Trade Deficits Can't be Cured with Cheap Towels

"Free" trade takes income from workers in the tradable goods sector and transfers it to government employees and the service sector. For workers in the tradable goods sector, income losses are much greater than the gains from cheaper towels. Of course, cheap towels don't help the unemployed much at all.

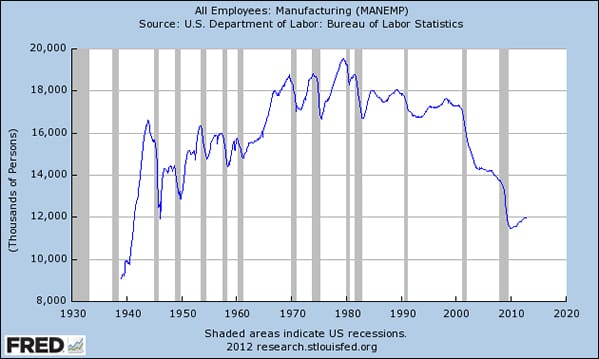

However, this isn't about what's good for one group of people versus another. The well being of America as a whole is the real question. Take a look at the chart below. Manufacturing employment is back to where it was in 1941 when America's population was vastly smaller. As a percentage of the workforce, the decline is much greater. Note the stunning fall in manufacturing employment starting in 2000.

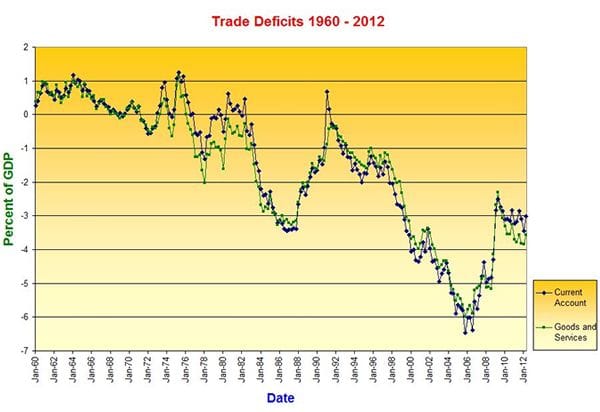

After 2000, the productive core (tradable goods) of the American economy was hollowed out. America ran trade deficits unprecedented in the history of the United States (actually the history of the world). By definition, a trade deficit means that debt was massively accumulating in some sector of the economy. It turned out to the consumer and real estate sectors.

Stated differently, the massive trade deficit weakened the U.S. economy. The Bush administration (and the Fed) attempted to offset depressed domestic demand by slashing interest rates, taxes, and promoting the housing bubble. This combination of policies worked reasonably well in the short term. However, it ended in disaster.

Indeed, gigantic trade deficits typically end in ruin. Ask the Greeks or the Spanish (or the Irish, a more complex case). The lure of cheap imports is fools gold at best. Argentina maintained a dollar peg to up to early 2002. It worked well in some respects. Inflation collapsed and imports were cheap. However, the trade deficit rose, debt proliferated, and in the end Argentina defaulted. The crash in Argentina was a deep as in the Great Depression in the United States. Fortunately, Argentina changed course (devalued) and world commodity markets rose (China). As a consequence, Argentina's depression was not nearly as long as the U.S. in the 1930s.

So far I have described trade policy up through 2007/2008. Bad to be sure, with a very unhappy ending. However, since 2008, America's trade policies have been even worse. Under Bush, the consumer/real estate bubble essentially offset the trade deficit. MEW (Mortgage Equity Withdrawal) matched the trade deficit dollar-for-dollar (partially a coincidence). That means that the U.S. was consuming more than it was producing and accumulating debt. Conversely, the U.S. enjoyed close to full employment.

Since 2008, we have continued to run huge (below the peak) trade deficits with very high levels of unemployment. In the current environment, the trade deficit is a pure loss for the United States as a whole. We are purchasing goods from abroad with debt that could be readily produced at home with idle resources. Stated differently, eliminating the trade deficit would raise GDP by at least the size of the deficit (roughly 4% of GDP). Allowing for multipliers, the likely GDP gains would be even greater.

Of course, the buyers of the imported goods would pay more (for towels and the like). However, the gains to unemployed workers would far more than offset the losses to consumers of imported goods. That has to be true, because a higher GDP increases the well being of the United States as a whole.

Ultimately, this isn't about the relative merits of blue collar workers in Ohio versus doctors and police officers in California. This is about the wealth and prosperity of America as a nation. If cheap towels are associated with gigantic trade deficits, they aren't cheap (Bush). If unemployment is the price of cheap towels, they aren't cheap (Obama).