Public Sector Unions Related to Higher Debt?

Earlier this year, Michigan became the 24th state in the nation with a ‘right-to-work’ law. And two weeks ago, a Michigan court ruled that the state’s new ‘right to work’ law applies to unionized state government workers. This means that state workers will not be forced to pay union dues as a condition of employment beginning next year.

These developments inspired some dramatic public debate. Thus far, however, business leaders and labor lawyers are reporting little dramatic change in the degree of unionization in either the public sector or the private sector in Michigan. See for example this recent article by Chris Gautz in Crain’s Detroit Business. Change takes time, however, and from a longer-term perspective, the degree of unionization has been significantly associated with real economic growth and government finances for states and local governments.

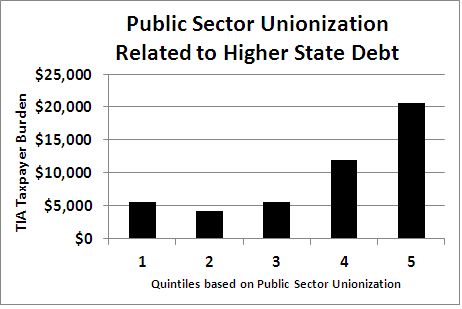

The chart above relies on a ranking of the 50 states based on the share of public sector workers covered by collective bargaining agreements. States with higher public sector unionization rates tend to have higher Taxpayer Burdens, as estimated by Truth in Accounting.

Both direct and indirect factors account for higher government debt loads in states with higher public sector unionization. States that have government workers with greater bargaining power also tend to be those with more onerous retirement-related obligations like pension and health care promises, which are important elements of the Truth in Accounting “Taxpayer Burden” metric. However, states with higher public sector unionization rates tend to be states with stronger special interest group forces more generally, which can also drive debt burdens higher.

It will be interesting and instructive to watch developments in Michigan on this score in coming years. They don’t call the states ‘laboratories of democracy’ for nothing.