Knight Capital Should Receive Time-out for Trading Errors

The recent debacle with Knight Capital, where they apparently rushed an untested new trading algorithm to market without rigorous testing first, caused the company to lose $400 million in just a few minutes. The stock market reacted by going higher because the trading platform was pushing prices higher (even as it lost money on each trade) until market circuit breakers were tripped, and the NYSE pulled the plug.

If a child is bad, he is given a time-out and put somewhere isolated to calm down. If you drive your car in a lunatic manner, your license can and should be suspended. Trading firms who recklessly wreak havoc on the markets with untested programs should be punished in the same way. As much as possible, they should simply be banned from trading until they prove they, and their computer programs can act like responsible adults.

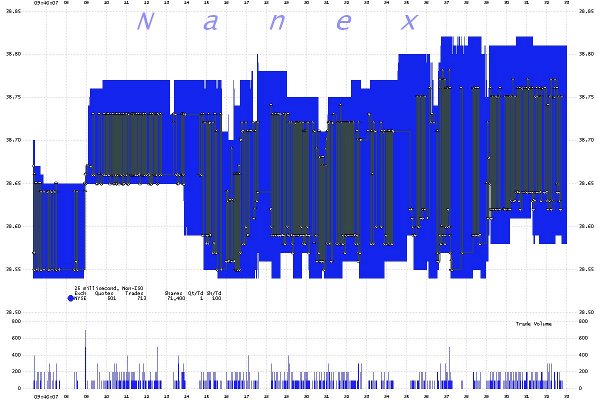

Zero Hedge gives a sense of what these computer programs, which make thousands of trades a second unburdened by human intervention, can do when they run amok.

Over and over and over and over. As Nanex laconically notes, "In the case of EXC [Excelon trades], that means losing about 15 cents on every pair of trades. Do that 40 times a second, 2400 times a minute, and you now have a system that's very efficient at burning money."

Multiply that by the 150 other stocks that Knight is a market maker in and you get a sense of the tremendous damages that can be done in just a few minutes to the stock market and to the trading company itself. Instead of an efficient market we have something more resembling a bipolar train wreck, and a super-quick way to burn money.

The stock price for Knight promptly dropped off a cliff and the predator became the prey. As Forbes says:

Company is stupid enough to bet its future on untested software. Company duly loses its entire market cap by buying high and selling low. Company, no doubt, gets bought out for peanuts and asset-stripped in short order.

Congresswoman Maxine Waters of California says this debacle shows the need for more government regulation and intervention. Forbes thinks this is nonsense. I tend to agree. If the best and brightest programmers on Wall Street make a blunder of this magnitude, and management rushes the product out the door before it has been properly tested, it’s difficult to see how the federal government would be able to help.

But what the government could do is mandate time-outs for trading firms who make colossal and stupid mistakes. For example, Knight Capital screwed up; they get banned from trading for six months. Just the threat of this would make companies be vastly more careful.