The Buffett Rule: Election-Year Partisan Showdown Looms

Warren Buffett, the world’s third wealthiest individual with a net worth of $44 Billion, made the statement last year that he pays a lower tax rate than his secretary. This is true. You might recall that Buffett’s secretary, Debbie Bosanek, was used in President Obama’s State of the Union last year as the ideal illustration of unfair tax code. Buffett himself says that he pays a 17.4% tax rate on his taxable income, his staff, and secretary who, according to Forbes, likely earns well over $200,000 a year, are taxed at a rate between 33% to 41%. In response to this ostensible unfairness, the President has proposed a solution now commonly referred to as the “Buffett Rule”.

President Obama has repeatedly claimed that the Buffett Rule is a major step in moving toward a more fair tax code that would no longer favor the wealthiest Americans. The official White House blog supports the Buffett Rule with the statement,

“No household making more than $1 million each year should pay a smaller share of their income in taxes than a middle class family pays. This is the Buffett Rule—a simple principle of tax fairness that asks everyone to pay their fair share.”

This sounds good on the surface, but the President has received vast criticism over his proposal to raise taxes for the wealthy. A closer look at the Buffett Rule explains why.

What exactly is the Buffett Rule?

It is an attempt to reduce the deficit by imposing a minimum tax rate for high-income tax payers. The rule would require American’s earning over $1 million to pay at least 30% of his or her income on taxes.

What is its main criticism?

Most of Buffett’s $44 Billion net worth comes from capital gains or dividends. These are taxed at a lower rate than wages and salary. The argument Buffett made concerning the inequity between his secretary’s tax rate and his own has incited confusion and criticism, because according to current tax codes she earns a larger amount of wages and salary to be taxed. This is explained by Forbes which states,

“What he [Buffett] says, with the qualifications he uses, is true as far as it goes. It is, however, extremely misleading, because he’s left out the effect of the corporate income tax.”

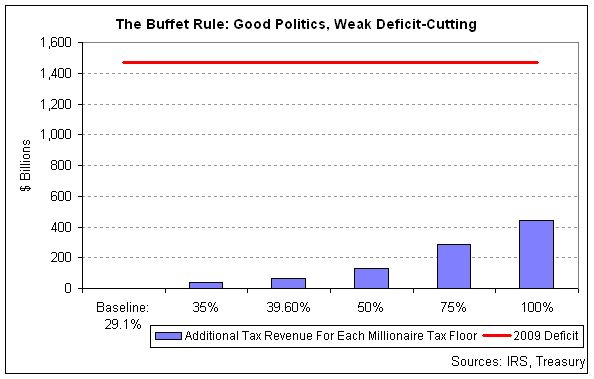

What will be its impact on the national deficit?

Not very significant. The Buffett Rule would generate tax revenue ranging from $47 Billion to $160 Billion over the next 10 years. In contrast, allowing Bush tax cuts, for American’s making over $250,000 a year, expire would produce $800 Billion over the next 10 years. In short, if the Buffett Rule were enacted, it would not create a significant impact in the federal budget.

Feasibility of the Buffett Rule becoming law?

The senate is scheduled to vote on the rule on Monday, but a Republican filibuster will stop Democrats from gaining the 60 votes necessary. In the meantime, there exists a pro-millionaire Facebook petition opposing the Buffett Rule.

Many see the Buffett Rule as nothing but a brilliant campaign move in President Obama’s 2012 campaign. The rule does make direct commentary on his likely Republican opponent, the very wealthy Gov. Mitt Romney, who has stated he pays “somewhere around the 15% rate” on taxes. With President Obama making all efforts to show his support for middle class Americans by promoting higher tax rates for the wealthy, he has positioned himself well against Gov. Romney, who seems ever more out of touch.