego Municipal Code discusses increases the cannabis tax rate. According listed in the code, the Cannabis Business Tax rate shall be set at 8 percent of gross receipts unless the City Council, by ordinance, takes action to set a different tax rate, not to exceed 15 percent of gross receipts.

3. Any surprises in the first year? Unexpected challenges?

No.

4. The revenue collected by the Development Services Department for permits is $1.7 million. What does $1.7 million go towards for the DSD?

It is important to distinguish the two sources of revenues that the City receives from the cannabis industry: Cannabis Business Tax and Permit Fees.

The Cannabis Business Tax is paid monthly by the outlet based on the gross receipts on taxable sales for each of the businesses. This revenue is General Fund revenue and is also discussed further above in the first three questions.

The permit fees received by Development Services of $1.7 million are solely revenues of the Development Services Enterprise Fund and not the General Fund. These permit fees are collected to recover costs incurred by Development Services to process permit applications for marijuana outlets and production facilities in accordance with San Diego Municipal Code Chapter 4, Article 2, Division 15.

Farm Bill To Legalize Hemp

Every five years or so, the Farm Bill reauthorizes farm and nutrition programs across the country, but this year the Farm Bill could bring sweeping changes to the Hemp industry. Hemp that contains less than .o3% of THC will get federal legalization. Senator Mitch McConnell worked with Senator Charles Schumer to get the hemp-friendly legislation crafted.

The legalization of Hemp will impact the CBD industry as a whole to where it's expected to grow by 40% over the course of the next 20 years.

City of San Diego officials were asked about the Farm Bill and here was their response:

"Once the proposed 2018 Farm Bill passes, the City will conduct a thorough assessment of the various aspects of the bill to ensure compliance."

Industry Reaction

March and Ash is one of about a dozen 14 dispensaries operating in the City of San Diego. The upscale boutique in Mission Valley is just east of Texas Street.

Blake Marchand is the CEO. He said the city's rules and regulations weren't overly challenging:

"The city has been great to work with and, in turn, we've worked hard to ensure they're happy with our space. We believe that everyone deserves a comfortable and confident cannabis experience and we prioritize customer education, safety, and satisfaction."

As it relates to the Farm Bill, Congress is poised to vote on its passage in the coming week.

March and Ash issued the following statement:

"The 2018 Farm Bill takes significant strides in the right direction when it comes to legalizing and regulating the industrial hemp industry. While this is good news for consumers and cultivators alike, greater policy coordination among government agencies like the FDA must be made in order for states like California to make a determination as to how best adhere to federal food and drug standards."

As for the City of San Diego, it expects revenues and fees to top $18 million by 2024.