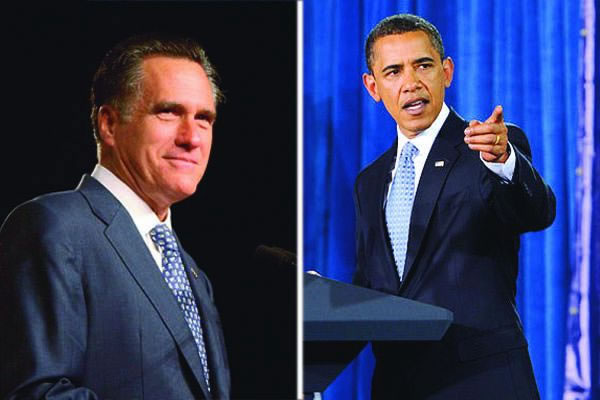

Obama And Romney Tax Policies At A Glance

The Obama and Romney Tax policies have been a focal point for criticism throughout the campaign season. There are various sectors to tax policy, all with different rules and rates of taxation. The categories outlined below are the proposed changes to Personal Income Tax, Capital Gains and Investment Income, Corporate Taxes, International Taxes, and Exemptions and Deductions.

Personal Income Tax: Current tax law recognizes six different marginal tax rates for single Americans and married couples:

Single

$8,700 and under - 10%

$8,701 to $35,350 - 15%

$35,351 to $85,650 - 25%

$85,651to $178,650 - 28%

$178,651 to $388,350 - 33%

$388,351 and above - 35%

Obama

Obama’s tax plan would keep in place current rates for the lowest four tax brackets. The two top tax brackets would increase back to their pre-2001 levels to 36% and 39.6% respectively. This is a one percent increase for those earning between $217,450 and $388,350 and a four percent increase on top earners

Married

$17,400 and under – 10%

$17,401 to $70,700 – 15%

$70,701 to $142,700 – 25%

$142,701 to $217,450 – 28%

$217,451 to $388,350 – 33%

$388,351 and above – 35%

Romney

Romney is proposing a 20% across the board cut. The six tax brackets would remain but at different rates, 8%, 12%, 20%, 22.4%, 26.4%, and 28 percent. These cuts would reduce federal revenue by trillions of dollars, but Romney contends that his proposal is revenue-neutral, meaning that all revenue lost in tax breaks will be made up in loophole closures, cuts in tax deductions, and increased economic growth.

Corporate Taxes: The current corporate tax rate is 35%.

The Obama tax plan would lower the corporate tax rate by 7% to 28% except for manufacturers.Romney’s tax plan lowers the corporate tax rate 10% for everyone, to 25%.

Capital Gains and Investments: Those in the two lowest tax brackets, making under $35,000 a year pay no taxes on capital gains and dividends. For everyone else, there is a 15% tax on capital gains and dividends regardless of tax bracket. Carried interest, which is the income paid to an investment manager for successfully investing for a hedge fund or private equity firm, is currently taxed at 15 percent.

Capital gains would be taxed at 20% for high-earners and the Buffet rule would take effect. The Buffet rule, named for Warren Buffet, would apply a minimum 30% tax on individuals making over $1 million a year. This affects 0.3% of Americans to the White House, and would prevent top earners from paying less in taxes as a percentage of income than lower-class Americans.A Romney presidency would extend the tax exemption for capital gains up to those earning less than $200,000 a year, up from the current bracket, those making less than $35,000 annually. The 15% tax for all other taxpayers will remain the same.

International Taxes: All income regardless of origin is taxed. Called residential taxation, this system taxes the local and worldwide income of resident and nonresident citizens and foreigners.

In a second term Obama would reform international tax law to hinder tax evasion through a minimum tax on overseas profits.Romney has proposed moving to a territorial international tax system. This would exempt profits earned abroad on domestic businesses, but implement U.S.-sourced profits on international companies

Exemptions and Deductions: Tax law allows for individuals to claim many different exemptions and deductions to lessen their tax burden. Both candidates have claimed they would make changes to current policy in this sector.

Exemptions and deductions would be limited to 28%. Properties worth more than $3.5 million would no longer be exempt from a 45% estate tax." or eliminate unspecified tax preferences to replace revenue lost due to rate cuts while also maintaining current progressivity of federal taxes. Romney has suggested capping itemized deductions and other tax preferences and possibly denying them entirely for high income taxpayers."