Everything You Need to Know About Donald Trump's New Tax Plan

On Monday, Donald Trump released his tax plan during a press conference at Trump Tower in New York. Trump cited the need to simplify the complex tax code to make America strong again.

It will simplify the tax code, it will grow the American economy at a level is hasn't seen for decades. All of this does not add to our debt and our deficit. - Donald Trump

According to the Tax Foundation, Trump's plan will reduce revenue by $10.14 trillion over the next 10 years. Another organization, the Citizen's for Tax Justice, studied Trump's plan and found it would decrease revenue by about $900 billion per year, meaning a total of $9 trillion over a decade. The Tax Policy Center has not rated Trump's plan yet, but the group's co-director, Eric Toder, told CNN, "[T]here's probably going to be a pretty big revenue loss."

For individual taxes, Trump's plan condenses the tax-bracket groupings from seven to four.

In a classic Trump move, he told earners making less than $25,000 that they can now send the IRS a one-page form that says, "I win."

Trump's plan reduces individual income tax rates significantly. It slashes corporate taxes from 35 percent to 15 percent, eliminates business tax expenditures, eliminates the Estate Tax, and the Alternative Minimum Tax. It also gives corporations, which currently have an estimated $2.5 trillion overseas, a one-time offer to bring their capital back to the U.S. taxed at 10 percent.

"These lower rates will provide a tremendous stimulus for the economy, significant GDP growth, a huge number of new jobs, and an increase in after-tax wages for workers," Trump said.

After previously stating he favored raising taxes on the wealthy, it is unclear how this plan would carry that out as it reduces their tax burden from 39.5% to 25%. Instead of challenging supply-side economics, it seems Trump is whole-heartedly embracing it.

Trump's earlier semi-populist statements explaining he favored raising taxes on those who are "getting away with murder" surprised many and prompted liberal economist Paul Krugman and U.S. Senator Elizabeth Warren (D-Mass.) to agree that they all have that goal in common. Trump's new plan, however, seems to continue along the trickle-down path that generally appeals to GOP voters.

Whatever the outcome, Trump's plan is a deep cut to government revenue and will need to be offset by cutting outlays significantly if he plans to uphold his promise of sustained growth and a reduced deficit.

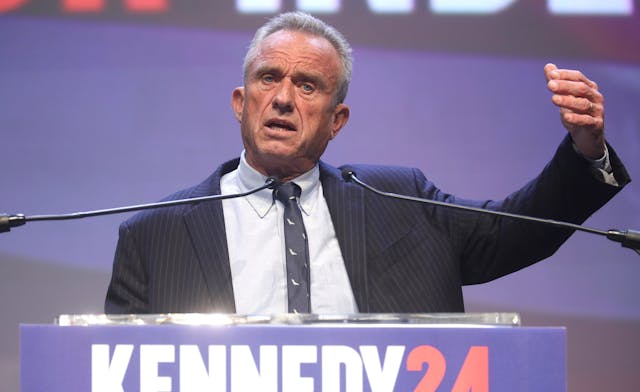

Photo Credit: Brendan McDermid/Reuters