Op-Ed: California Proposition 30 Provides Stability

Tax proposals are not the most attractive issues on a ballot. However, we have to understand what the tax proposal is for and who it affects. California’s public school system is facing a tough time for funding. California Proposition 30 is a temporary tax measure that asks consumers and the state's high-income earners to help ensure the education of fellow Californians.

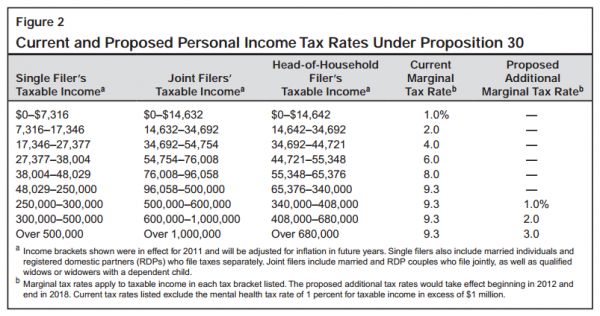

Along with a 0.25% state sales tax increase for four years, Proposition 30 will have the following effects on income taxes for seven years:

Credit: sos.ca.gov

The Bay Area Council, a business-supported public policy advocacy organization, endorses Proposition 30. The California-based group, supported by over 200 of the largest employers in its region, understands the consequences of further cuts to education. "The alternative is not acceptable," said Jim Wunderman, President and CEO of Bay Area Council. He also explained the group's position on the issue:

Increased taxes are very difficult for a business group to support, but our member CEOs, who will bear the burden of much of these taxes, want to do what they think is right for California.I believe our members are to be commended for the exhaustive and deliberative process they followed in taking this position, the subject of numerous meetings and discussions, plus extensive research and analysis.

The Bay Area Council is showing that some of California's high-income earners are willing to make necessary sacrifices for public education.

Implications of Proposition 30

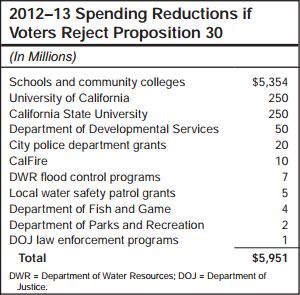

Credit: sos.ca.gov

We constantly hear that there will be a $5.85 billion trigger cut to education if Proposition 30 does not pass. This is real and voters have to understand what another cut in education looks like.

K-12 public schools in California have already experienced $20 billion of cuts in the past four years. The state let go of 30,000 teachers in the process, which was the most in the United States during that time-frame.

The official California voter guide says that, "Schools and community colleges could respond to this cut in various ways. Drawing down reserves, shortening the instructional year for schools, and reducing enrollment for community colleges." Since the 2008-2009 academic year, community colleges have already experienced a 17% drop in enrollment. In an economy where jobs require an educated workforce, it is not a sound decision to further limit enrollment.

The California State University and University of California system is also facing the heat. ABC Los Angeles states:

If Proposition 30 passes, CSU and UC campuses will receive $125 million from the state, and CSU trustees will consider rescinding a 9-percent tuition increase. A tuition freeze is pending the outcome of the November election.

The CSU system is holding off on admission decisions until after the election. The CSU trustees are going to either pass a 5% tuition increase or limit the number applicants admitted if Proposition 30 fails.

What School Districts Say

President of the Pleasant Valley School Board, Bob Rust, weighed in on the tax measure and the state of education:

State funding that used to be more than $6,000 per elementary student is now about $4,800 and will drop another 10 percent without passage of Proposition 30. We're 47th among the 50 states now in per student funding; defeat of Proposition 30 will take us to 50th in the nation

Despite the constant shrink in education funding, the San Diego Unified School District (SDUSD) is on a four year streak of overall improved academic performance. Current SDUSD Board President Dr. John Lee Evans gave the statistics in his State of the District speech:

Since 2008 we have 27% more students proficient in English language arts and we are #1 in the state for large urban districts. We have 24% more students proficient in math than 4 years ago. We have 53% more students proficient in science than we had 5 years ago.

The success in San Diego Unified during constant cuts is a testament to the community-based reforms that the district has been implementing. The board instated a plan, Vision 2020, to take learning beyond the basics and make teaching more effective. The district already made concessions to keep 1,500 teachers in classrooms to keep a consistent academic environment for its students. SDUSD Board Trustee Richard Barrera stated the following at a Proposition 30 debate:

Our student achievement rates in San Diego and in the state are the highest they’ve ever been. They’ve been growing faster over the past several years than they ever have before. Students have been producing and achieving while we have been pulling the rug from underneath them with budget cuts.We can stabilize the situation and have the ability to not go through every year with layoff notices. If we can just focus on doing our job then you will see greater and greater results. We’re asking everyone in California to contribute and be part of the solution, instead of putting the burden on teachers and parents.

The San Diego Unified School District earned an Academic Performance Index (API) score of 808 for the 2011-2012 school year. The district improved by 10 points and exceeded the state-wide goal of 800 API. SDUSD leaders acknowledge that there is still work to be done. Another year of under-funding would not be just a short-term hurdle; it would strike a blow to the long-term success they've been building towards.

Making Sure Education Receives Revenues

Opponents make the argument that the revenue generated from Proposition 30 is not guaranteed for education. To counter that claim, the measure provides taxpayer safeguards by creating a state account called the Education Protection Account. "Of the funds in the account, 89 percent would be provided to schools and 11 percent to community colleges," and the measure outlines additional safeguards:

Opponents make the argument that the revenue generated from Proposition 30 is not guaranteed for education. To counter that claim, the measure provides taxpayer safeguards by creating a state account called the Education Protection Account. "Of the funds in the account, 89 percent would be provided to schools and 11 percent to community colleges," and the measure outlines additional safeguards:

- Revenue is guaranteed in the constitution to go into a special account for schools that the legislature can’t touch.

- Money will be audited every year and can’t be spent on administration or Sacramento bureaucracy.

- Proposition 30 authorizes criminal prosecution for misuse of money.

It may be tough to support Proposition 30 without giving a 'woe is me' impression. However, students should not be on the receiving end of consequences from a shrinking budget. Opponents call for reforming California's budgetary system, but no reforms are in place to balance the detrimental effects if Proposition 30 fails. An indefinite burden would be placed on California's public school system that we can avoid with a temporary tax measure. California's wealthiest do not face the dire financial situation that California's public education faces.