How Trump, Dems Can Solve Income Inequality, If They Work Together

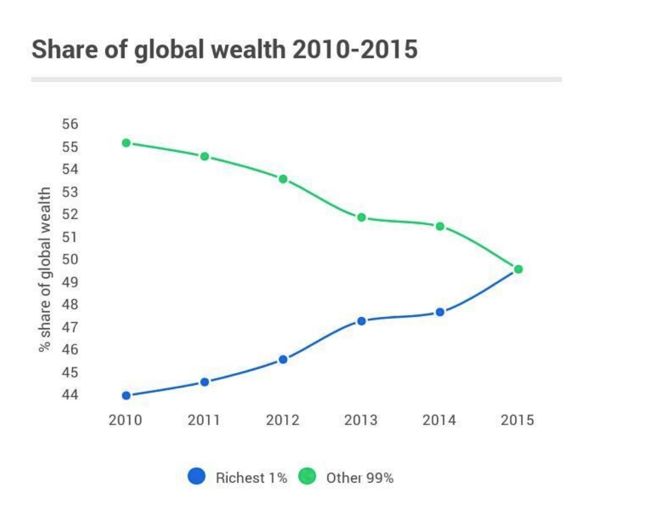

The flowing tide of income inequality has been garnering attention in most every country on earth.

Aside from being an “American” issue, income inequality has increased dramatically around the globe over the past 30 years or so. In response, policy makers have proposed a myriad of ideas in order to curb the issue. In the United States, programs to provide temporary windfalls of cash to middle and working class families seem to be the most popular amongst Democrats and Republicans.

More specifically, many officials have touted infrastructure spending as a way to curb income inequality, but as we will see, there is a significant possibility that these stimulus programs actually have the reverse effect over time. To be clear, infrastructure spending is vitally important and desperately needed. Passing an infrastructure package would be a good thing for the economy, but claims that infrastructure bills are useful tools in fighting income inequality may be misguided.

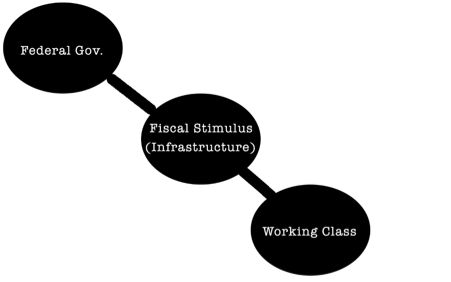

Immediate Flow of Capital

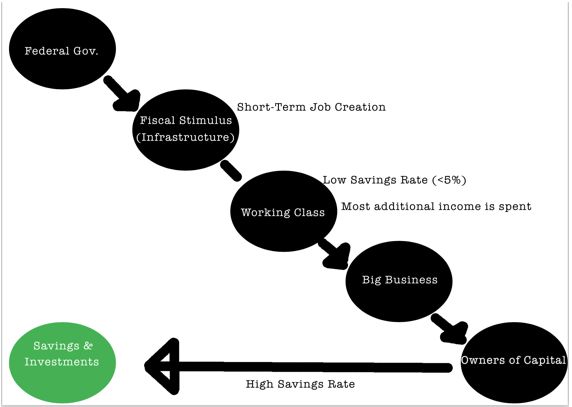

To see why, let’s look at this simplified chart that illustrates the immediate flow of capital from a federal infrastructure initiative. Obviously, this money originates from the government, where it then flows to specific infrastructure projects around the country.

In order for these projects to be completed it will of course take labor, which emanates from the middle and working class. So, the rationale goes, if we fund these projects then a good deal of the money we devote to it will end up in the hands of the middle and working class.

And actually, this is true.

However, it is not true for very long, and to see why we’ll have to look at a few other factors.

Middle and Working Class Savings Rate

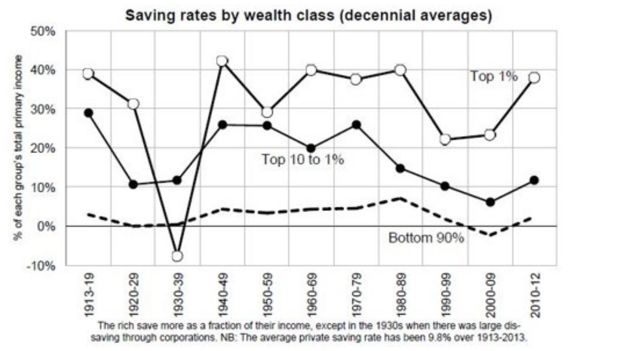

In order to complete the chart shown above, we must first consider the savings rate (what percent of income is saved rather than spent) for Americans across the board.

As shown in the graph above, while the top 1% has a savings rate close to 40%, the bottom 90% has a savings rate of under 5%.

So, rather than saving or investing this new income, statistics show us that almost all of it would be spent. Most likely, the majority of the money received by the bottom 90% will be spent on three things: rent, mortgage payments, or debt servicing; and with personal debt levels increasing, we can only expect for the savings rate amongst the “bottom 90%” of Americans to continue to fall.

Following this line of thinking, it appears that the “owners of capital,” or business owners, will end up with the lions share of the money earned via these projects. This point is further bolstered when we look at data provided by the Federal Reserve concerning US Household Debt.

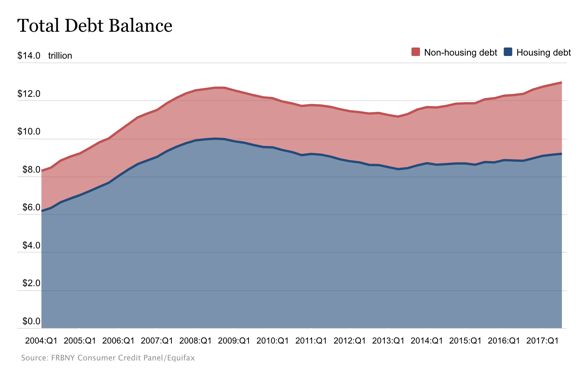

Personal Debt Levels are Increasing

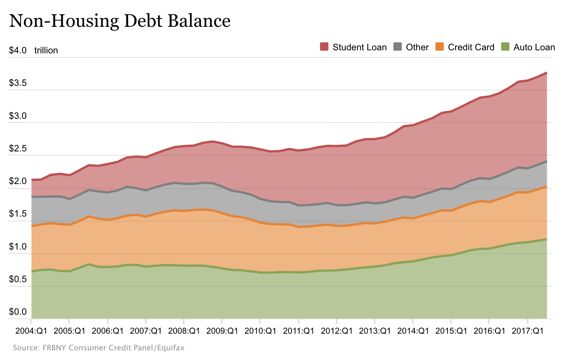

As you can see, Household debt has hovered between 8 and 10 trillion dollars since the end of the recession, and non household debt has seen a rapid increase over the past few years, growing by about $1 trillion since 2013. So, what has lead to the increase in non-household debt? The following graph will give us some insight:

Were you surprised to see the rapid increase in student debt levels? Neither was I. What is more, is that this is an issue that shows no signs of slowing down.

The reason this is important to point out, is because it shows that we have larger, structural issues in our society that must be addressed in order for us to ameliorate our issue with income inequality. Understanding that the intended beneficiaries of these stimulus packages will most likely turn around and use that money to cover expenses or pay down debt allows us to complete our initial graphic, which now looks like this:

Since we’ve gone over the first three parts of this graphic, let's turn our attention to the rest of it. When the working class spends the additional income received from a government stimulus, they are most likely to spend it at a big businesses. For example, we previously discussed how there is a great possibility that any additional income received from the middle and working class would go towards paying down student debt.

The company that receives those debt payments could most certainly be considered a “big business.”

And as we know, every business has at least one owner. These owners, shown as “Owners of Capital” in the graphic, tend to be towards the top of the income spectrum, and have much higher savings rates than the average American. Since they have a higher savings rate, they are the ones who will benefit from government stimulus packages over the long term, as they are in a position to invest and save much of what they earn.

Once again, this article’s intention is not to decry infrastructure spending or fiscal stimulus, as both of these things are immensely important to our economy. In the case of fiscal stimulus, it is important only to use these measures judiciously, when the economy is really in need of a stimulus. That being said, the belief that government spending will curb income inequality is a misguided one.

Rather, it is more important for our government to address the structural issues that lead to income inequality.

For example, investments in our educational system that allow for cheaper (or free in some cases) tuition will help keep the cost of living for average Americans at a reasonable level.

Furthermore, we must make deep investments in ensuring that our educational system is providing our students with the skills they will need to secure jobs in the future. Of course, this means making computer science and coding a staple in high school curriculums (I wrote about this at length in a previous article you can read here). In theory, the return on our educational investment would be higher paying, more secure jobs for the United States’ workforce. Finally, it will also be important to offer favorable tax environments to companies that employ highly skilled tech workers.

Currently, neither of the major political parties in the United States have put this together.

While Democrats advocate for more affordable education, they have yet to properly address the other two facets of this issue. Conversely, while Republicans have certainly made the tax environment for tech companies more favorable, they have perhaps done so at the expense of investing in public education.

It is important to understand that all facets of this plan must be implemented for it to work. Continuing our dependence on “stopgap” policy, in which we put band-aids on infected wounds, rather than taking the time to fully heal them, will only damage us in the long run.

As we have seen all too often, our two political parties favor short-term wins over long-term results. The purpose of this article was to point out how crafting policy proposals that address big issues like income inequality takes a lot of time and effort. Curtailing this issue cannot be done with the stroke of a pen, anybody who tells you differently simply hasn’t thought through the issue enough to know better.

Photo Credit: Prazis / shutterstock.com