61% of U.S. Voters Disagree with Internet Sales Tax Bill

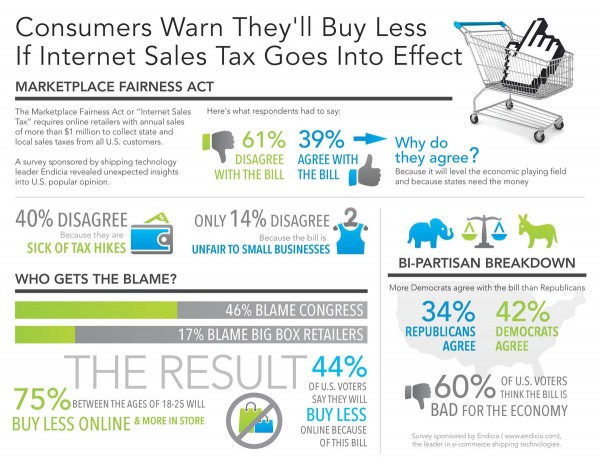

On May 6, the Marketplace Fairness Act, commonly referred to as the Internet sales tax bill, passed the Senate. If passed through Congress, the bill would force retailers to collect taxes for online purchases, even if the buyer lives out-of-state.

States lose $23 billion a year in uncollected sales tax, the National Governors Association estimates, a gap the Internet sales tax bill hopes to close.

In what was meant to level the playing field, the Internet sales tax has faced opposition from those arguing that a new tax would disadvantage small businesses by forcing them to collect sales taxes from multiple states.

Joining the opposition are consumers, a new study suggests, with 61% of U.S. voters saying they disagree with the bill, with 40% of those disagreeing because they are "sick of tax hikes."

The study, sponsored by Endicia and published on Mashable, also reveals that 44% of U.S. voters responded they would make less online purchases if the Internet sales tax was in place.

Would sales tax on prevent you from spending online?