Mitt Romney Budget would "Have to Raise Burdens on Middle Class"

The non-partisan Tax Policy Center has completed an analysis

The non-partisan Tax Policy Center has completed an analysis

On the campaign trail, we hear the same old mantra from both sides of the aisle: we need to reduce the tax burden on the middle-class, reduce spending, and balance the budget . Because neither party as proposed substantive spending decreases, the Republican plan would necessarily burden the middle class if they were to make good on their promise. Without addressing any impracticalities of the Democrat's plan, the Tax Policy Center explains:

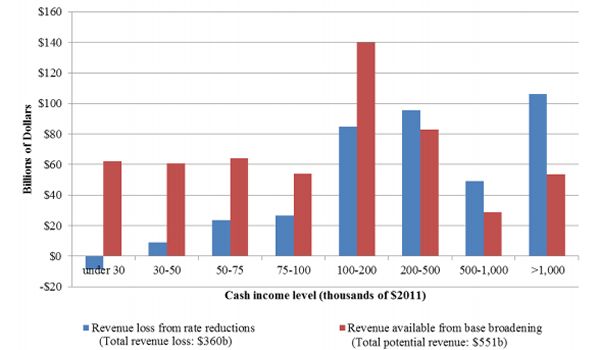

The graph shows that cutting individual income tax rates by 20 percent from today’s levels would reduce tax burdens by $251 billion per year (in 2015) among households with income. Governor Romney has explicitly promised to retain current preferences for dividends and capital gains ... if we assume a strict interpretation of the second goal ... there are only $165 billion of available tax expenditures to close in that group if tax rates are cut).

The report goes on:

For example, if Governor Romney eventually specifies a full tax reform proposal that is not revenue-neutral and/or that raises taxes on some forms of saving and investment, there is no a priori reason why that full-reform proposal would have to raise taxes on middle-class households. Nevertheless, it remains true – as we showed in our paper – that a reform proposal that meets the five goals stated above would have to raise burdens on middle-class households.

The paper lists a few Q & A's to clarify their findings:

Q: How can you analyze Governor Romney’s proposals when there is no fully-specified Romney tax plan? A: We acknowledge upfront, here and in the earlier paper, that Governor Romney has not fully specified his tax plan. But it is still possible to examine the broad implications of the five goals noted above, which derive from information he and his campaign have made available. We analyzed the implications of those five goals; we chose the most progressive route for financing his stated choices, given how much revenue can be raised by broadening the tax base that is available after accepting the five goals. Q: Did you say that Governor Romney wants to raise taxes on the middle-class? A: No. We said that simultaneously achieving all five of the tax goals stated above would result in lower taxes for high-income households and thus – because of the revenue-neutrality constraint – would require raising taxes on other households.

The five goals are the policy center refers to are:

(1) cut current marginal income tax rates by 20 percent,(2) preserve and enhance incentives for saving and investment(3) eliminate the alternative minimum tax,(4) eliminate the estate tax, and(5) maintain revenue neutrality

With a bit of editorial liberty, how can a presidential candidate get away without specifying a single loophole that he would close to make up for such a significant budget shortfall?