Despite What Your Candidate Tells You, There Is No Simple Way to Handle The Debt

Suppose you had an infinitely long life and could have spent a million dollars a day since the beginning of the Christian Era. How much would you have spent by 2015?

About $736 billion -- that's it.

When we start talking about things like the $19 trillion national debt or the $3.3 trillion federal budget, they become imaginary numbers, ones we can't even fathom the math behind.

One of my favorite Internet memes is one that shows what a trillion dollars in $100 bills would looked like stacked in pallets. There would literally be no way to actually store so much money securely.

Money would be stacked everywhere, with so much that even a Scrooge McDuck-style vault wouldn't be able to hold it all.

And while we cannot fathom these amounts in our minds, in our daily conversations, especially political ones, we throw out billions and trillions as if they are nothing at all.

The U.S. Navy's newest aircraft carrier, the U.S.S. Gerald Ford, came with a price tag of almost $13 billion for the ship and another $5 billion in R&D. About 48 years of spending that hypothetical million a day.

And yet we still throw these numbers around, touting this tax program or that tax cut -- all while not even actually considering one simple point.

What if we completely froze spending and committed to pay down the national debt in 30 years?

Everyone seems to agree that the national debt is too high, the budget deficit is too high, and the debt service is too much. And every politician seems to have a plan to cut at least some spending, increase tax revenues, and resolve the crisis -- and yet every single plan fails horribly in one regard.

What would it actually take to pay down the debt?

Compound Interest: The Most Powerful Force in the Universe

While Einstein probably didn't actually say this, the point remains valid. Compound interest is an unavoidable reality in the modern banking world -- and though our national debt is at relatively low rates (about 2.12% effective rate on all outstanding), it still comes to a huge amount of interest.

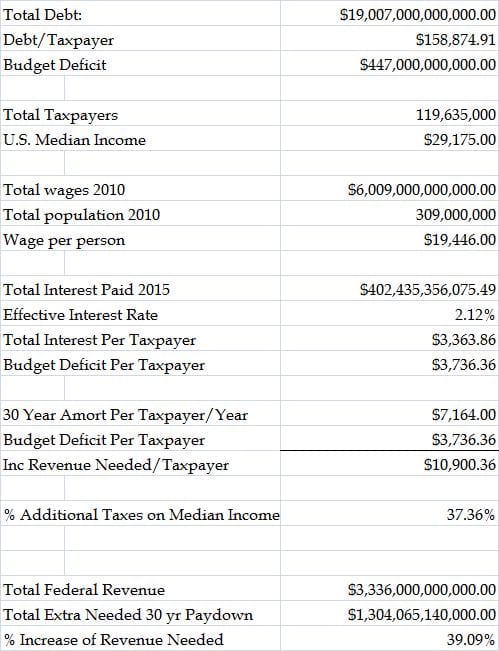

When talking numbers of this magnitude, it's best to illustrate through table:

The bottom line of this is that to freeze spending at current levels, pay down the debt in 30 years, and account for shortfalls as they exist today, every single taxpayer in America would have to pay an extra $10,900.36 in addition to all taxes already paid.

Is this really feasible?

A 37.36% tax increase on the median income in America would represent a huge loss in buying power, lower GDP, and even decrease tax revenues in the long run.

So let's say, for argument's sake, that our favorite politician is going to do everything right and the economy bangs away at a pace we've never seen in history. It would still have to increase enough to pay the 39.09% increase of revenue the government would need. What kind of inflation would that cause in the long run?

So, the next consideration is that we just slash spending. Where do we cut? The largest line items on the budget are Social Security, Medicare/Medicaid, and the military.

Social Security and Medicare/Medicaid are calculated already in the national debt (at least the amounts held in bonds). It's money owed by the government, to a government agency, for a program that was (at least supposed to be) fully paid by the taxes of workers and employers.

So then we are left with the military: is it ever politically expedient to cut back on it?

After those three, the federal budget gets pretty slim; any cuts are merely symbolic at that point.

Is There Actually an Answer?

It seems almost wrong to end an opinion piece without a definitive answer on what we should do--but there is no really good answer to this dilemma.

Every single dollar that the government spends is income to someone, whether it is the corporations that built the $18 billion U.S.S. Gerald Ford, the Social Security pensioner, or the food stamp recipient.

When cuts happen, people and businesses get hurt.

Even sales giant Walmart is forced to reduce SEC mandated outlooks every time there is a reduction in food stamps. It is not so easy to pick and choose where to cut and then calculate the ramifications of it.

But in general, rather than schemes that promise a robust economy, lower taxes, bringing back expatriated wealth, or massive spending cuts, we need realistic views on what our objectives as a nation will be for the next century. And this debate isn't really happening.

The only real answer is that 'it's complicated,' and that many, many people's lives are affected by every single decision made by our politicians trying to fix it.

As for me, I'd rather see a politician promising nothing but hard-work and hardship over the next century--at least it would be honest.

But when we see our favorite politician touting their plans, we must always keep it in the back of our minds...

Will this really matter?

Photo Credit: Elena Yakusheva / shutterstock.com