The Dilemma of Raising the Retirement Age

Entitlement programs such as Medicare, Medicaid, and Social Security are often blamed for the federal government's recurring deficits. The social security retirement program, following the US demographic evolution, will see its costs rising in coming years and raising the retirement age is often seen as the solution to this problem.

Between 2010 and 2050, the number of Americans over the age of 65 is expected to rise from 40.2 million to 88.5 million. This will increase the number of people who will be entitled to social security retirement benefits significantly. This program allows any American or legal alien who has worked at least 10 years to receive a monthly allowance from Social Security after the age of 62. The amount of this allowance is calculated on a number of factors, the most important being how much an individual earned during their working career as well as the age of retirement.

The concerns over the future of this program come from the way it is funded, which is mainly through contributions from working people. This system of funding becomes vulnerable when the gap between how long the individual levied works and how long he or she will receive retirement benefits becomes too small.

For example, in the 40s, a worker usually started working at 18, could retire at 65, and lived, on average, another 13 years. This means an individual would work 47 years to benefit 13, spending only a forth to a third of their working years on retirement. Today, a worker usually starts working at 21, is able to retire at 62, and will likely live another 20 years. This means they will work 40 years for 20 years of benefits, thus spending half of their working years on retirement.

To avoid this necessary decrease in funding, raising the retirement age is seen as the most straightforward solution as it would reflect the demographic changes in the American population. Many other developed countries have taken this route in recent years.

Three options are possible when it comes to raising the retirement age: a raise of the full retirement age, of the early retirement age, or both. Currently, the age of full benefit retirement is at 66 and will be raised to 67 by 2022. However, it is possible to retire as early as 62 with reduced benefits.

Raising either or both will benefit Social Security as it will provide an increase in funding and a diminution of the expenses. Raising the retirement age would create a higher financial hardship on the low income population that usually works physically demanding jobs. Someone retiring at 62 today will receive 75% of the full allowance he would receive at 66. If the full allowance age is raised, raising the early retirement age will be necessary or if early retirement at 62 is maintained, a decrease in the allowance will be required.

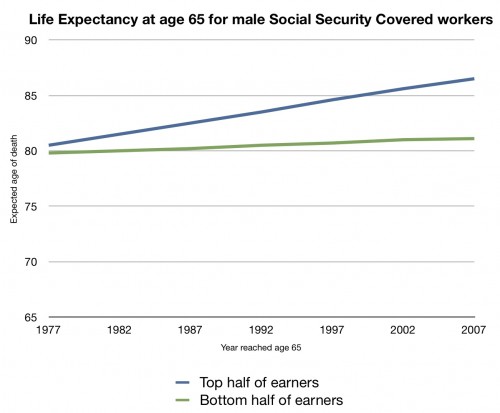

This would affect the majority low income population, who constitute the majority of early retirees. This demographic also retrieves retirement allowances for less time than their higher-income counterparts. The increase in life longevity does not affect everybody equally, thus making policy decision on raising the retirement age more complicated. In 1972, a male in the top half of the earning distribution who reached 60 could expect to live 1.2 years longer than someone from the bottom half. In 2001, the gap had grown to 5.8 years.

Credit: http://theincidentaleconomist.comSome potential solutions that would take this discrepancy into account include a graduated eligibility system:

"People in the bottom half of the lifetime earnings distribution would become eligible for normal retirement benefits at age 65 for Medicare and 66 for Social Security, just as they are today. But people in the next quarter of the lifetime earnings distribution would become eligible for the respective programs at 67 and 68, and those in the top quarter would become eligible at 70 and 71."

This would raise every eligibility age, because such raise is inevitable according to various factors such as the evolution of working conditions or life expectancy, while allocating this burden more fairly. The current Social Security's surplus, which will allow the program to run until 2033 without any change, buys Congress extra time to find a solution to the retirement dilemma.