California Sales Tax Rate May Increase Again Due To Consumer Behavior

California consumers may have no one to blame but themselves for the state's increasing sales tax rate. According to a Legislative Analyst's Office report, authored by Mac Taylor, the increasing sales tax rate is linked to consumers favoring non-taxable services like healthcare and housing over purchasing taxable goods.

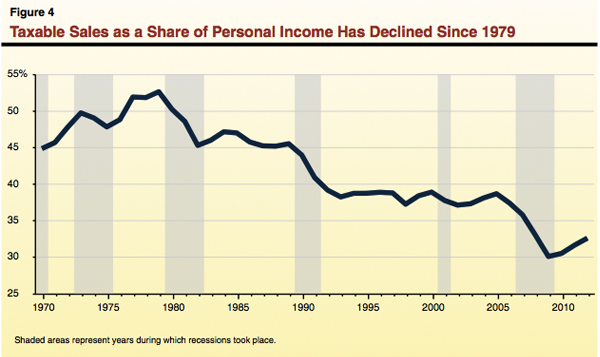

The report, which was released Monday, traced spending habits over nearly 30 years and found that consumers have spent less of their incomes on taxable goods nearly every year since 1979. As goods like cars and electronics take up relatively less of the average consumer's income, healthcare and housing combined (both non-taxable services) now take up more than 40 percent.

The sales tax rate has increased since 1980, but has not kept pace with the growth of California's economy.

"Had consumer spending not shifted toward services, the sales tax would generate the same amount of revenue as it does today at a significantly lower rate—5.2 percent instead of the current rate, 8.4 percent."

Even Proposition 30's sales tax increase, which was approved by a majority of voters last November, has not closed the gap with respect to reaching pre-1980 taxable sales revenues in real terms.

This shift has left the state to pick up the pieces elsewhere, inevitably leading towards the income tax. As Taylor points out, the continued decrease of taxable sales is unlikely to reverse. "Taxable sales are therefore likely to make up a declining portion of the state’s economy over the next decade."

The future economic reality will prompt the state to make revenue adjustments elsewhere, potentially via another sales tax increase or even through an increased income tax.

Overall, the trend has put more weight on personal income tax when it comes to the state's finances. Income tax comprises over 60 percent, or $60.8 billion, of the General Fund's revenue stream. Whereas, sales tax is the second largest component and constitutes nearly a quarter of California's General Fund income.

As the state attempts to balance it's budget in coming years, it's probable that yet another sales tax rate increase is down the road if current trends persist.