Forecasting The National Debt

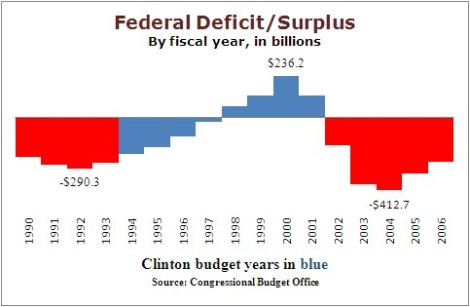

The current debt problem may not be new, but every fiscal year since 2002 the United States government has been running on deficits. This is not necessarily shocking. The vast majority of budgets have not been balanced, which partially explains why the debt is so large, but what happened in the few years prior to 2002 that bucked the trend?

Forecasting surpluses and deficits is not an accurate science. From 1998-2001, the US had record surpluses and according to White House forecasts at the time, the government would have been debt free by 2010. The current debt levels would have been unimaginable.

When President Clinton came into office, he attacked the deficit and year over year, it decreased. By 1998, the United States saw its first surplus in decades. During those last four budgets, the total surplus amounted to over $555 billion, $450 billion of that went to pay down the debt. Although that trend stopped when Bush took office, he is not entirely to blame for the way the fiscal matters turned out.

The fiscal year runs from October 1 through September 30. Two months after the final budget under the Clinton administration, in FY 2001, and a few weeks before then President-elect Bush was inaugurated, Treasury was expecting a third consecutive record-breaking surplus of $256 billion. That was to follow surpluses of $70, $122, and $237 billion from 1998 through 2000, respectively. By the end of FY 2001, that anticipated surplus decreased to only $127 billion.

According to an ABC News report, Clinton's budget experts anticipated the United States to be debt-free by 2010. That never happened due to a variety of issues, the greatest of which was the terrorist attacks on 9/11. However, the War on Terror still was not the sole reason for the current national debt.

Prior to 9/11, President Bush proposed a massive tax cut totaling $1.3 trillion over a decade. That followed the forecasts after Clinton left office that the US government would be running a $1.9 trillion surplus over that same time period. Theoretically, the surplus would have paid for the tax cuts. Furthermore, the logic was that tax cuts would spur the economy to grow more, in essence almost paying for themselves.

The flaw to this logic was that it was based on a lengthy period of booming tax revenue. A 2005 Bloomberg article notes several causes for a newly burgeoning debt brought on by terrorism, natural and financial disasters, and tax cuts, but also how the earlier forecasts were based on the tech bubble and a surge in capital gains taxes and increasing salaries. Treasury Secretary John Snow said "You're going to make a lot of mistakes if you forecast based on a bubble...Bubbles burst."

This is a sterling example of how years of excess money and rising stock prices can cloud future estimates. The unexpected good times in the 1990s led the government to underestimate the revenue coming in. Forecasts after 2000 were based on those revenue levels continuing which they did not. Other unforeseeable factors added to the spending side of the budget equation. This occurred before after both World Wars and the boom never lasts as long as the experts had hoped they would.

As for the unforeseeable increases in revenue, much of it was understandable at the time given the extreme circumstances surrounding the terrorist attacks, wars, and stimulus money to prevent further financial disaster. It seems that Bush’s biggest error and those of his budget experts were these unfunded tax cuts and spending increases, but at the time, the forecasts were so positive that they were supposed to be “paid for” by the booming tax revenue.

Aside from the tax cuts and the War on Terror, President Bush's other extensive addition to the national debt was the 2003 Medicare drug benefit plan. At the time, healthcare costs were increasing faster than expected, much like they still are, and Bush placed a lot of political capital into forcing Medicare Part D through Congress. Bruce Bartlett, an economic adviser for Presidents Reagan and George H. W. Bush, was critical of Bush 43's economic policies.

As a supply-side economist and historian, Bartlett provides a conservative critique of his Republican contemporaries. Bartlett critiqued the GOPs actions towards "Obamacare" by contrasting their support for Part D.

"According to the 2003 Medicare trustees report, spending for Medicare was projected to rise much more rapidly than the payroll tax as the baby boomers retired. Consequently, the rational thing for Congress to do would have been to find ways of cutting its costs. Instead, Republicans voted to vastly increase them--and the federal deficit--by $395 billion between 2004 and 2013."

Furthermore, that $400 billion was not only unpaid for, increased year over year, but was an underestimated figure from the beginning. Similar to how Mitch Daniels' grossly conservative estimates on the initial costs for the Iraq War, Bush’s Medicare drug plan actually cost as high at $534 billion according to Medicare's official actuary. Republican and Democratic deficit hawks alike would likely not have been supportive if they had known what the effects were in the following years. This law added to healthcare costs rising faster than forecast and is proof that Democrats and Republicans are at fault for the current fiscal crisis.

Over ten years ago, nobody saw this coming, but the debate over the national debt is not new. The partisan gridlock has never been this strong before. The financial crisis has turned the public's attention to these fiscal matters, amplifying both liberal and conservative point of views. Democrats believe in revenue increases just as much as Republicans want to cut taxes. Entitlements, long believed to be the safest portion of the budget, have never been this close to the proverbial chopping block. Times may have changed, but the issues remain the same.