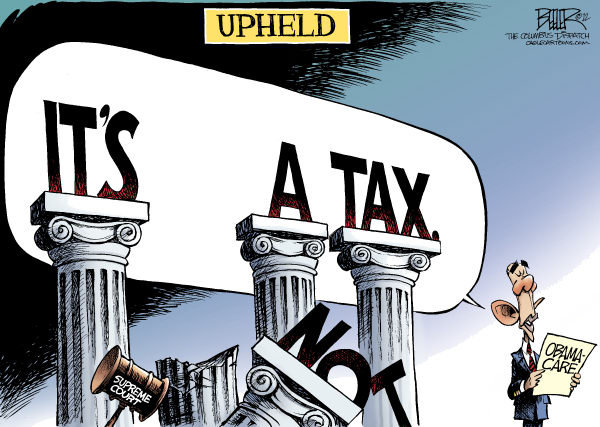

Is the Individual Mandate a Tax?

On Thursday, the Supreme Court ruled that the central component to Obama's healthcare reform, the individual mandate, is constitutional because the payment is a tax. There has been much confusion following the ruling over whether or not the "shared responsibility payment" is actually a tax. The language of the statute clearly distinguishes the payment from a tax by labeling it a penalty that someone must pay if he or she refuses to buy insurance. And the Obama Administration has said a number of times that the policy was not a tax.

But, the Supreme Court ruled that for the purposes of the Constitution, it is a tax, because it functions as one. Chad did a great job of explaining the distinction on one of his recent blog entries:

On page 12 of the opinion, Roberts points out that “Congress cannot change whether an exaction is a tax or a penalty for constitutional purposes simply by describing it as one or the other.” What he implies is that the ACA penalty is a “tax” under the constitution because that is how it functions. Congress has no power to change what a “tax” is, just by calling it a “penalty”. However, with respect to the Anti-Injunction Act (and the ACA), Congress can decide that a “tax” or “penalty” is whatever they intend it to be (as opposed to what it actually is), because Acts are creatures of Congress. If a law is a creature of Congress, they get to decide what the terms are supposed to mean.

What do politicians think?

Jack Lew, White House chief of staff, refrained from referring to the individual mandate as a tax on ABC's "This Week," using words like "penalty" and "charge" to describe the payment. When pressed by ABC's George Stephanopoulos about the mandate, he continually refused to call it a tax.

STEPHANOPOULOS: He called it a tax. So you’re conceding that?LEW: I’m saying that it was set up as a penalty for people who choose not to buy insurance, even though they can afford it, and for that one percent, we call it fair.

In an interview this morning with MSNBC host Chuck Todd, Senior advisor to Mitt Romney, Eric Fehrnstrom, defended the mandate as a penalty. He noted that Mitt Romney agreed with the dissent, written by Justice Scalia, in the very clear statement that the mandate was not a tax. He continued:

"I do think that President Obama's position is contradictory and unsustainable because on the one hand President Obama and his team are celebrating the majority opinion of the court, they accept the opinion on the court, but then they argue against the central premise of the ruling, which is that the mandate is a tax." In Massachusetts "it was a penalty, and the governor had all the authority he needed under our state constitution to put in place the reforms that he did put in place."

Todd proceded to play a clip of Mitt Romney calling the penalty a tax in 2008. Fehrnstrom responded by defending the Massachusetts reform as unique to Massachusetts, arguing that it was never meant to be a "one size fits all" policy.

House Speaker John Boehner, R-Ohio, accepted the mandate as a tax, using the Supreme Court's decision to criticize Obama for a new tax on Americans.

“The American people do not want to go down this path,” Boehner said. “They do not want the government telling them what kind of insurance policy they have to buy and how much they have to pay for it, and if you don’t like it, we’re going to tax you.”

Using this same rationale, the conservate group Americans for Prosperity, launched a $9 million ad campaign, categorizing the mandates as "one of the largest tax increases in American history."

Democrat and Massachusetts Governor Deval Patrick responded to the group, calling the attack "bizarre."

"First, this is a penalty. It's about dealing with the freeloaders, the folks who now get their care without insurance in high-cost emergency room settings.

He made clear the intent of the mandate, complimenting Romney for providing the model in his Massachusetts health care reforms.

"That's Romneycare in Massachusetts, and that will be Obamacare for the rest of the country."

Regardless of the partisan battle, the Supreme Court has spoken, and as the highest court in America entrusted with the responsibility of interpreting the Constitution, both Republicans and Democrats should accept the ruling. Instead, GOP Governors are banding together and are appearing to ignore the Supreme Court's decision. Louisiana Governor Bobby Jindal, Florida Governor Rick Scott, and Wisconsin Governor Scott Walker all made statements, vowing to ignore the health care law in their states. Tax or not, the highly politicized nature of health care reform has forced it into the political arena as a critical issue in the 2012 election.