Oops...Sacramento Did It Again, Overestimates Tax Revenue

In what has become a time-honored and truly bipartisan ritual in Sacramento when much-dreaded budget negotiations are starting, the governor announces hugely perky estimates of new revenue. The non-partisan Legislative Analyst’s Office (LAO) then opines that the governor’s estimates are not in line with accepted measures of gauging reality. The governor’s office responds that this time will be different because California is now on the rebound. After much gnashing of teeth, a balanced budget is passed using the perky estimates. Champagne corks are popped. All will be well now. Except, a few months later -and who could have ever predicted this would happen - the expected revenue doesn’t materialize. The budget becomes a train wreck with the whole process being repeated the following year.

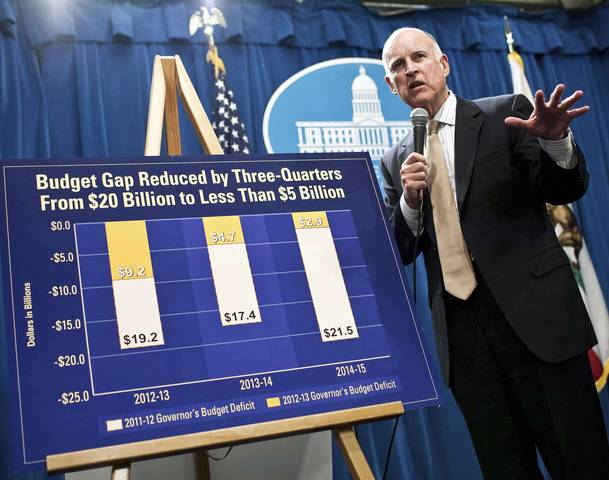

Former Gov. Schwarzenegger did this and now Gov. Brown is doing the same. Truly, in these deeply divisive times, it is heartening to discover such truly bipartisan agreement on crucial budget issues. If the budget doesn’t look like it will balance (and by law, California must have a balanced budget) then rest assured, let’s conjure up some revenue estimates that will make it balanced.

Gov. Brown says his new compromise ballot measure for raising taxes will generate $9 billion. The LAO says the real number is more like $6.8 billion. The Brown Administration says much of the expected higher revenues will be from capital gains and that they expect $2.5 billion over 5 years from the Facebook IPO. The LAO says with $1.5 billion of that will be in 2012-2013. However, they also note there are many unknowns about the Facebook IPO, most importantly, about if and when those owning stock will sell. There will undoubtedly be major one-time revenue to the state from the IPO, but the actual amount and timing of the revenue is not known. Pardon those who don’t think Sacramento should spend the money quite yet, or even assume when it will come.

If the governor’s ballot measure passes and taxes are raised on the top 1%, some of them may simply decide to leave the state. Don’t think that can’t happen. If it does, then the deficit will get substantially worse. Ditto if revenue estimates prove to be inflated (and they invariably are). Of course, the governor's tax measures might not pass at all. Then what?

Sacramento budget negotiations are bi-polar, swinging from mania about projected revenue increases to depression when they don’t materialize. California needs a reality-based system for managing the budget, which is something it doesn't have now.