Compromise on Student Loan Interest Rates May Result in Higher Costs

The two-party structure and compromise within the duopoly hasn't always led to the best solutions. Much like sequestration, Congress let subsidized student loan interest rates pass its deadline, resulting in undesired results stemming from inaction. However, the federal government is now pushing for a compromise on student loan interest rates.

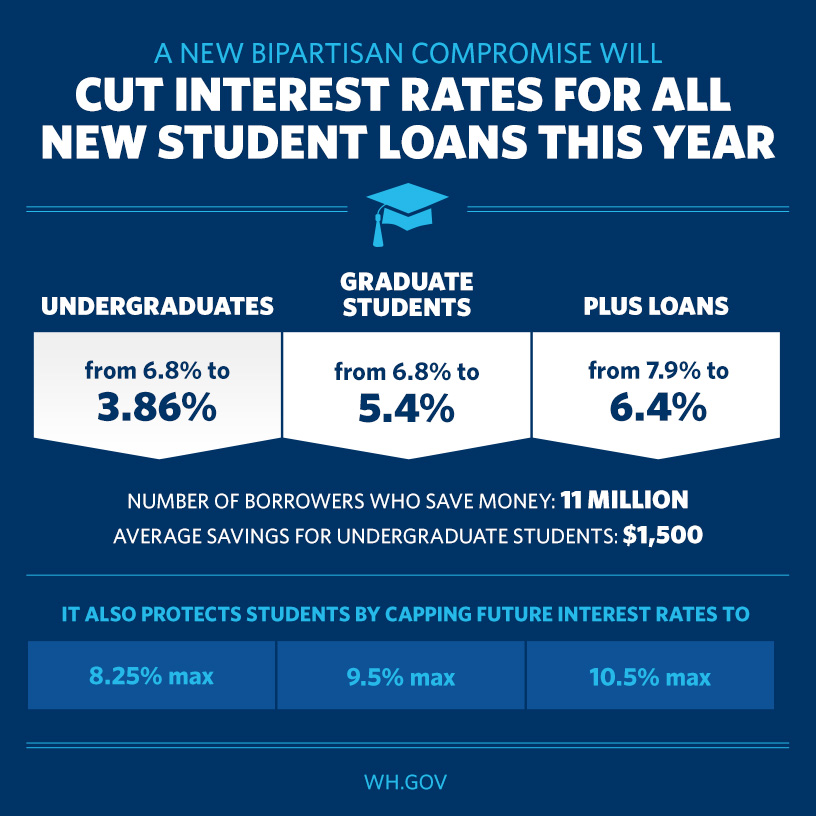

Credit: whitehouse.gov (click to enlarge)The compromise -- Bipartisan Student Loan Certainty Act -- originated from the Senate Committee on Health, Education, Labor, and Pensions by notable lawmakers such as Sen. Tom Harkin (D-IA), Sen. Richard Burr (R-NC), and Sen. Angus King (I-ME).

The deal initially brings the 6.8 percent interest rate on subsidized undergraduate loans down to 3.86 percent. This is still a slight increase from the original 3.4 percent rate before July 1st. Graduate students would have their subsidized loans at a 5.4 percent rate. PLUS loans are reduced from 7.9 percent to 6.4 percent.

Notable criticisms express dissatisfaction because the compromise does not go far enough in reducing loan rates. Banks experience lower rates of borrowing, a concern that Sen. Elizabeth Warren (D-MA) emphasizes.

Sen. Bernie Sanders (I-VT) is skeptical of the bipartisan compromise on student loan interest rates, saying the pre-July 1 rates should have been extended in order to reach a better solution.

Details from the Congressional Budget Office outline exactly how the rates are constructed from the bipartisan bill:

All interest rates would be a fixed rate set for the academic year during which the loan is made and it would be based on the 10-year Treasury rate. The interest rate for subsidized loans and unsubsidized loans to undergraduate students would be the 10-year Treasury rate plus 2.05 percentage points, but capped at 8.25 percent;Graduate students would be the 10-year Treasury rate plus 3.60 percentage points, but capped at 9.50 percent;GradPLUS and parent loans would be the 10-year rate plus 4.60 percentage points, but capped at 10.50 percent

No deal is perfect, government does not function without compromise. However, the bipartisan bill leaves the possibility of students paying loans at a higher rate than the current increase.

Check out previous coverage of student loans and student debt: