Prop 30 May Encourage Reform to Controversial Prop 13

Photo: Mathew Sumner

A Bay area community organization, called Evolve, is seeking to reform the 1978 law known as Proposition 13. In California, Prop 13 has become more controversial with each passing year; the law is a point of contention between taxpayer advocates who claim a limit on government’s ability to arbitrarily raise taxes is good and those who say the state is being robbed by Prop 13’s corporate loopholes and limited tax revenue.

Prop 13 caps property taxes according to the 1975 value of a home, but once the home transfers to new ownership, the tax is reassessed according to the current home value. Evolve believes Prop 13 is unfair for its imbalance against new homeowners, who tend to be middle class, young new homeowners. According to Evolve, in San Francisco 57% of single-family homeowners are paying 81% of taxes.

The Public Policy Institute of California put out a report detailing the “unintended consequences” of Prop 13 preceding the 1998 Envisioning California Conference. The report noted that since the passage of Prop 13, school financing was becoming almost entirely centralized at the state level. Schools, which also rely on local property taxes for funding, were continually missing out on a large amount of potential tax revenue.

Today, California public schools rank among the worst in the country. In particular, it is currently 47th in per-pupil spending. There simply isn’t enough money to invest in students.

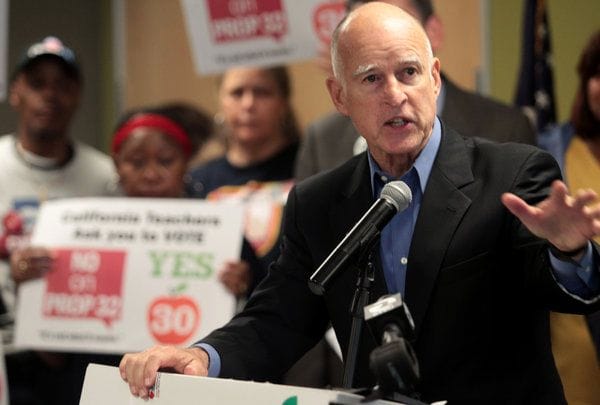

Now, after Governor Brown’s Proposition 30 passed in the November election, it seems California’s residents might be open to some tax reform in the state. Prop 30 is the state’s first voter-approved statewide tax increase in 8 years and should avoid $5.5 billion in school budget cuts.

Proposition 30 is just the first step in getting the public used to the idea that if better schools, better infrastructure, and a revitalized economy is possible in the future, higher taxes – and, especially, a reassessment of Prop 13 – might be one of the state’s viable options.

Community organizations like Evolve are trying to educated residents on the benefits of Prop 13 reform, going door to door to add steam to their “Close the Corporate Loophole” campaign. However, the PPIC reported this month that Prop 13 remains relatively popular in the state despite signs of flexibility in its reform. Upwards of 60 percent of eligible California voters say Prop 13 has been a good thing for the state.

The survey contacted 2,001 California residents on both landlines and cell phones, via a computer-randomized phone list. This calls into question whether the likely voters surveyed are fully aware of the wide-ranging effects of the proposition, such as the corporate loopholes that have led to loss of potential state revenue.