Yellow Journalism? VICE Produces Emotional Spot On Insulin Pricing With No Facts

VICE News produced a 5 minute video for its HBO series following a Colorado diabetes patient who is testifying at the state capitol in favor of a bill which would require insulin manufacturers to disclose insulin pricing information.

In producing the VICE video, correspondent Hamilton Morris has delivered a high-quality and emotionally engaging production. The only problem? It is factually lacking.

Yellow Journalism?

From Wikipedia: "Yellow journalism and the yellow press are American terms for journalism and associated newspapers that present little or no legitimate well-researched news while instead using eye-catching headlines for increased sales."

The VICE video runs just 285 seconds. More than half of that describes the problem of rising insulin prices in an emotional fashion through the eyes of a diabetes patient. Twelve seconds of the video describes the bill. Thirty seconds shows disjointed statements from lawmakers and witnesses in the bill's hearing that don't really hang together coherently or explain how insulin pricing actually works. I follow drug pricing, I have worked in a legislature and I didn't understand the way VICE edited the hearing.

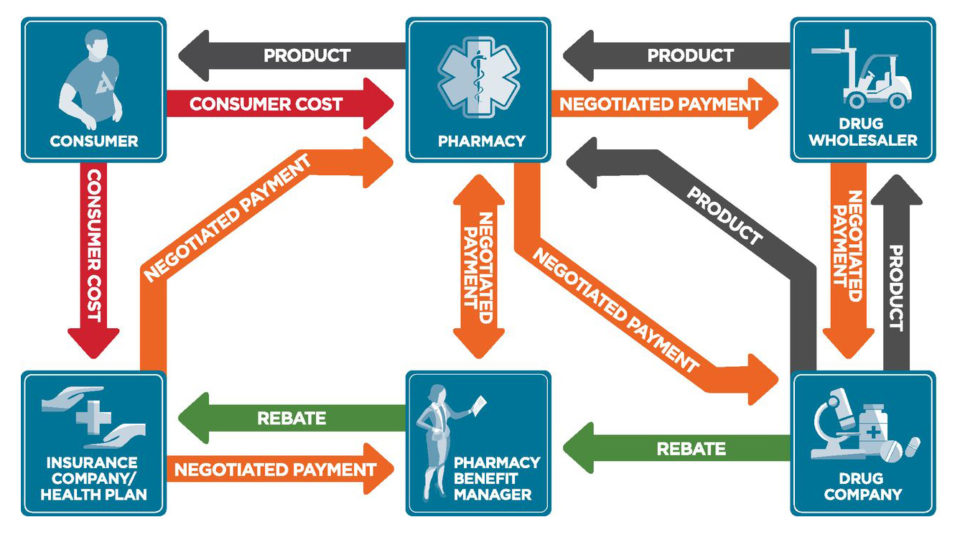

No part of the video mentions the broader Pharmaceutical Industrial Complex - wholesalers, the insurance industry, pharmacy benefit managers, pharmacies - or any of the major players that actually profit from the $237 billion Americans spend annually on diabetes.

So I did a web search for HB-18-1260, the Colorado bill, in an attempt to supplement the 12 seconds shared by VICE.

The bill would require pharmaceutical drug manufacturers to “...notify state purchasers, health insurers, and pharmacy benefit management firms when the manufacturer... increases the price of certain prescription drugs by more than 10%.”

The fundamental flaw in this bill and the VICE analysis is that the “pharmacy benefit management firms” have rocketed to the top of the Fortune 500 using a business model that primarily sets retail prices for prescription drugs and takes a cut of the high price. So, why would we give some of the biggest corporations in the world an even bigger advantage in the healthcare marketplace by unilaterally giving them industry/company secrets, like manufacturing costs?

"Journalists" like Hamilton, should be asking and getting answers for these questions. Instead, we get emotional appeals that are long on the truth of the problem, and short on taking the time to really understand it.

That is exactly why our healthcare costs are still high. People who take advantage of the system (e.g. those who put profits ahead of our collective health) have no bigger friend than an emotional "journalist" who has no idea how the world actually works and displays little desire to find out.

PBMs Make More Money than ExxonMobil

Look, I'm not a full-time journalist. And I certainly don't have a VICE/HBO-level budget. But I do have access to Google, a working cell phone and resources I could use for research if I were going to produce a documentary that is intended to be productive journalism.

PBM's are little-known entities (which is why we should talk about them more) that have huge leverage in drug pricing negotiations. Just three Fortune 25 corporations control as much as 80% of retail drug prices in America. Yes, there are corporations in America that make billions largely by setting retail prices of the products other companies manufacture and taking a cut. A big one.

Make no mistake. I am not defending Big Pharma. And manufacturers have plenty they need to defend. But the simplistic view of the insulin pricing problem recounted by VICE does nothing to further solutions. There is no single waxed-moustache villain in a black top hat victimizing diabetics. A lot of fingers are in the pockets of insulin users.

Some of the other corporations trying out for the villain role include Express Scripts, the largest free-standing PBM, which debuted on the Fortune 500 in 2000 at #371. Today Express Scripts is 25th on Forbes list, larger than Boeing, Microsoft, Citigroup, and every single drug manufacturer.

The two other major players are part of other corporations - OptumRx, a division of UnitedHealth and CVS Caremark. UnitedHealth and CVS Caremark are the #5 and #7 largest corporations in America. With revenues of $64 billion, OptumRx accounts for nearly 40% of UnitedHealth's annual revenues. CVS Caremark's $131 billion PBM division accounts for 60% of the company's revenues. The top three PBMs, collectively, account for nearly $300 billion in revenue. For perspective, ExxonMobil, a corporation that needs no introduction, weighs in with $244 billion.

2017 Revenue

CVS PBM division

$130,596

Express Scripts

$100,065

OptumRx

$63,755

Total PBM Revenues

$294,416

ExxonMobil

$244,363

The top fifteen drug manufacturers combined for $551 billion in revenues in 2017. So the top three PBMs, whose function is to set retail prices for prescription drugs and process transactions, make an amount equal to 53% the revenue of the top fifteen manufacturers ... the companies that actually produce something.

This calculation holds true on a more granular level. In 2016, Merck released some pricing information for its drugs, revealing that 40.9% of its drug revenue went to pay rebates and discounts to middlemen such as PBMs.

Could it be that PBMs are making a little profit from their big portion of the healthcare industrial complex...?

Follow the Money... and the Insulin

The American Diabetes Association (ADA) even issued a report in June of 2018 detailing the problems with insulin pricing and illustrating the insulin pricing chain which Hamilton missed.

Pay attention to the role of the pharmacy benefit manager in the graphic below. The PBM is paid by the drug manufacturer through the form of a rebate, the green arrow. It is paid by pharmacies through a negotiated payment, the orange arrow. PBMs are paid similarly by pharmacies.

But the gray arrow, showing the path of the insulin product, never touches the PBM. The PBM doesn’t develop better insulin, it doesn't manufacture insulin, it doesn’t ship insulin, it doesn’t warehouse insulin, it doesn’t sell insulin to consumers. But it gets a big cut of insulin profits three different ways in the process. This is how the three biggest PBMs, accounting for 80% of the market, have become Fortune 25 companies as the de facto broker for the drug market.

Who Sets Retail Prices?

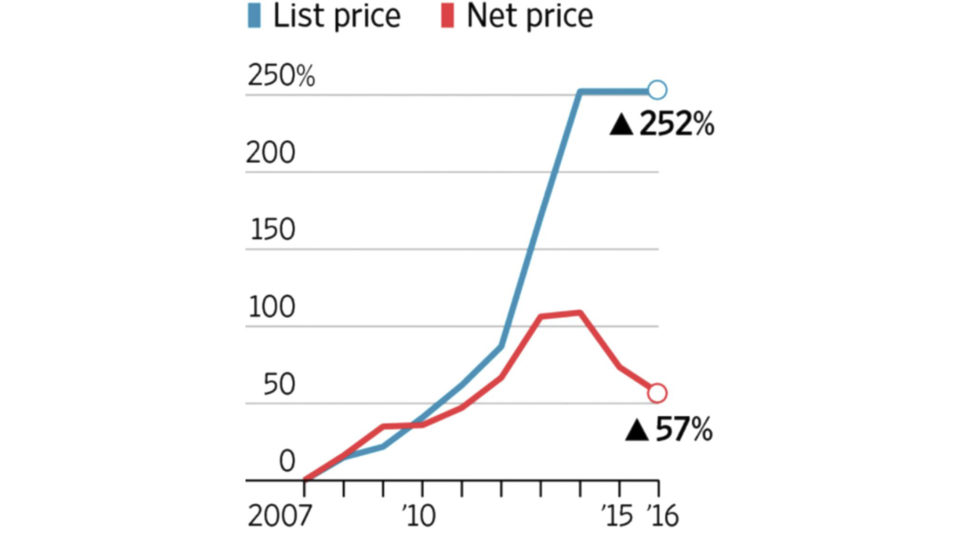

The authors of the ADA paper also note that insulin makers are making significantly less than the list price they charge. The list price of Eli Lilly's product Humalog, for example, increased 138% between 2009 and 2016, but Lilly's after-rebate price increased 6% in the same period.

More broadly, the chart below details the rise in the list price for insulin - the price the manufacturers set - and the net price, which is the revenue the manufacturer receives after paying rebates to pharmacy benefit managers.

Chart: Wall Street Journal

So ... where does that money go? Well, who sets the retail prices? If Hamilton spent half as much time in the video explaining the basics of drug pricing as telling us how much insulin costs, over and over again, he might have educated policy-makers and voters on potential solutions.

PBMs work for health insurance plans. They negotiate rebates and discounts from drug manufacturers in exchange for including them on their clients’ list of covered drugs. They look not for the best drug, not for the cheapest drug, but the drug from manufacturers that are most willing to give PBMs big discounts and rebates.

In short, insulin pricing is a complex issue and has many profit-seeking actors. VICE News and HBO may find emotion-driven activist journalism a boon to ratings. But by shorting the public on a path to a solution, maybe VICE should consider whether they are part of the problem.