The California Budget Surplus and the Dangers of One-Time Revenues

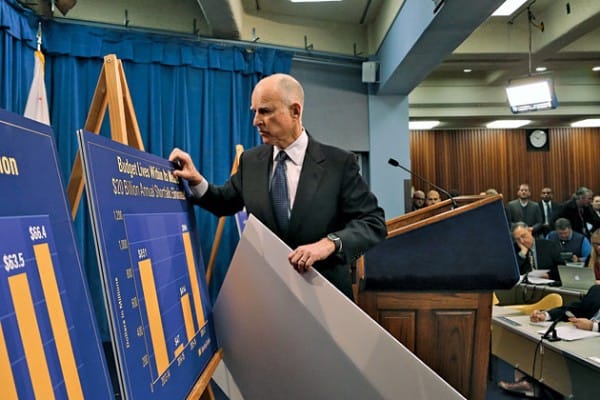

Credit: Jim Wilson/The New York Times

Next week, Governor Brown will announce the revised state budget for May and California is expected to have an important surplus for the first time in years. However, before Californians expect too much from the Legislature, they need to understand that this could be a one-time revenue gain.

The latest figures show that tax revenues in April were $4.6 billion higher than the estimates in Governor Brown's initial budget plan and the total surplus could be even higher. This would be the first budget with a surplus in years and a significant improvement compared to the $25 billion budget deficit Brown inherited when elected into office in 2010.

However, over the years, California's capacity to wisely use these surpluses has been challenged over and over again. By the end of the 1990s, under the Gray Davis administration, California had a number of good years with big surpluses due to a strong economic period. Such surpluses were followed by an increase in state spending -- especially on education and tax rebates.

Soon after, however, California entered a decade of budget crises, some of which can be explained by the decisions made over surpluses from years before. The danger is to implement long-term policies that will lead to spending on an inaccurate prediction of future revenues.

In order to avoid the mistakes made in the past, the Legislature and the governor will have to careful analyze the reason behind the 2013 surplus before moving forward with any new spending plan.

The budget surplus can be explained in a number of ways. The Brown administration reduced the state's expenditures by cutting $8.1 billion in spending and California received more revenue than the previous years.

In November 2012, Californians agreed to have their taxes raised when they voted in favor of Proposition 30. The proposition implemented a 5-year increase on the state's sale tax as well as a 7-year increase in income tax for high-income households. The latter being retroactive on any income made in 2012, this contributed to this year's good tax harvest.

The other major source of revenue this year, which is often underestimated, is the capital gains tax. Revenue from capital gains increased this year not only because the rise of the stock market in 2012, but also because of the federal government's actions. With the fiscal cliff and the threat of an increase on the capital gains tax from 15 to 20 percent for 2013, many Californians sold their investments in 2012.

The extent of the role played by the fiscal cliff threat will be difficult to evaluate, but analysts believe it could have played a major role in the upcoming surplus. This means that this year's surplus will be the result of a one-time hike in revenues.

Unlike the revenues from Prop. 30's tax hikes, which will continue to flow for 5 to 7 years, capital gains will not be as important in the coming years. Not only will the unique circumstance of the fiscal cliff not be there, but when people sell there assets, they cannot sell them again the next year.

Despite the temptation of easing the pain that Californians have suffered through the spending cuts, the Legislature needs to be very careful about what it will do next. Misinterpreting the reasons for the surplus could lead to more long-term plans that California will not be able to sustain in the future.

Will this year be different?