On Highway Funding, Both Major Parties are Proposing the Wrong Solution

After much debate, division, and uncertainty, the U.S. House, Senate, and President Obama all agreed to pass legislation to allow the Highway Trust Fund to continue operating in the short term. However, this new bill of $10.8 billion does not actually put more money into the highway fund. Instead, it takes from pension tax changes, customs fees, and money previously allocated to repair other programs.

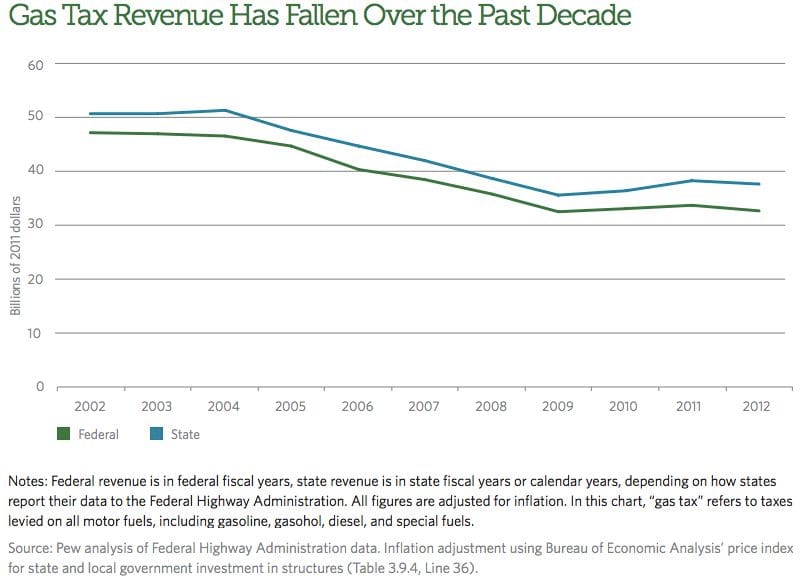

Direct funding for the Highway Trust Fund relies on the federal gas tax. This tax has not been raised since its increase to 18.4 cents per gallon in 1993. This means that the rise in inflation over the last 20 years has eroded up to 39 percent of the value of tax revenue received from the gas tax.

Some on the economic left, joined by a few further right supporters, believe this is a clear indication that it is time to raise the gas tax, despite failing to do so with this most recent round of legislation.

These lawmakers argue that an increase of several cents per gallon is needed to shore up the funds for greatly needed repairs and to create a more stable financial backbone for the infrastructure of the United States. A flat increase would, in general, cause those who use the roads the most to pay the most for the repairs.

And, when compared to some other countries, a greater tax investment in the Highway Trust Fund seems justifiable as long as a large part of the economy relies on automobile-based transportation, not only for consumers, but to transfer goods and services.

Many politicians on the economic right and the majority of U.S. citizens, however, are adamantly opposed to raising the federal gas tax.

Some have proposed letting states pay for the highways within their own borders. Others argue that the federal government should take the money from another program, rather than tax the American people more through a direct means. The program that would be chosen varies from person-to-person.

Both sides in this debate, however, are looking at the issue the wrong way.The people who benefit from highways are not just the individuals who drive on them. The highway is a public, social institution like the local police or public schools. Every business and individual consumer benefits from the highway system being in place and maintained financially, no matter how often they choose to use it themselves.

This means that a tax must be in place to support the nation's highways if the social institution is to be maintained, but it shouldn’t be based on gas consumption. Additionally, as nice as the idea is of letting each state maintain its own highways, there would likely be a large decline in organization and quality due to the large capital required for some projects that individual states could never afford without cutting back on other essential services.

The easiest way to pay for highways would be to adopt a progressive tax system modeled after the federal income tax. Those with the most income pay a larger share and help ensure that the highway system stays well-funded, rather than being reliant on the use of an economic commodity as volatile as gas. This would create a more solid foundation to keep the program running without hurting those who often need the federal highway system the most.

Photo Credit: mikecphoto / Shutterstock.com