The Fair Tax: Is It Fair?

What is the Fair Tax... other than the Libertarian platform for tax reform? According to FairTax.org, "The Fair Tax Plan is a comprehensive proposal that replaces all federal income and payroll based taxes with an integrated approach including a progressive national retail sales tax, a prebate to ensure no American pays federal taxes on spending up to the poverty level, dollar-for-dollar federal revenue replacement, and, through companion legislation, repeal of the 16th Amendment. This nonpartisan legislation (HR 25/S 1025) abolishes all federal personal and corporate income taxes, gift, estate, capital gains, alternative minimum, Social Security, Medicare, and self-employment taxes and replaces them with one simple, visible, federal retail sales tax." It sounds like a lot, but it is a relatively simple idea... and one that could possibly simply by the tax codes.

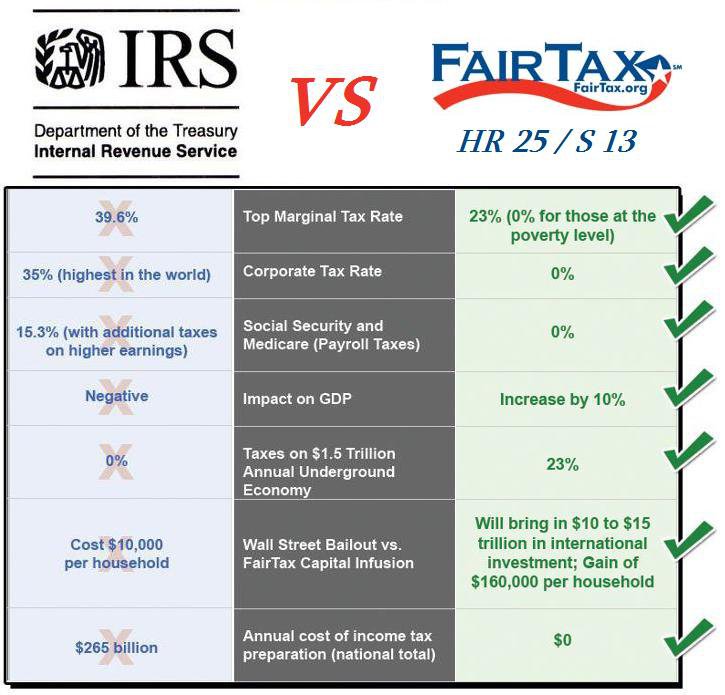

We all know that the federal government needs taxes in order to pay for things. Up until the passage of the 16th Amendment almost 100-years ago, the government collected its tax dollars from alcohol sales. But since the amendment's passage, it's been income taxes, which have become more and more complex over time. In 1913, there were only 400-pages of federal tax codes, regulations, and IRS rulings. Today, that number has grown to 73,608-pages. And the compliance burden on the taxpayers to pay their taxes correctly is costing us $431.1-billion a year. This can be broken down into Time Value Costs ($377.9-billion), Direct Outlays ($31.5-billion), IRS Administrative Costs ($12.4-billion), and Comprehensive Tax Audits ($9.3-billion). So basically, we are spending 30% of our tax dollars just to pay our taxes. The Libertarian Party's approach is to simplify all of this by abolishing all federal income taxes and replacing it with a simpler federal retail sales tax.

We all know that the federal government needs taxes in order to pay for things. Up until the passage of the 16th Amendment almost 100-years ago, the government collected its tax dollars from alcohol sales. But since the amendment's passage, it's been income taxes, which have become more and more complex over time. In 1913, there were only 400-pages of federal tax codes, regulations, and IRS rulings. Today, that number has grown to 73,608-pages. And the compliance burden on the taxpayers to pay their taxes correctly is costing us $431.1-billion a year. This can be broken down into Time Value Costs ($377.9-billion), Direct Outlays ($31.5-billion), IRS Administrative Costs ($12.4-billion), and Comprehensive Tax Audits ($9.3-billion). So basically, we are spending 30% of our tax dollars just to pay our taxes. The Libertarian Party's approach is to simplify all of this by abolishing all federal income taxes and replacing it with a simpler federal retail sales tax.

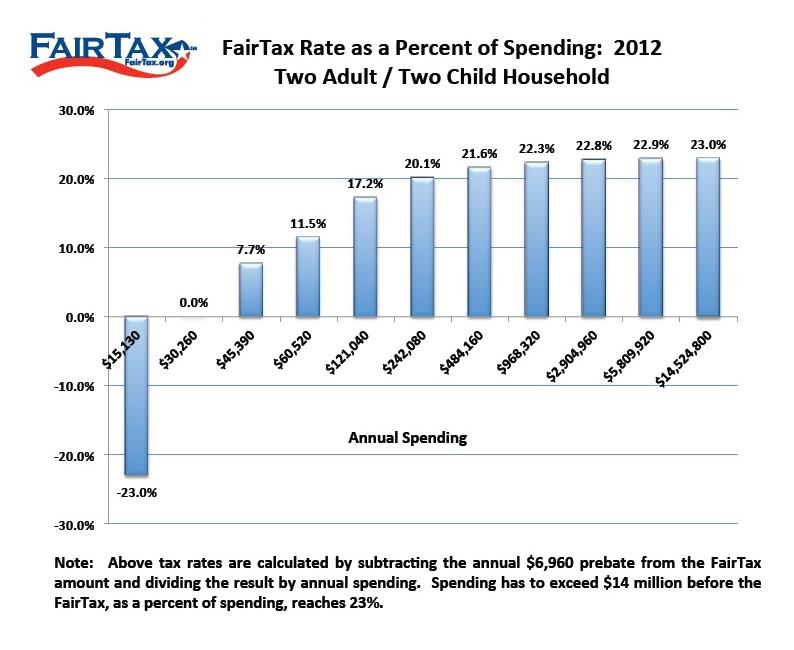

With the Fair Tax, people would take home 100% of their paychecks... except where state income taxes apply. It would establish a uniform tax across the board on all new items at 23%. Why 23%? At that level, it's becomes revenue neutral. The government takes in exactly what it is taking in now. A large argument against such a tax plan is that it would favor the wealthy over the poor as the poor already have trouble being able to afford items. This is solved though by a monthly prebate that all American citizens (those with Social Security cards) would receive to cover the tax spent on necessities up to the federal poverty level. A single person would receive a monthly prebate of $199. A 2-adult, 2-children household would receive a monthly prebate of $537. (Numbers based on the Department of Health and Human Services 2008 Poverty Guidelines) And also note that I've been saying that the Fair Tax only applies to new goods. That's because you would not be paying the tax on used items as they were already taxed once before. So if you bought a used car, a used house, use clothing, etc., there would be no federal tax at all. It's only applied to new goods and services, and it can only be charged one time... right when you make the purchase.

Did you know that when you buy something, that you are paying for the company's corporate taxes plus their compliance costs? Corporations have to pay payroll taxes and make contributions into Social Security and Medicare. All of this is passed along to the consumers at a higher price. With the Fair Tax, corporate income taxes would be abolished, too. No longer would corporations have to hide these taxes in higher retail prices. Prices are allowed to drop then without revenue or profit being affected. This could allow a company to employ more people. And before you start thinking that corporations don't pay taxes under the Fair Tax, FairTax.org states, "Corporations are legal fictions that have not, do not, and never will bear the burden of taxation. Only people pay taxes. Corporations pass on their tax burden in the form of higher prices to consumers, lower wages to workers, and/or lower returns to investors." And when it comes to jobs and exporting/importing goods, "the Fair Tax does not burden U.S. exports the way the current income tax does. The Fair Tax removes the cost of corporate taxes and compliance costs from the cost of U.S. exports, putting U.S. exports on a level playing field with foreign competitors. Lower prices sharply increase demand for U.S. exports, thereby increasing job creation in U.S. manufacturing sectors. At home, imports are subject to the same Fair Tax rate as domestically produced goods."

So what about Social Security and Medicare? They come out of our paychecks. Our tax dollars specifically pay for them. They actually stay the same... maybe coming out a bit ahead. Instead of the money coming from our paychecks, they come from the tax dollars on the new goods and services we buy. Spending by Americans is usually more constant than income levels. Currently, Social Security and Medicare funds are taxed three times: 1) when payroll taxes are initially withheld, 2) when those withheld payroll taxes are counted as part of the taxable base for income tax, and 3) when the promised benefits are finally received. This would completely negate all of that until you spent it on some new good or service. And with the Fair Tax, both programs would have a wider base participating in the program... which, if you think about it, would include all members of Congress.

So are there any countries today that use this type of taxation? The simple answer is no though the states of Florida and Texas use a similar system for their state taxes. However, in England after the defeat of Napoleon, did repeal its income taxes and had major economic gains which only stopped with the re-imposition of the income tax. Now what about state sales taxes. States will have the choice to participate or not... meaning they can keep their current state sales tax on items or they can choose to go to the federal sales tax, in which they would receive a fee for their participation that would take the place of their state sales tax. They cannot do both. And with the IRS gone, who collects the taxes? Pretty much everywhere you buy things... just like they do now with state sales taxes. In the end, you get to determine how much you pay in taxes by how much you spend on new goods and services. This is also the only plan that calls for the full repeal of the 16th Amendment, though even without it, there would still not be a federal income tax and a federal sales tax. The 16th Amendment only gives Congress the right to tax our income, but it doesn't state that there has to be an income tax.

So are there any countries today that use this type of taxation? The simple answer is no though the states of Florida and Texas use a similar system for their state taxes. However, in England after the defeat of Napoleon, did repeal its income taxes and had major economic gains which only stopped with the re-imposition of the income tax. Now what about state sales taxes. States will have the choice to participate or not... meaning they can keep their current state sales tax on items or they can choose to go to the federal sales tax, in which they would receive a fee for their participation that would take the place of their state sales tax. They cannot do both. And with the IRS gone, who collects the taxes? Pretty much everywhere you buy things... just like they do now with state sales taxes. In the end, you get to determine how much you pay in taxes by how much you spend on new goods and services. This is also the only plan that calls for the full repeal of the 16th Amendment, though even without it, there would still not be a federal income tax and a federal sales tax. The 16th Amendment only gives Congress the right to tax our income, but it doesn't state that there has to be an income tax.

I want to close with a few examples from FairTax.org. This might help in seeing how this would affect us all. Under our current income tax system, let's say that you earn $100. You get to keep $77, so your income tax rate is 23%, and the government keeps $23. Now let's move to the Fair Tax. You again earn $100. You get to keep $100, and you choose to spend $77. Your Fair Tax rate is 30%, and the government only gets $23. Now that was based just on an individual. Now let's look at different income levels and how they are taxed under the Fair Tax. Let's say a billionaire (who is married with no children) spends $10-million and pays a tax of $2.3-million. He gets a prebate of $4,697. His tax rate is 22.95%. Now let's look at a couple with no children that spends $50,000. They pay a tax of $6,803. The prebate check would be the same as the billionaire's at $4,697. Their tax rate would be 13.6%. For a quick comparison to today's income taxes... that same couple that would earn $50,000 would pay a total of $7,918 in taxes (income and payroll taxes). Their tax rate would essentially be 15.8%.

There is a lot of information on the Fair Tax... far more than I can get into. The website does a fairly good job of breaking it all down and making it easy to understand. Whether you are leaning for or against it, I highly encourage everyone to go to the site and look over the details. It may even answer some questions you might have that I haven't addressed. This was only written to be a summary and to be a brief introduction... not an endorsement. So check it out and feel free to leave feedback below. There will also be some added shortcuts linked below, too.

SIDENOTE:

All quotes are from FairTax.org unless otherwise stated.

LINKS:

Thumbnail Sketch of the Fair Tax with FAQ (pdf)