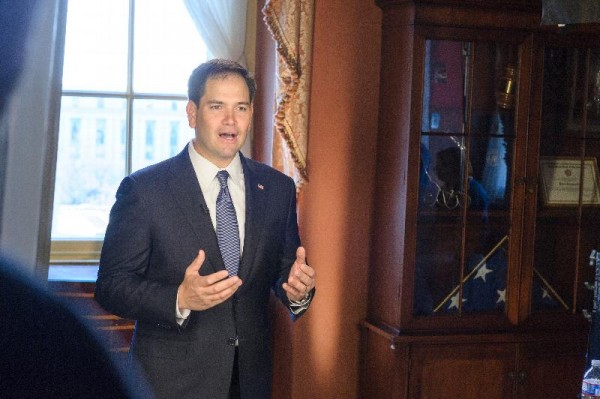

Sen. Rubio Education Policy Response is School Choice Legislation

Cast aside the water bottles when looking into what Senator Marco Rubio's GOP State of the Union response outlined. The senator's speech may have been a familiar platform push, but one portion turned into action the next day. Sen. Rubio introduced Senate Bill 297 to put forth a tax benefit for donations made to a private school scholarship fund. Tweet Senate Bill 297: Tweet

The official text of the bill has not yet been released, but is posted in the Library of Congress. Sen. Rubio confirmed the bill's content by tweeting a Washington Times article discussing the legislation:

https://twitter.com/marcorubio/status/302087521884581889

During the 15-minute response, Rubio alluded to the bill he planned to introduce:

"We need to give all parents, especially the parents of children with special needs, the opportunity to send their children to the school of their choice." Tweet quote: Tweet

The bill would serve as an amendment to the Internal Revenue Service (IRS) Code of 1986 and is titled the "Educational Opportunities Act." A dollar-for-dollar tax credit for donations to a non-profit, called the Scholarship Grant Organization, would be instated. The scholarships are for private K-12 schools and would be made available for students of lower-income families. Tweet it: Tweet

Families at or below 250 percent of the poverty line would qualify for scholarships to private schools, offering school choice. Donation limits are set at $4,500 for individuals and $100,000 for corporations.

Issues with school vouchers have risen over the cirriculum of private schools. A voucher system exists through tax breaks and the argument has been made that vouchers are essentially tax dollars used for private school tuition.

The Congressional Budget Office (CBO) has not had a chance to analyze the bill, and its impact on federal tax revenue cannot be projected.

Florida, the home-state of Sen. Rubio, has a similar system of school vouchers through tax incentives. The Miami Herald notes that the 2001 program, passed by former Governor Jeb Bush, influenced the current federal legislation. According to the Herald, the state "has about 50,821 students who receive $229 million in tax credit benefits." Tweet it: Tweet

If Sen. Rubio expects it to have any sign of significance, modifications will have to be made as the bill circulates the Senate. A full tax break for donations to private school scholarships might be asking for too much and the proposal is expected to face opposition from public education activists. School choice is a hot-button issue in education policy as the quality differences between public and private education continually come into question.