3 Pitfalls of the Fair Tax Proposal

Several weeks ago, several people criticized the article about comparing America's tax rates to the rest of the world, countering with comments on Facebook like:

Who cares? These comparisons are always intended to show us just how lucky we are to be in indentured servitude to the state when we should be trying to be a shining light of individual freedom and liberty to the rest of the world. Fair Tax --- Michael Storc

In a very long thread, the Fair Tax proposal was debated, with at least one reader asking for a separate article on the pitfalls of the proposal.

While there are numerous criticisms to the Fair Tax, this article will only focus on 3 pitfalls -- ones that should make any voter leery of the idea.What this article will not focus on are the endless "what if" scenarios, which include the rise of a black market, whether businesses would actually turn over collected taxes, whether the tax rate is actually high enough to be revenue-neutral, whether interest would be fully taxable, or the possibility that increased prices could result in less consumption.

While these are all valid concerns, the purpose of this article is to focus only on the pitfalls in the text of the bill.

Most bills in Congress are written in fairly plain, but "legalese" English. However, support for a bill is too often based on other people's interpretations of what the bill says, rather than the supporter actually reading the bill.

H.R. 25, The Fair Tax Act of 2015, is a fairly short bill (as far as bills of Congress go), with just over 23,000 words of text. It can be read in one sitting and doesn't take a law degree to understand.

This was one of the hallmark points of support from the bill's sponsors: bills in Congress are too complicated for the average American to read or understand. The underlying crux of the bill is to eliminate all payroll, estate, and gift taxes and institute a 23 percent consumption tax on all goods and services purchased.

But just because something is easy to read, doesn't mean that there won't be plenty of pitfalls and shady mathematics remaining within the proposal.

Pitfall #1: It Isn't A 23% Tax

From the very beginning, shady math is employed to make the tax rate seem smaller than it really is -- even most of the proponents on Facebook failed to see the difference in their criticism:

If you buy something for $85 they would multiply that number by 15% and add it back to $85. That's what I'm saying you made up and don't have a source for. --Michael Storc

This is how almost all Americans view sales taxes: the sale price is multiplied by tax rate, then the tax amount is added to the sale price to give the gross price (15% was just used for illustration purposes; it has nothing to do with the Fair Tax proposal).

Here's what the Fair Tax bill says (after 2017, the rate would fluctuate based on the needs of what is currently called the Social Security Trust):

"In the calendar year 2017, the rate of tax is 23 percent of the gross payments for the taxable property or service." -- Section 101(b)1 of H.R. 25

Twenty-three percent of the gross payment is vastly different than a 23 percent tax added on to the sale price:

gross payment=(23%* gross) + sale price

100=23+77

100/77=1.2987

77*1.2987=100 (roughly, the rounding throws it off by a few cents -- a $77 sale at 23 percent sales tax would equal $94.71)

The tax rate is 29.87 percent, not 23 percent.

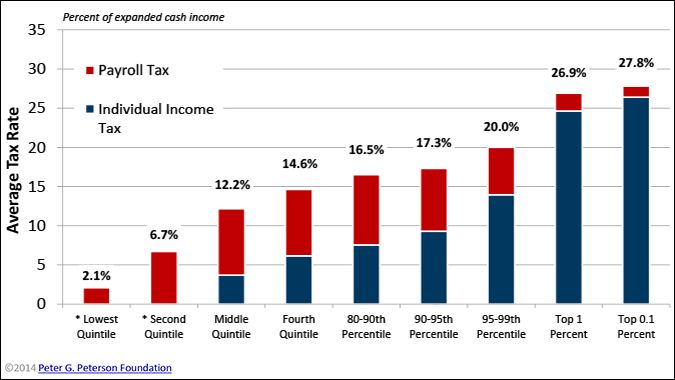

This is an important distinction to make, primarily because no tax bracket currently has an effective federal income tax rate of 29.87 percent. This would be a tax increase for most Americans.

Why wouldn't it be a tax increase for all Americans? The bottom four quintiles are likely to spend most of their incomes; the top quintile is equally likely to not spend most of its income, creating a very powerful tax deferment.

Shouldn't it concern consumers when the sponsors of a bill conceal the real tax rate with phony math that isn't normally used by any American consumers when calculating the sales tax on an item?

Pitfall #2: Americans Would Constantly Be One Medical Calamity from Financial Ruin

With a level of pride, the sponsors of the Fair Tax bill tout the fact that there are no exemptions and no loopholes to the tax. Plain and simple, all goods and services are taxed to the consumer -- from food, shelter, and clothing, to prescription drugs and medical services.

Every household would get a prebate (calculated from the poverty level), but this amount would never take into account special life circumstances.

Thelifetime risk of a man developing cancer is 1 in 2; for a woman, it is 1 in 3. Cancer is one of the most expensive conditions to treat -- often chemotherapy drugs cost over $100,000 per year.

While many Americans have health insurance, most have fairly high out-of-pocket deductibles and copays. These are all taxable services, payable by the patient, not their insurance company (oddly enough, the amounts paid by the insurer are tax-free under a special exemption in Sec 2(a)8C).

A report by Duke University Medical School noted that most cancer patients are currently forced to skimp on both care and necessities because of the out-of-pocket costs associated with treatment, with out of pocket costs often exceeding payments for housing. Adding taxes to this burden would only increase the financial distress.

Cancer is just one scenario. Millions of Americans have self-pay portions on long-term and nursing care (even when on Medicaid, the patient still has a self-pay portion due to the facility). For instance, in Kansas, a person on Medicaid is only allowed roughly $70 per month in income when in nursing care. The rest of their income is paid by the patient directly to the nursing facility as a copayment. This would also become a taxable amount.

Does it really make sense to be taxing the most vulnerable Americans at a time when most are spending more than they are earning?

Pitfall #3: The Fair Tax Law Would Be Subject To Its Sunset Clause after 7 Years

After all of the wrangling, the Fair Tax would just fade away after 7 years.

If the Sixteenth Amendment to the Constitution of the United States is not repealed before the end of the 7-year period beginning on the date of the enactment of this Act, then all provisions of, and amendments made by, this Act shall not apply to any use or consumption ... -- Section 401

This makes most of the arguments a moot point -- there hasn't been an amendment to the Constitution passed from start to finish in over 44 years (the Twenty-Seventh Amendment was intended to be part of the Bill of Rights).

The whole bill rests on the assumption that three-fourths of the states will go along with the program. Just one look at a current political map would indicate that this would never happen.

The crux of the Fair Tax argument is that once in place, everyone would automatically see how beneficial the program is, and it would get overwhelming support to repeal the Sixteenth Amendment. This, of course, completely ignores our entire history: Americans, in general, hate all taxes regardless of the type or perceived fairness.

The Fair Tax proposal has been introduced into every session since the 106th Congress. The bill has had more than ample chance to pass Republican-dominated, mixed-party, or Democratic-dominated Congresses, yet has failed each session to even make it out of committee.President George W. Bush sponsored a panel to examine several different tax reform programs and found that any national sales tax scheme would be undesirable for many reasons (including the unlikelihood of being revenue neutral, the high risk of an emerging black market, and rampant tax evasion).

The most significant finding of the panel was that a national sales tax would have to be at least 49 percent to overcome rampant tax evasion (see pages 215-219).

Built into the Fair Tax proposal was a 15 percent tax evasion rate, which is lower than current rates. The panel used three sources of data and determined that the tax evasion rate would likely be around 50 percent.

These recommendations effectively killed any support from the Bush administration for the Fair Tax proposal.

Likewise, President Obama is completely outspoken against any tax scheme that is not progressive in nature; simply put, the Fair Tax program doesn't have support where it counts (in either party).

Does it really make a lot of sense to waste time and money on a proposal when it will almost certainly die during the legislative or amendment process?

Even worse, too many laws with sunset clauses become part of the bureaucratic nonsense of Washington, with the so-called democratic snooze button routinely employed to prevent sunset clauses from ever meaning anything. This added layer of legislative dishonesty only serves to provide false hope to voters -- hope that will be stripped away by no-debate votes to extend promised sunsets.

Do we really need to add more provisions that Congress will never carry out?

Should Taxes Be Progressive?

Whenever you use the term "progressive tax structure," you always have to be careful to define it. It's not progressive in the sense of newness or reform; it's progressive in the sense of higher income brackets paying higher tax rates.

The question of whether the rich should pay more (or the poor pay less) is a question of fairness versus equity. Fair is everyone paying the same amount. Equity is people paying proportional to the benefit they receive from society.

The entire basis of the social contract theory is that people will have to give up rights (and at times their life or property) for the protections that government gives them. A rich person would not be rich for very long without the legal protection of the courts or the enforcement power of the police -- there would always be someone willing to take their wealth by force.Too often we think of the poor being the greatest burden on the system, but how much of the government's time, money, and effort goes into ensuring the property rights of those with wealth? From deeds and titles, to court cases, most civil cases revolve around the protection of property rights.

Without the protections of government, only anarchy and brutality would remain.

To whom much is given, much is expected -- a 2,000-year-old principle that is still valid today.

There is no doubt the American tax system is in constant need of reform, but any system that tries to spread the burden "fairly" ignores the fundamental principles of the social contract.