Jeb Bush Rehashes Old 'Solutions' to Social Security While Fund Marches Toward Insolvency

Jeb Bush charged straight into one of the most politically divisive issues of our time: altering the minimum age to start receiving Social Security.

While Bush stated this should be done in a "relatively short order," he did not have an age in mind to share with reporters. Potential presidential candidate Chris Christie has suggested that the retirement age should be raised to 69. The current minimum age is 67 for those born after 1960.

The unfortunate reality is that politicians have never been faithful to the basic mathematics required to keep the Social Security Trust solvent. Raising taxes is often political suicide and raising minimum age requirements risks alienating important voting blocs. However, something does need to be done to guarantee the solvency of the Social Security Trust.

The Cold Math of the Social Security Act of 1935

The Social Security Act of 1935, as far as congressional bills go, is remarkably small -- only 37 pages long. But from this bill evolved a set of programs that makes up close to half of the entire federal budget, which was far from the intent of the original bill.

The pensions provided by the original versions of the Social Security Act paid a lifetime pension to those who reached 65 years of age, who during this time period were some of the most vulnerable Americans.

But the actuarial data behind this was almost draconian in nature -- especial for a so-called "liberal plan."

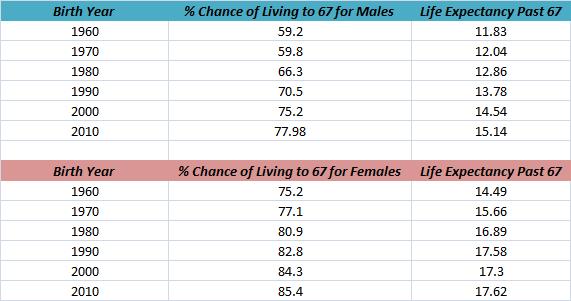

Using the government's own figures, it was built into the plan that 50 percent of the populationwould never live long enough to receive benefits. The government's calculations also predicted that those collecting the pensions would only have a life expectancy of 11.83 years.

This was due to high childhood and young-adult mortality rates, coupled with limited medical knowledge in the field of gerontology.

In the decades following WWII, medical advances eliminated most childhood diseases, while mechanization and federal safety laws provided an additional level of safety to young-adult workers who primarily died from work-related accidents.

Life expectancy rates started to skyrocket -- especially for women -- and politicians did not keep up with the actuarial necessities of the program for it to remain solvent.

Simply put, Congress needed to keep pace by one of two methods: increasing the age of eligibility or increasing the premiums. However, it has never been politically expedient to do either at a rate that would keep the program solvent.

One of the greatest political ploys of the past few decades has been the accusation that various politicians have "robbed from the Social Security Trust."This is both an accounting and a political falsehood.

By law, excess amounts of money held by the Social Security Trust (as in money not needed for the payment of immediate benefits) is held in government securities (i.e. Treasury Bills or special issue bonds).

This amount is included in the national debt, and the government has used this money for its operations.

On the surface, this has the appearance of issuing worthless IOU's, but the accounting realities are something completely different.

First, government bonds are the only truly risk-free investment. As the issuer of currency, the government can always print more money to pay for the bonds. As long as the currency is still good and valuable, the bond is good and valuable -- but the stability of the currency is a political issue outside of the Social Security program. And frankly, if the currency is no good, no other investments are good either (it's not like stocks and bonds in the market aren't denominated in dollars, too).

Second, even if the government built a huge bin, like Scrooge McDuck's, to hold all the money collected from the payroll taxes, that amount of money is counted in the national debt.

Why? Because from an accounting standpoint the government still owes that money to someone at a future date.

A Treasury security is only an interest-bearing alternative to cash. There is zero difference (other than the interest earned on the bonds) between the Social Security Trust holding Treasury securities and money being stored in a huge vault -- the balance sheet accounting is exactly the same.

The Colder Math of 2015

Even with the minimum age of 67 for those born in the decades after 1960, this minimum age starts having a profound impact:

People born in every subsequent decade from the 1960s on have both a higher life expectancy (with a few exceptions) and a greater percentage of cohort survival (more of each decade's population is going to live to receive benefits at current age requirements).

The generation of the 1960s will be able to draw Social Security (reduced-early benefits) within one decade. This is a mathematical reality we have to face at some point soon.

Three 'Solutions' to the Problem

There are two obvious solutions to this problem, and one not so obvious one -- one that might be the least "draconian" of the solutions.

The two obvious solutions are raising taxes or raising the age minimums for benefits.

Raising taxes has never been politically expedient for either party because of their internal beliefs or the political damage caused by the other party.

Raising minimum age requirements has two problems: (1) Which statistic do you use? (2) Do you treat each gender the same?

Should the percentage of cohort statistic be used or the life expectancy statistic? There is really no good answer for this, but in a society with 64 million people currently receiving benefits, the cohort statistic would probably be the soundest of the two.

Women, on average, live far longer than men. There needs to be some consideration to the difference in longevity, although treating over half of the population differently would cause considerable problems. This reality may have no solution at all, but it still impacts the system as a whole.The third solution is quite simple: limit, by legislation, the amount of outside income you can earn (of any type) to receive Social Security.

The law could be generous, even allowing pensioners to earn $31,200 (40 hours a week at $15 an hour--roughly the national average wage), but this fixes two problems that we are immediately facing: young workers not finding decent paying jobs and the solvency of the Social Security Trust.

What this solution also does is restore the concept of Social Security to what it was originally intended to be; namely, a safety net for those who were the most vulnerable and least able to support themselves.

We can't discount any options when it comes to restoring the solvency of the Social Security Trust, but we should also explore ideas that restore the intention of the program and not conduct business as usual in Washington.

Photo Credit: Kim Reinick / shutterstock.com