Will Panama Papers Leak Spur Lawmakers to Tackle Tax Avoidance?

The political commentator Michael Kinsley once quipped that in Washington, "the scandal isn't what's illegal, the scandal is what's legal." President Obama echoed this sentiment last week during his comments on the Panama Papers – the 11.5 million leaked files released by the International Consortium of Investigative Journalists (ICIJ) that have disclosed how the Panamanian law firm Mossack Fonseca set up shell companies to help wealthy individuals avoid paying domestic taxes.

“There is no doubt that the problem of global tax avoidance generally is a huge problem,” Obama has said on April 5, adding, “The problem is that a lot of this stuff is legal, not illegal.”

The disclosures have caused embarrassment for leaders and business magnates all around the world: the Icelandic prime minister resigned over a revealed conflict of interest relating to his handling of the 2008 financial crisis, and politicians from the United Kingdom, Russia, China, and Brazil have been implicated in scandals large and small.

The documents also implicate at least 200 American individuals, including accused and convicted criminals, and more than 600 entities based in the United States.

Some commentators, including Microsoft founder Bill Gates, have expressed surprise at the seemingly small number of Americans mentioned in the Panama Papers, but various explanations have been offered, including Americans' use of other international firms that provide these services, their reliance on tax havens in the United States, and the deterrent effect of closer ties and greater cooperation between the U.S. and Panama.

Despite the comparatively small impact of the Panama Papers themselves (it largely confirmed what many knew wasalready happening), they have brought to the fore the issue of tax avoidance and its effects on government budgets.

According to economist Gabriel Zucman, approximately $7.5 trillion of global financial wealth is hidden in tax havens, costing governments worldwide approximately $200 billion in revenue each year. This tax avoidance affects the United States most of all. One economist estimates that in 2012, the U.S. lost nearly $100 billion in taxes as a result of tax avoidance.

The legal services provided by Mossack Fonseca, which creates shell companies to disguise taxpayers as corporate entities, represent the latest strategy in the cat-and-mouse game between tax collectors and wealthy individuals that has been evolving for longer than a decade.

In 2003, the European Union adopted the European Savings Directive (ESD) to combat tax avoidance on the continent. Yet two years later, when the directive went into effect, Swiss banks began offering financial services to help depositors avoid a tax on their savings and to escape detection by national governments.

Since the ESD applied only to individuals and not corporations, banks like HSBC in Switzerland offered to transfer their clients' money through non-bank intermediaries into shell companies located in tax havens such as the British Virgin Islands and Panama.

These dealings were disclosed by a former HSBC employee, who shared confidential bank documents from 2005 through 2007 with national governments, as well as European newspapers and the ICIJ – the organization behind the release of the Panama Papers. The so-called "Swiss leaks" were made public in 2015.

While not nearly as harmful to budgets as corporate tax avoidance, the storage of individuals' money in secret accounts has also thwarted tax collection. Since 2009, the U.S. Treasury Department has reached settlements with 80 Swiss banks that collectively helped Americans hide as much as $48 billion in more than 34,000 accounts.

The U.S. took a major step to curb tax avoidance in 2010, when Congress passed the Foreign Account Tax Compliance Act (FATCA). It demands that foreign financial institutions provide the IRS with information about Americans' overseas accounts. Subsequently, the OECD – an organization comprised of 34 developed countries – developed a plan to foster international cooperation to tackle what it calls "base erosion and profit sharing" (BEPS).

While these steps have been successful in minimizing the appeal of secretive banking – the number of HSBC accounts dropped from 30,000 to 10,000 between 2007 and 2014 – FATCA, like the ESD, suffers from a fatal loophole: entities like banks and trusts have to register under FATCA, but non-bank "middlemen" such as law firms and tax advisers, including Mossack Fonseca, do not.

Despite global efforts in recent years to harmonize financial oversight and reporting, the U.S. Congress has been resistant to joining international tax treaties. While Senate committees in 2014 and 2015 approved treaties with several countries, they have not advanced to the Senate floor, where a two-thirds vote is required for ratification.

Moreover, among the dozens of countries invited by the OECD to adopt the stricter BEPS standards, the U.S. is one of the few countries to have declined to do so.

Congress has also failed to pass legislation tackling corporate inversion, a process by which an American company acquires a foreign company and relocates its holdings to a low-tax jurisdiction. Companies based overseas only pay the U.S. corporate tax (minus a foreign tax credit) when they "repatriate" their profits, or bring them back to the U.S.

Companies are able to keep their profits indefinitely offshore in subsidiaries located in tax havens by claiming they are "permanently reinvesting" them – a practice called "deferral." According to the Center for Tax Justice, American Fortune 500 companies are avoiding paying nearly $700 billion in taxes by "permanently reinvesting" $2.4 trillion overseas.

In the absence of congressional action, the Treasury Department has taken measures to address tax avoidance by proposing rules modeled on the OECD's BEPS plan. It also recently made several changes governing corporate inversions that have made them less lucrative – changes that thwarted Pfizer's proposed mega-merger with Ireland-based Allergan earlier this month. The deal would have saved the company a billion dollars each year in reduced taxes.

Lawmakers in Congress are gridlocked over the issue: in recent years, Democrats have proposed several plans to address tax avoidance and corporate inversion, but Republicans insist that any such measures must be paired with broader tax reform, particularly related to lowering the 35 percent corporate income tax.

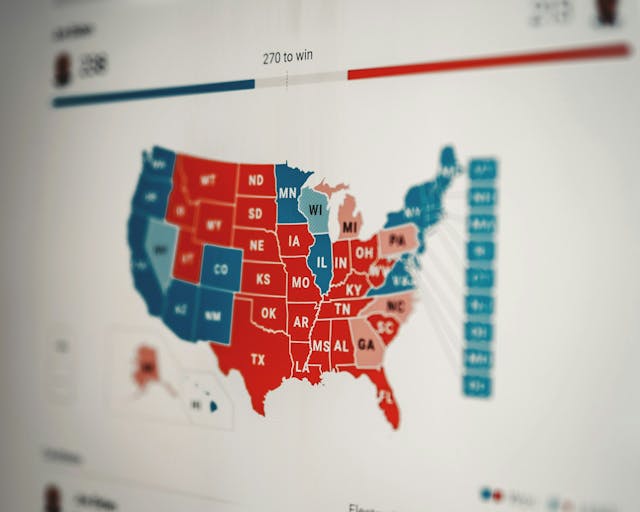

The presidential candidates have different plans for addressing tax avoidance and corporate tax reform.

Sanders wants to end deferral, citing the billions that would fall into federal coffers, and Clinton has promoted an "exit tax" to make inversion deals less attractive. He and Clinton have not called for a reduction in the corporate tax rate.

Candidates Ted Cruz and Donald Trump want to lower the corporate tax rate to 16 percent and 15 percent, respectively. Experts note that any reduction in the corporate tax rate could both increase domestic job creation and increase the federal deficit.

Photo Credit: dennizn / Shutterstock.com