Legislative Analyst Office Findings on Proposition 39

The Legislative Analyst's office has given an independent analysis of Prop 39. The report has been the mainstay for Proposition 39 proponents who often echo the estimated creation of 40,000 green-energy jobs.

This characterization is slightly misleading. The Legislative Analyst's Office released a different report back in May of 2010, under the title 'Reconsidering the Optional Single Sales Factor,' that said:

This figure suggests that mandatory single sales could produce an eventual net gain of about 40,000 jobs based on the Franchise Tax Board’s (FTB’s) latest cost estimates. The DRAM estimate of the state and local revenue feedback effect from increased sales, property, and income taxes stemming from the job gains was about 14 percent of the initial revenue loss, which is consistent with the general empirical evidence on these effects. These estimates should be interpreted with caution as they are based on the 2001 state economy and incorporate a lot of assumptions, but we believe that they are reasonable ballpark figures.

The July 2012 LAO report directly regarding Proposition 39 makes no mention of the supposed 40,000 jobs. It does, however, recognize the proposed creation of the Clean Energy Job Creation Fund. The fund would support retrofitting of public facilities such as schools and governmental buildings to be more energy efficient. It also establishes job training for green-energy projects. The $550 million fund will be overseen by a nine-member board charged with conducting independent audits to ensure financial accountability.

Jack Stewart, president of the California Manufacturers and Technology Association, criticized the mischaracterization on KQED and offered his challenges to Proposition 39,

“There aren’t any independent studies specifically on Prop 39. There was a Legislative Analyst study, somebody earlier mentioned 40,000 jobs would be created. If those jobs were going to be created, they should have already been created. The Legislative Analyst’s study is not on Prop 39, but on going from multiple factor to single sales factor. So we went, companies that can take advantage of single sales factor have already taken advantage of that. So that the jobs that were going to be created are already created. Now what you’re doing is you’re doing a tax increase on companies that are operating in California. Multi state companies, companies that operate in California and other states, who have plant and equipment, huge investments in California and employ thousands of Californians. That is when you raise taxes the cost of business goes up…”

Proponents are skeptical that businesses will cut jobs due to Proposition 39 and cite other states, like New York and Texas, as models for implementing the mandatory single sales tax structure. Current tax policy allows corporations to choose between tax formulas, a choice that tends to favor out-of-state businesses.

Three-Factor Method: "One method uses the location of the company’s sales, property, and employees. When using this method, the more sales, property, or employees the multi-state business has in California, the more of the business’ income is subject to state tax." - LAO Report

Single Sales Factor Method: "The other method uses only the location of the company’s sales. When using this method, the more sales the multistate business has in California, the more of the business’s income is taxed. (For example, if one-fourth of a company’s product was sold in California and the remainder in other states, one-fourth of the company’s total profits would be subject to California taxation.)" - LAO Report

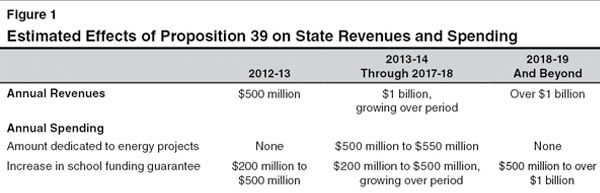

Although the assertion that Proposition 39 will create 40,000 jobs is somewhat nebulous, the Legislative Analyst Office findings on Proposition 39 show an increase in state revenues by almost $1 billion into 2019. Also, it will provide additional funds for California schools and, beginning in 2013, allocate funds for green energy projects inside the state exclusively.